CTV: Everything, Everywhere All at Once

As NextGen TV waits in the wings, broadcasters are securing a robust presence in the connected TV universe

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

TV broadcasters are moving at an accelerating pace down the NextGen TV track,

well ahead of any opportunity to leverage ATSC 3.0 at mass audience scale.

Propelled by surging connected TV (CTV) penetration, the popularity of free ad-supported streaming television (FAST) and AI-enhanced workflows and monetization touching uniquely localized output to every type of device, station owners are discovering OTA conversion to 3.0 is far less of a barrier to getting where they want to go than it appeared at the outset of the next-gen transition. As E.W. Scripps President/CEO Adam Symson put it at the recent NAB Show New York, “We’re looking for every opportunity out there on an avenue we’ve never been on before.”

Fast-Growing

From multiple perspectives, i.e., the scale of CTV penetration, consumer viewing behavior, the pace of local TV ad spending and the importance of local TV, is as important to broadcasters as the connected television set. CTV penetration has hit 90% in the U.S., according to Statista, led by smart TVs at 68%, as measured by Parks Associates, with the rest connected via streaming media players.

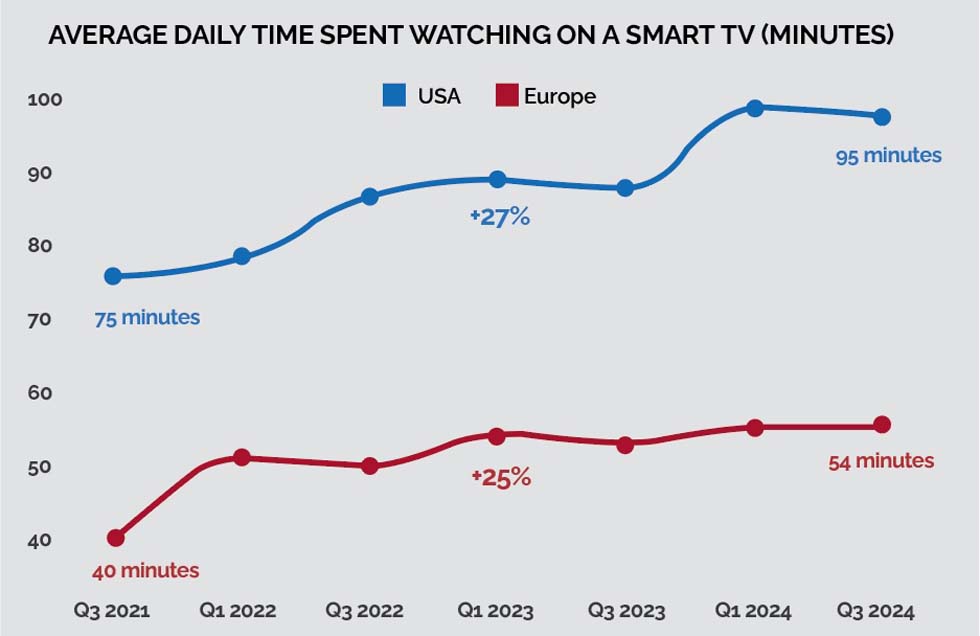

An international study released in 2025 by Ampere Analysis reported that smart TVs—with 90 minutes of average daily viewing time, 27% higher than four years ago—consume 31% of internet users’ total content viewing time, the most of any device category. According to Nielsen, 82% of broadband-only U.S. households, meaning those not using MVPD or OTA services, are watching TV stations’ output on their CTVs.

Some of that viewing stems from the inclusion of linear broadcast channels in OTT bundles, but FAST channels have become the dominant means of delivering station groups’ expanded news and other local content to CTVs. Gracenote, Nielsen’s content-navigation unit, recently reported sports and news channels on the real-time broadcast side of FAST programming are now the platform’s second- and third-most prominent content categories, respectively, collectively accounting for 21% of all channels carried by the 10 leading aggregators it tracks.

