Broadcasters Mark Momentous Year of Challenges Amid Viewing Fragmentation

Easing ownership rules, NextGen TV progress and AI’s impact highlight busy period

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Three issues dominate television’s outlook as this tumultuous year concludes: The fate of NextGen TV (even as the FCC tries to boost its implementation), ownership and consolidation at all levels and the significance of broadcasting itself in a video landscape that is now fragmented by streaming media usage.

While 2025 fomented an array of technology, business and regulatory highlights, many of these controversial developments will grow in importance in the years ahead. Most notably, artificial intelligence tools are exploding into production and operations. At the same time, IP-based video production is transforming production workflows.

Collectively, the year’s progress has set the stage for more near-term industry upheavals—especially given the turbulent political environment.

Mixed Message on NextGen TV?

The Federal Communications Commission’s notice of proposed rulemaking in late October calling for “less regulation” of NextGen TV sent a mixed message. It would not require broadcasters to simulcast ATSC 1.0 and 3.0 signals and would not mandate 3.0 tuners in new TV sets. Nor would it set an end date for the current ATSC 1.0 transmission. Nonetheless, the agency’s official statement curiously contends that its plan “will accelerate the nation’s ongoing transition” to ATSC 3.0.

FCC Chair Brendan Carr has characterized 3.0 as “the future of broadcasting,” offering “new ways” to deliver services such as interactive programming, enhanced video and audio formats and other data services through its internet protocol-based transmission system.

“Television is moving to an IP-based format that supports features and functionalities that will allow broadcasters to compete more effectively with digital platforms, both on content and economics,” Commissioner Anna Gomez added, acknowledging the “very complicated questions” of this transition. “First and foremost is the issue of timing.”

Throughout the year, ATSC 3.0 hurtled on a roller coaster of developments. On the international front, Brazil declared its broadcasters will use the physical layer of the ATSC 3.0 standard as its “DTV+ television format of the future.” Commercial service is targeted for the FIFA World Cup next year; meanwhile, stations in Rio de Janeiro and São Paulo are running experimental transmissions, with a station in Brasilia expected to launch soon. Globo TV plans to offer enhanced capabilities, such as 4K and 8K content.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Among other NextGen projects during the year: the Run3TV applications platform got a boost when NBCUniversal became an investor in the ATSC 3.0 Framework Authority (A3FA), which supports the technology for local services.

Satisfying the Urge to Merge

An ongoing consolidation effort is bubbling among station owners as well as technology providers. Beyond the marquee deals—such as the prolonged saga of Skydance (which climaxed with its takeover of Paramount Global, including CBS and cable networks)—there is the proposed alliance of Sinclair Broadcast Group with Tegna, which would potentially create the nation’s largest station group. Meanwhile, Tegna was in talks with Nexstar Media Group about joining forces. And Sinclair was also flirting with Gray Media.

Adding to the merger fantasy and frenzy was the FCC’s signaling that it may review its national ownership cap, which now limits the reach of a station group to 39% of U.S. TV homes. Separately, the 8th U.S. Court of Appeals ruled in July to vacate the “Top-Four Prohibition.” That restriction prevented a single entity from owning more than one of the four most-watched television stations in a local market. Many analysts expect that lifting the regulation will generate local-market juggling, which could be used to blend station newsrooms and ad-sales groups.

Thanks to the relaxation of regulations on the audience reach of broadcasters, media companies and their technology and content suppliers are entering a new age of consolidation.

