The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

PORTSMOUTH, NH—”Bundling” is not only becoming more popular among insurance carriers, it’s become increasingly more popular among TV viewers.

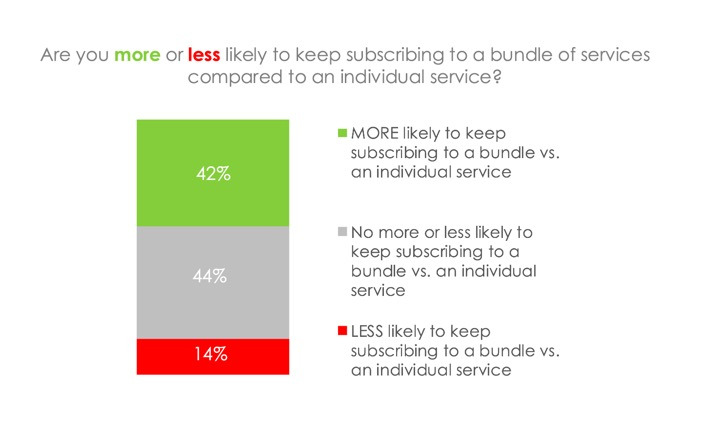

Consumers seeking more value out of their viewing options are more loyal to services that are bundled and new bundles introduced over the past year like Disney+ and Max, Hulul with Disney+, etc.) have proven to be popular. In a new survey from Hub Entertainment Research, 42% of respondents said they are much more likely to keep bundled services compared to services they subscribe to individually.

The results are from Hub Entertainment Research’s "Monetizing Video" which conducted interviews with 1,600 US consumers ages 16-74 with broadband access in June 2025.

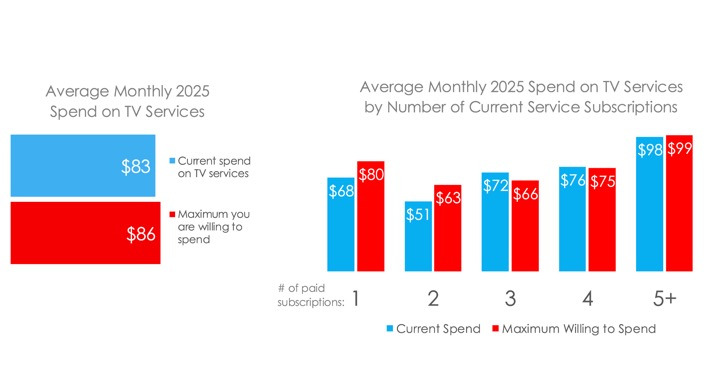

The average user, according to the survey, spends $83 per month on TV services, but say they are only willing to spend a few dollars more ($86). Consumers are tapped out on paying for multiple subscriptions—those paying for 3 or more services are spending more than they’d like and are unwilling to spend more, according to Hub.

The biggest attraction to bundles is the price, with “free” leading the way, but users will still pay for the right combination of content and features from a TV service.

To better understand viewer priorities and how they value different aspects of TV services, Hub asked respondents to rank what they value most when choosing a TV service.

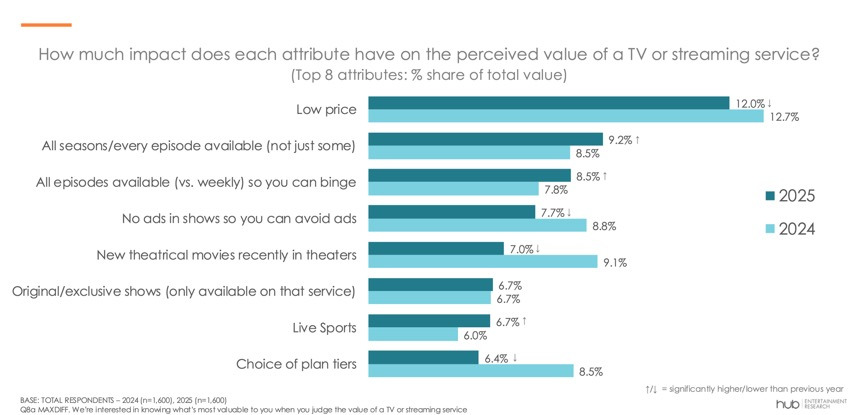

Of 16 attributes tested, below are the top 8 attributes and the percentage share they contribute to the total value of a service - with some notable changes since last year:

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

- "Low price" by far still matters most to the value of a TV service (hence the growth of free services like YouTube, Tubi, and the Roku Channel).

- Having access to full seasons and being able to binge watch have grown in importance; Netflix has made these attributes table stakes.

- Tolerance for ads has increased: having "no ads so you can avoid ads" is less important vs. last year, as users lean into using free services with ads.

- Demand for new theatrical movies on TV services has decreased as theater-going remains soft and viewers lean into plentiful original content from streamers.

- As leagues have sold more sports rights to streamers, live sports have become more important to consumers in how they value favorite teams and games.

- New, cheaper streaming tiers introduced since 2022 have softened interest in plan tier choices as they embrace new bundles of services.

"Emphasizing ‘low price’ and ‘unlimited access’ are evergreen value drivers that streamers can lean into as they manage the ups and downs of new programming slates,” says Jason Platt Zolov, Senior Consultant at Hub. "Leaning into attractive bundles of complementary services is proof-positive that combined services bring winning value and even stronger customer loyalty."

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.