FAST allows stations to deliver their most valuable locally produced content without the schedule limitations imposed by their linear channel lineups, noted Meredith McGinn, NBCUniversal Local executive vice president of digital networks and original production.

“We’re delivering news all the time on FAST, not just five to six on broadcast TV,” she said at NAB Show New York, noting that all NBCU O&Os have FAST channels with a good deal of additional coverage given to local events and personalities.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Not surprisingly, while local advertising on linear TV is projected to remain on a negative trend line, excluding the political advertising bumps anticipated for 2026 and 2028, CTV local ad spend is heading in the opposite direction. Speaking at NAB Show New York, Rick Ducey, managing director at BIA Advisory Services, said core (nonpolitical) ad spending on local TV dropped from $14.9 billion in 2024 to $14.3 billion in 2025, with a further decline to $13.9 billion expected this year. Meanwhile, the CTV share hit $2.2 billion in 2025, matching the local TV ad take in the MVPD market, he said.

Clearly, broadcasters are working in a vastly altered landscape than when the

NextGen TV strategy was formulated. Looking at the year ahead, they can operate in this environment with much-improved skill sets compared to where things stood a year ago, starting with their ability to reach digitally focused segments of TV viewing audiences with an expanded lineup of localized live news and other content that can’t be found anywhere else.

Speaking to investors on Nexstar Media Group’s Q3 earnings call in November, chairman and CEO Perry Sook cited the CTV impact on his company’s fortunes. The fastestgrowing segment of Nexstar’s take from political spending in 2024 was CTV, Sook noted, and that’s likely to be the case in 2026. “We have rolled out CTV applications in the vast majority of our marketplaces and are producing alternative programming to fill the hours on those apps,” he said.

Follow the Advertisers

Of course, taking advantage of the CTV trends isn’t just an opportunity—it’s an imperative, given the pace at which ad dollars are flowing into the platform. FreeWheel, noting in a 2025 first-half marketing report that CTVs account for 85% of total streamed video ad views in the U.S., said stateside CTV ad spending was on course to reach $32.57 billion in 2025, with projections showing CTV surpassing traditional TV ad spending by 2028.

There are many reasons for this beyond the sheer audience numbers, starting with the fact, cited by FreeWheel, that 70% of marketers regard precise audience targeting, now accounting for 80% of the inventory, as CTV’s biggest advantage. As a result, CTV advertising ROI is averaging 4.5 times the level reached with linear TV, FreeWheel reported. Technology—especially advances combining programmatic selling and buying support with the use of AI—is playing a major role.

Moreover, as Amazon Web Services (AWS) is demonstrating with its In The Game (ITG) platform, streamed content distribution to CTVs creates compelling new ways to monetize sports, news and other live content through personalized ad messaging without the disruptive intrusion on viewing experiences common to traditional TV advertising.

“ITG is driving a fundamental shift in CTV monetization strategies by enabling nonintrusive advertising formats that maintain viewer engagement while maximizing revenue opportunities,” said Stephanie Lone, global leader for solutions architecture in media entertainment games and sports at AWS.

ITG utilizes Server-Guided Ad Insertion (SGAI) across all major CTV platforms to turn advertising into a value-added experience by programmatically placing messaging in formats like L-Band ads, split-screen ads, shoppable overlays and pause ads, Lone said. The platform, sold to AWS cloud users through the AWS Marketplace, leverages the continuous contextual and messaging opportunity analysis of generative AI models supported by Amazon Bedrock in conjunction with intelligent ad triggering and placement orchestration, live media ingestion, processing and packaging, and other functionalities available through AWS.

We have rolled out CTV applications in the vast majority of our marketplaces and are producing alternative programming to fill the hours on those apps.”

Perry Sook, Nexstar Media Group

AI-powered insights “are enabling CTV and OTT providers to maximize high-value moments by monetizing when viewers are actively engaged and watching the screen, using nonlinear formats during high-attention periods without interrupting the experience and reserving traditional linear ads for naturally less exciting moments,” Lone said, noting research shows such strategies produce a 50% gain in user engagement compared to traditional TV advertising.