Streaming Conquers Cable

Although FAST (free ad-supported streaming TV), SVOD (subscription video-

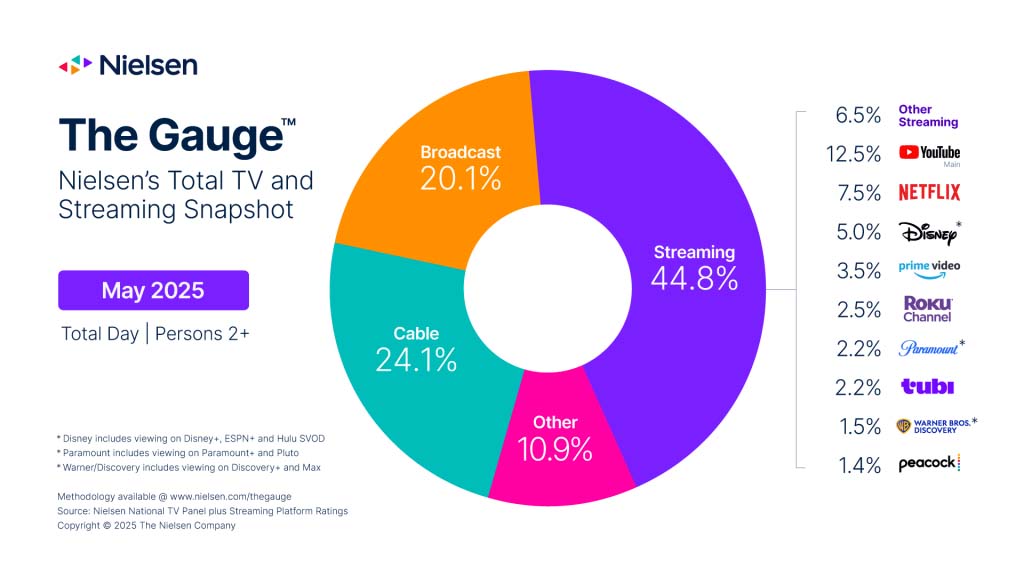

on-demand) and other online video formats have been growing rapidly since the pandemic, May 2025 marked the first time their combined share of total television usage surpassed the collective viewing of broadcast and cable, according to Nielsen’s monthly report “The Gauge.”

Nielsen’s analysis showed 44.8% of viewing was via streaming platforms (notably YouTube and Netflix), while 20.1% was on broadcast channels and 24.1% on cable channels. (“Other” accounted for the remaining 10.1% of viewers’ attention.)

The online migration came as program networks accelerate their online presence. Fox One debuted as a streaming service that includes all of Fox’s cable channels; Disney expanded its ESPN cable brand to an online app; and CNN (via its parent Warner Bros. Discovery) introduced a similar standalone app.

When the dust settles, some analysts contend that venerable networks such as MTV could be shuttered under Paramount’s new Skydance ownership.

“Free services have been a major driver of streaming’s overall success,” according to Nielsen’s analysis. But the shifting environment—and viewers’ dismay about increasing costs for multiple streaming services—is likely to alter the lineup in the years ahead.

AI Everywhere

Two decades ago, toward the end of the internet/web bubble, a cheeky prediction from Silicon Valley proclaimed “IP on Everything,” suggesting internet protocol was integral to the emerging Internet of Things and other services that would all become connected. Now the comparable hype involves artificial intelligence, which is weaving its way into countless aspects of our lives.

AI is seeping into media creation and delivery, from creative workflow and production to home displays. Skeptics are already voicing concern that it is reshaping news production, trust and ethics, deriding the AI onslaught as “virtual saturation” and predicting “AI fatigue” among customers and providers.

Yet, as Jeff Zellmer, executive vice president of digital operations for Fox TV Stations, told TV Tech earlier this year, “AI represents a massive shift in culture and technology.” He and other station and group officials cited the range of tasks AI can enhance or generate, ranging from real-time, multilanguage translations to workflow management.

Among the capabilities are hybrid-generated content creation, such as automated sports highlight reels, that could devise video packages within seconds after live action. Ad targeting and other personalized features are also likely—and will inevitably face challenges from privacy advocates.

AI is also finding its way into TV displays. For example, at CES, Samsung demonstrated a voice remote control that creates personalized responses, including custom picture settings. Another Samsung feature is an AI button on its remotes that can offer the ability to live translate from a show’s native audio language into subtitles for another language. Can synthesized real-time dubbing be far behind?

Defunding Public Broadcasting

Although many of 2025’s media tech issues had a political component, perhaps none was as transformative as the federal rescission package that eliminated more than $1 billion from public media funding and wiped the 58-year-old Corporation for Public Broadcasting out of existence.

Since CPB was a significant funding source for the Public Broadcasting Service and member stations, the impact was quick and vast. Many local and regional public broadcasters almost immediately announced plans to cut their staffs by up to 40%, and some said they will slash budgets, including purchase of PBS programming.

“Without federal funding, local stations are eliminating or reducing local programs, including local history programs, community event coverage, agricultural programming and local public affairs programming, among others,” Kate Riley, president and CEO of America’s Public Television Stations, said in October.

A few stations will go dark in June 2026. WPSU-TV at Pennsylvania State University sought to transfer its operating assets to WHYY, a Philadelphia public media organization; but the Penn State Board of Trustees rejected that plan.

New Jersey PBS, that state’s only public TV channel, will also go dark in June. It plans to continue producing a nightly news program on digital platforms via a broader operations deal with WNET-TV in New York City.

Public broadcasters vowed to tap other funding streams, especially corporate sponsorships, individual donations and member station fees.

Gary Arlen, a contributor to Broadcasting & Cable, NextTV and TV Tech, is known for his visionary insights into the convergence of media + telecom + content + technology. His perspectives on public/tech policy, marketing and audience measurement have added to the value of his research and analyses of emerging interactive and broadband services. Gary was founder/editor/publisher of Interactivity Report, TeleServices Report and other influential newsletters; he was the long-time “curmudgeon” columnist for Multichannel News as well as a regular contributor to AdMap, Washington Technology and Telecommunications Reports; Gary writes regularly about trends and media/marketing for the Consumer Technology Association's i3 magazine plus several blogs.