Study: New Streaming Bundles Are Attracting Consumers

As consumers work to reduce spending, the percentage of homes paying for three or more major streaming services declined in 2025, the Hub Entertainment Research survey found

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

PORTSMOUTH, N.H.—New streaming bundles launched over the past year by both distributors and streamers are generating strong consumer interest in 2025, according to a new survey from Hub Entertainment Research.

These bundles feature cable TV packages that include Disney+ and Max, and opportunities to buy competing streaming services directly in new bundles (e.g. Disney+, Hulu, Max bundle w/ ads for $16.99).

As consumers face inflationary pressures, Hub Entertainment Research’s annual “The Best Bundle” study highlights the attractiveness of these new bundles, which give cash-conscious consumers a way to maximize their entertainment spend.

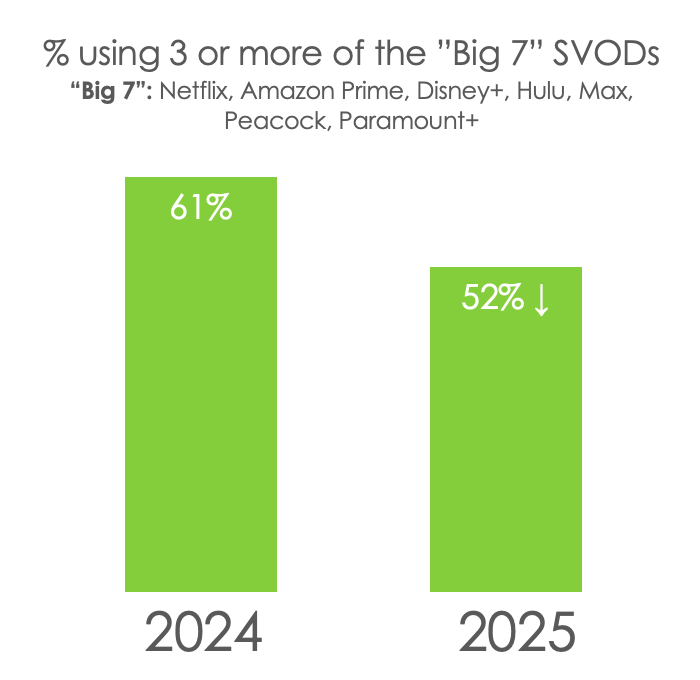

Illustrating the fact that consumers are working to control their spending, is the study’s finding that consumers paying for three or more major streaming services declined in 2025. Only 52% of consumers report having 3 of the “Big 7” SVODs (Netflix, Amazon Prime, Disney+, Hulu, Max, Peacock & Paramount+) services in 2025, declining from 61% last year.

With each service offering an abundance of content, and free services like YouTube and Tubi offering myriad additional content, appetite for paying is waning, the researchers reported.

"The promise of entertainment bundles is nothing new," says Jason Platt Zolov, senior consultant at Hub. "Attractive packaging and pricing of services has always provided more value and simplicity for consumers - and recent efforts at places like Spectrum to provide these attractive bundles are making headway. We can certainly expect more subscriber growth and retention in 2025 as a result of these bundling efforts."

"Package deals" were among the top drivers of sign-ups in 2024 and have become more important than exclusive titles or specific shows, the study found.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Consumers signing up for specific services have historically been motivated by wanting to watch a specific show. This year, "package deals" are a top reason for sign-ups to Prime, Hulu (bundled now with Disney+), and Max, the survey found.

These bundles also have the upside of making TV simpler, the researchers noted.

