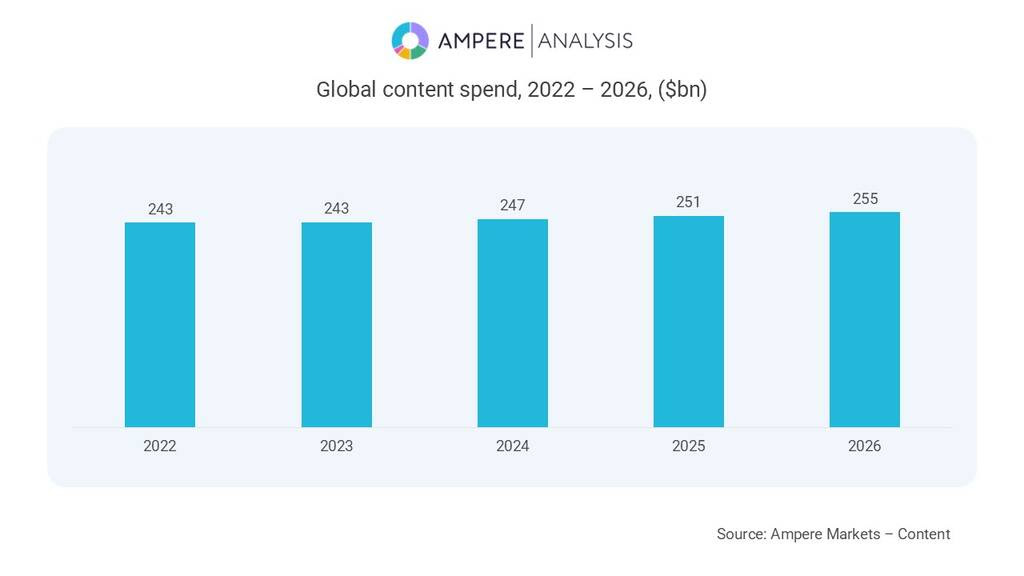

Global Investment in Media Content to Hit $255B in 2026

Streaming platforms drive modest growth in content spend, widening the gap with traditional broadcasters as shifting dynamics reshape the market, according to Ampere Research

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

LONDON—Investment in media content production worldwide will reach $255 billion in 2026, rising 2% year-on-year, according to new forecasts from Ampere Analysis.

The researcher said growth continues to be driven by sustained investment from global streaming platforms, which are further increasing their share of content spend. While overall growth remains modest, this continued shift is widening the gap with traditional broadcasters, as ongoing advertising pressures impact their ability to increase content investment.

The report finds:

- Global streaming platforms remain the primary driver of growth in content investment. Ampere Analysis forecasts that ad-funded and subscription-based streamers will spend $101 billion on content in 2026, representing around two-fifths of total global content spend.

- Traditional broadcast models face a more constrained outlook. Ampere expects pay TV, commercial broadcasters, and public broadcasters to see stagnant or declining content investment, reflecting ongoing pressure on advertising revenues and rising production costs.

- The divergence between global streamers and local broadcasters continues to widen. While international streaming services scale investment, local broadcasters face increasing challenges sustaining content output amid rising costs, ongoing advertising pressure, and shifting post-pandemic viewer behaviour. In the US, commercial broadcasters are reducing spend as studio parent groups redirect budgets to their owned streaming platforms. In contrast, broadcasters outside the US show slightly better resilience, maintaining their investment levels through 2026.

- Major global sporting events, including the football World Cup and Winter Olympics, will provide a boost to content spend in 2026. Historically dominated by broadcast television, streaming platforms continue to expand their sports strategies, with platforms such as Amazon Prime Video securing major NBA rights through 2026.

“Spend in 2025 was in line with Ampere’s expectations, marked by streamers overtaking commercial broadcasters for overall contribution to the content spend landscape for the first time,” said Peter Ingram, Research Manager at Ampere Analysis. “In 2026, we expect streamers to further build on this, seeing 6% growth in expenditure. The accelerating shift in content investment toward streaming underscores a structural rebalancing of the global TV market, with scale and reach emerging as the central competitive differentiators for operators to remain buoyant.”

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.