Such results are to be expected when broadcasters can “transform content into dynamic marketplaces, where, for example, cooking shows can sell kitchen gadgets, home renovation programs enable furniture purchases and automotive shows become interactive car showrooms, creating entirely new business models.”

Local Ad Exposure

No platform provider has gone further than Roku in affording station owners the ability to capitalize on local TV advertising through FAST channel placements. Noting that viewer content discovery “is one of the key benefits of our platform,” Roku Head of Content Lisa Holme said the company drives awareness of hundreds of locally targeted channels that serve viewers “the same live content they’d see on traditional TV in their location.”

The benefits TV stations gain with the local ad exposure that comes with this support is abetted by the fact that Roku advertising, as Holme put it, “is becoming more and more performant.”

Having invested in partnerships and innovations that support “advanced audience targeting, real-time data, and programmatic ad buying,” Roku believes “this is a key differentiator and reason why marketers will continue to move traditional TV advertising dollars to CTV,” Holme said.

Along with the experience broadcasters have gained generating local news and other content for more exposure via FAST channels and other digital feeds, they’ve benefited from vendor support that has made channel creation for digital viewing on CTVs far more efficient than it was before the advent of FAST.

Rethinking Playout

“FAST pushed our traditional customers to rethink the way they were designing playout operations,” Imagine Communications Chief Revenue Officer Glodina Lostanlen said. Citing the unified ground and cloud resource management enabled by Imagine’s Aviator Automation and Orchestrator platforms, Lostanlen added: “Our customers don’t differentiate the quality of viewers anymore whether they’re watching FAST or traditional linear TV. They need to operate a FAST channel and a linear traditional channel in the same way with live playout at five 9s quality.”

With live local news and other coverage proving out as a big audience draw for FAST channels, dealmaking and new amalgams of broadcasters’ output on FAST are proceeding at a dizzying pace. The former VuIT FAST platform has been revamped into Zeam, which is offering content from nearly 300 local TV stations, covering close to 80% of DMAs, including the NewsON aggregation of local newscasts acquired from Sinclair in August.

LG’s recent launch of News Hub brought in dozens of Fox LiveNOW and Allen Media Group Local Now FAST station channels, along with many other local station feeds. And apps supporting local TV access are abundantly available for Android TV and Google TV users and through the Google Play store. In Roku’s case, Holme noted, along with supporting hundreds of FAST channels carrying individual stations’ live content, the company’s Live TV offering features FAST channels from every major national broadcaster.

The notable big station group bucking this trend is Sinclair, which, with the NewsON deal and sale of the STIRR collection of live channels two years ago, has shifted away from live FAST broadcasting, although some of its stations are still in the game with participation in LG’s News Hub local-station lineup. But the station group is all in on fulfilling what Sinclair Chief Operating Officer and President of Local Media Rob Weisbord described at NAB Show New York as the “need to be hyperlocal” through digital feeds served over NextGen TV outlets. With ATSC 3.0, “we have something to make stations vibrant again,” he said, adding, “I’m very bullish.”

Meanwhile, the local TV explosion into monetization over CTV connections has already produced the biggest change in the local TV business model since the transition from analog broadcasting. NextGen TV will be emerging in the years ahead to ice an already well-baked cake.

Fred Dawson, principal of the consulting firm Dawson Communications, has headed ventures tracking the technologies and trends shaping the evolution of electronic media and communications for over three decades. Prior to moving to full-time pursuit of his consulting business, Dawson served as CEO and editor of ScreenPlays Magazine, the trade publication he founded and ran from 2005 until it ceased publishing in 2021. At various points in his career he also served as vice president of editorial at Virgo Publishing, editorial director at Cahners, editor of Cablevision Magazine, and publisher of premium executive newsletters, including the Cable-Telco Report, the DBS Report, and Broadband Commerce & Technology.