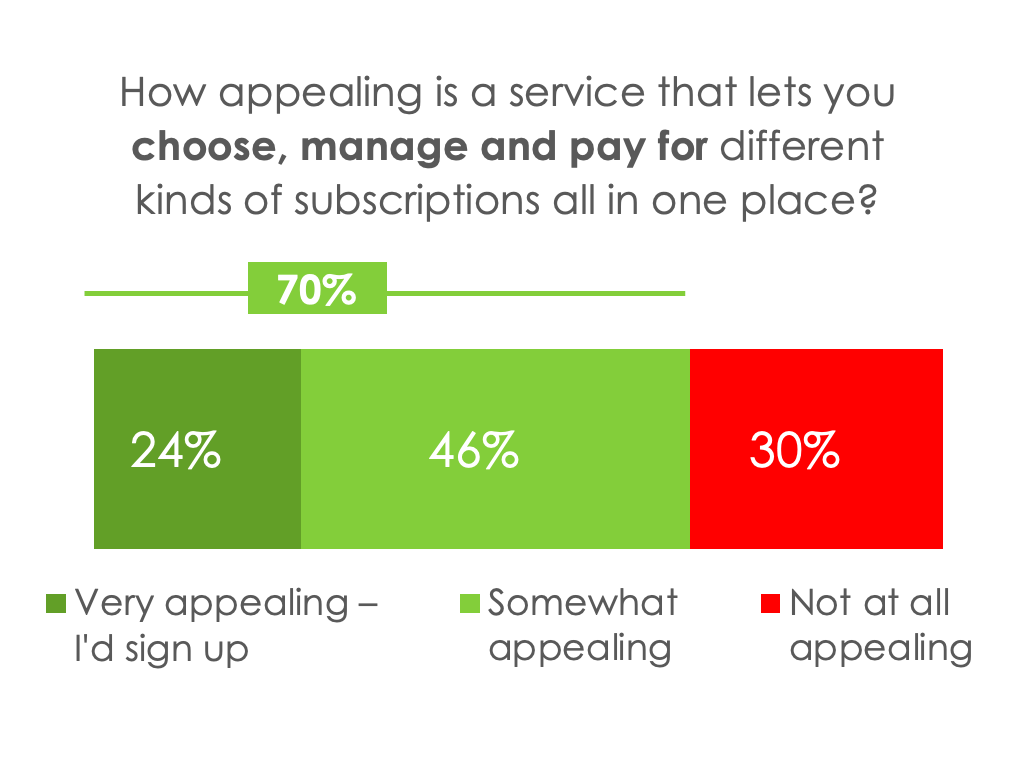

Many consumers feel overwhelmed trying to navigate all their services. So, providers that centralize the task of managing them have a big advantage – even if they don’t lower the cost of those subscriptions.

Nearly three quarters of those surveyed said a service that lets them manage and pay for multiple subscriptions in one place was appealing, and 24% said they’d sign up.

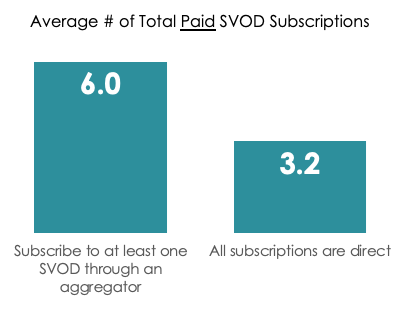

In another notable finding, the study also found that consumers who use aggregators pay for more services overall.

Aggregators like Amazon (with Amazon Prime Video Channels) and Roku (with the Roku Channel store) let consumers buy multiple streaming services in one place. These efforts to sell consumers on the added value of bundling plays out clearly: consumers who bundle services this way subscribe to almost 3 more services than consumers who pay for subscriptions directly.

“Bundles and aggregation are the most important way that streaming platforms can compete with Netflix or YouTube,” concluded Jon Giegengack, principal at Hub. “But it’s critical to remember that the appeal of bundling goes beyond price. The biggest reason people like using aggregators like Amazon Channels is that they can discover and watch content from multiple services, all in one place.”

These findings are from Hub’s 2025 “The Best Bundle” report, based on a survey conducted among 1,600 US consumers ages 16-74 with broadband access. Interviews were conducted in April 2025. A free excerpt of the findings is available on Hub’s website, part of the “Hub Reports” syndicated report series.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.