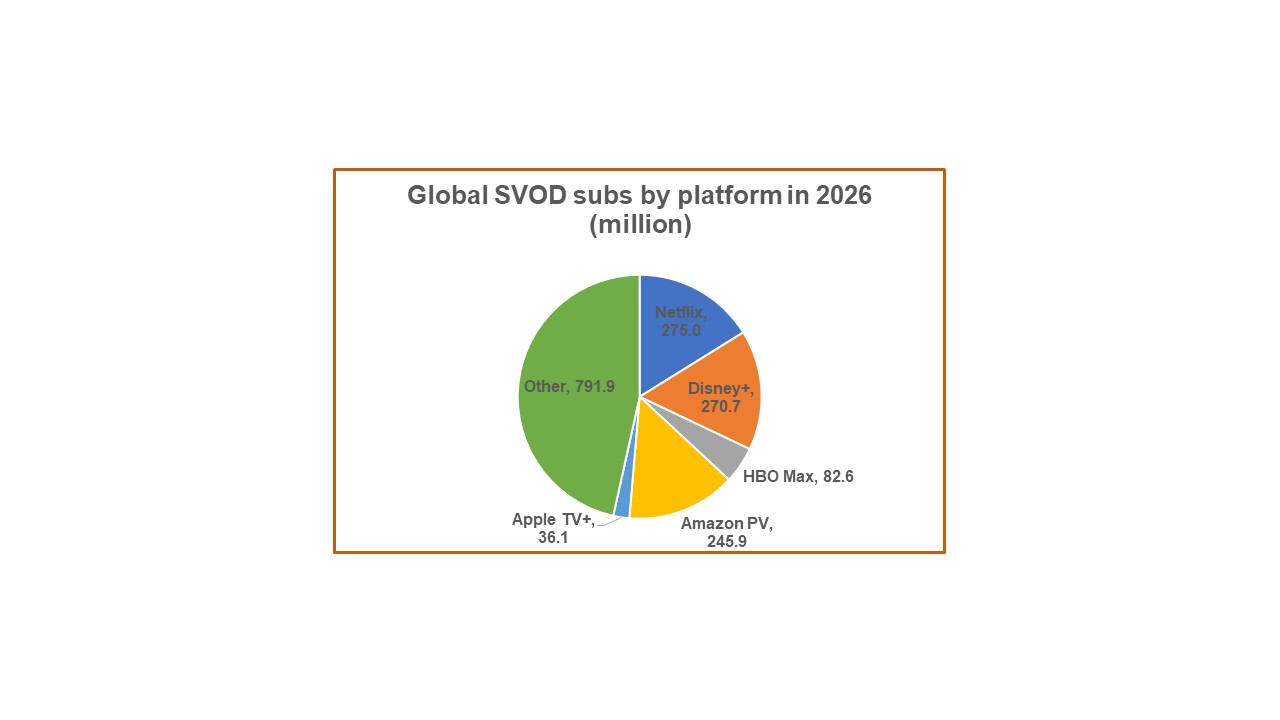

Netflix to Hit 275M Subs in 2026

The five major U.S.-based platforms will control 53% of the world’s 1.7 billion SVOD subscriptions by 2026, according to Digital TV Research

LONDON—In the wake of sluggish Disney+ sub growth during the last quarter, new projections from Digital TV Research are estimating that Netflix will continue to hold onto the top spot as the world’s largest streaming service in 2026 with 275 million subs but that Disney+ will catch up and surpass Netflix sometime in 2027.

In late spring, Digital TV research estimated that Disney+ would surpass Netflix in 2025 but slow growth in the quarter ending on September 30, 2021 prompted the researcher to revise those estimates.

The new report estimates that the five major U.S.-based platforms will control 53% of the world’s 1.7 billion SVOD subscriptions by 2026. That equates to a collective 910 million subscriptions by 2026; up from 585 million in 2021, Digital TV Research estimated.

Simon Murray, principal analyst at Digital TV Research, said: “our previous forecasts based on June 2021 results estimated that Disney+ would overtake Netflix in 2025. Based on the September 2021 results, we now expect that this will happen in 2027.”

Even with the revised estimates, Disney+ will be the biggest winner in the streaming wars, adding 140 million subscribers between 2021 and 2026 to take its total to 271 million. About 102 million of Disney+’ subscribers [38% of the total] in 2026 will be in 13 Asian countries under the Hotstar brand.

Murray continued: “Disney+ only started in six new countries during 2021. Delayed from 2021, the Eastern Europe launches will take place in 2022. This is likely to push back the remaining Asian launches to 2023.”

HBO Max will have 83 million subscribers by 2026, up from 29 million by end-2021. Future launches include territories where it has pay TV operations: Eastern Europe in 2022 and the rest of Asia (probably in 2023).

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

For more information on the SVOD Platform Forecasts report contact Simon Murray at simon@digitaltvresearch.com.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.