Study: ViX On Track to Be Fastest-Growing Major Streamer in Americas This Year

‘Freemium’ strategy is helping the streamer see rapid growth, Ampere Analysis finds

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

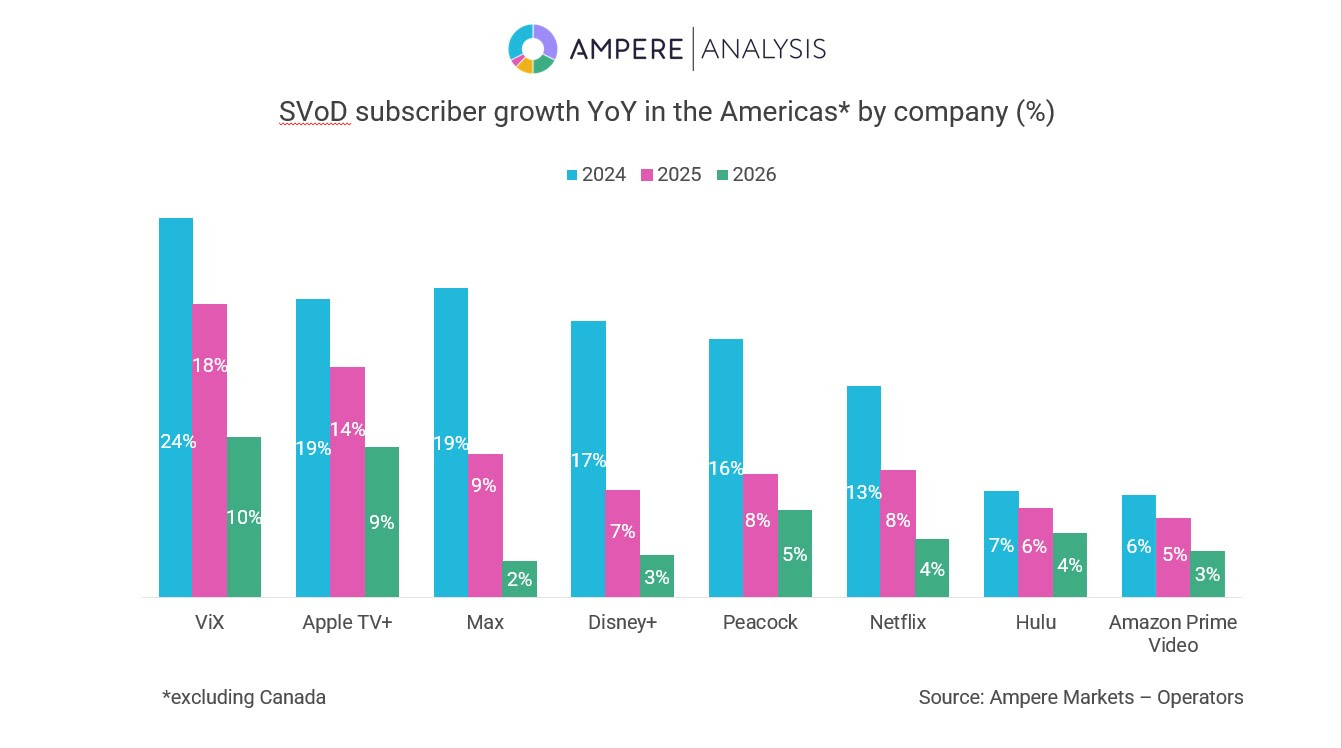

LONDON—Spanish-language streamer ViX is expected to be the fastest-growing subscription streaming service in the Americas in 2025, according to the latest forecasts by Ampere Analysis.

The analyst firm predicts that the TelevisaUnivision-owned service will grow its subscriber base by 18% this year, reaching 10.5 million paying customers in the Americas. This growth rate is expected to surpass that of any other major subscription entertainment streaming platform in the region. Strategic partnerships with major US telcos, a diverse retail network in Mexico, and its unique ‘freemium’ business model are notable factors in the company's expansion, the study found.

Deborah Polanco, analyst at Ampere Analysis explained that “as most streamers shift focus from chasing subscriber growth to achieving profitability, ViX entered the market with a clear strategy, offering tiered options from the outset. While competitors are catching up with ad tiers and implementing password-sharing crackdowns, ViX has already become the third global streamer to reach profitability, and in record time.”

Other key findings from the report include:

- ViX has grown its subscriber base by 70% over the past three years. Its forecast of 18% subscriber growth in 2025 will outpace other fast-growing streamers, such as Apple TV+ (14%) and Max (9%). Ampere expects the remaining global streamers to experience lower growth rates.

- ViX also leads the pack in streaming advertising growth. Its ‘freemium’ mixed business model, which includes an entirely free tier as well as ad-free and ad-supported subscription options, has helped it capture the Hispanic/Latino audience across the US and Latin America.

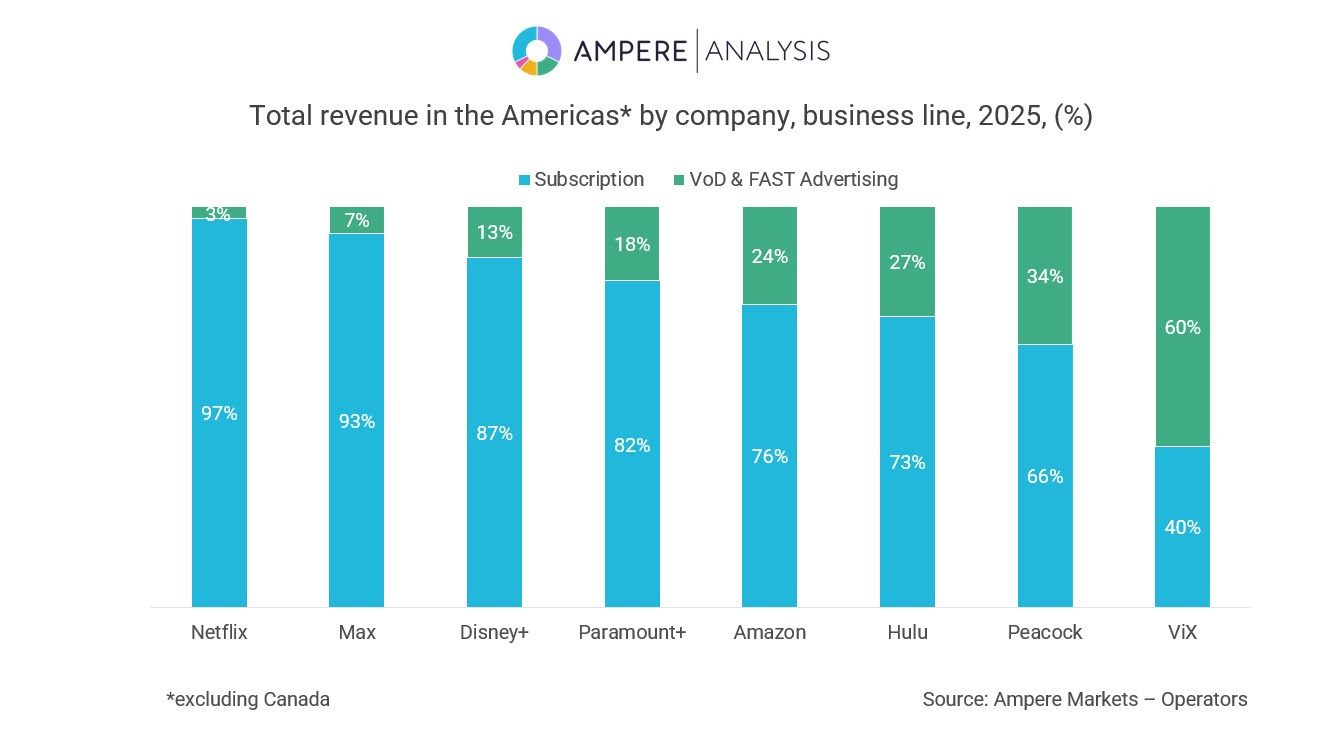

- In 2025, Ampere predicts 60% of ViX’s revenue will come from advertising on both its free and premium ad-supported tiers, with an additional 36% generated from its ad-free subscription tier. With total streaming advertising in Latin America projected to double over the next five years, ViX is poised to continue leading the streaming market in advertising growth.

- The streamer has leveraged bundling to drive rapid growth, securing several key hard-bundle partnerships. A recent deal with Charter Communications in the U.S. will add 900,000 new ad-tier subscribers from 2024 and into 2026. In Mexico, ViX has partnerships with major retailers OXXO and Mercado Libre, and has most recently launched a bundle deal with Disney+.

- More than 40% of US ViX subscribers say a wide choice of movies and TV is a key driver for choosing a subscription platform. ViX has doubled its SVoD catalogue size since its launch in 2022, adding more than 2,500 distinct titles and increasing its lead as the largest Spanish-language content streamer in the world.

- A key advantage is access to TelevisaUnivision’s vast legacy content, which continues to draw viewers. ViX’s parent company’s catalogue is robust in two core genres that resonate in Latin America. Crime & Thriller (20% of its catalogue) was the most commissioned primary genre in Latin America in the second half of 2024, and Romance (18% of catalogue), reflecting Latin America’s enduring telenovela culture.

Natalie Cruz, analyst, Ampere Analysis, added: “ViX has maximized viewer demand for Spanish-language content. Its unique hybrid business model offers a variety of subscription tiers and a vast catalogue, appealing to all audience types. Its stronghold in the Americas and deep understanding of Spanish-speaking audiences have allowed it to effectively monetize through advertising, which now drives the majority of its revenue. With these advantages, ViX is well-positioned to continue outpacing competitors in both subscriber growth and revenue expansion, particularly through advertising.”

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.