2026 Local TV Ad Forecasts Offer Growth and Uncertainties

Political spending will spike next year, but stations will struggle to reverse a longstanding shift away from local TV

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

In most years, a graph of annual local TV ad spending is about as predictable as an electrocardiogram of a reasonably healthy patient in a doctor’s office. Revenue spikes upwards on even-numbered years as a pulse of political advertising pumps into the system and declines in odd-numbered years between the regular cycles of midterm and presidential elections.

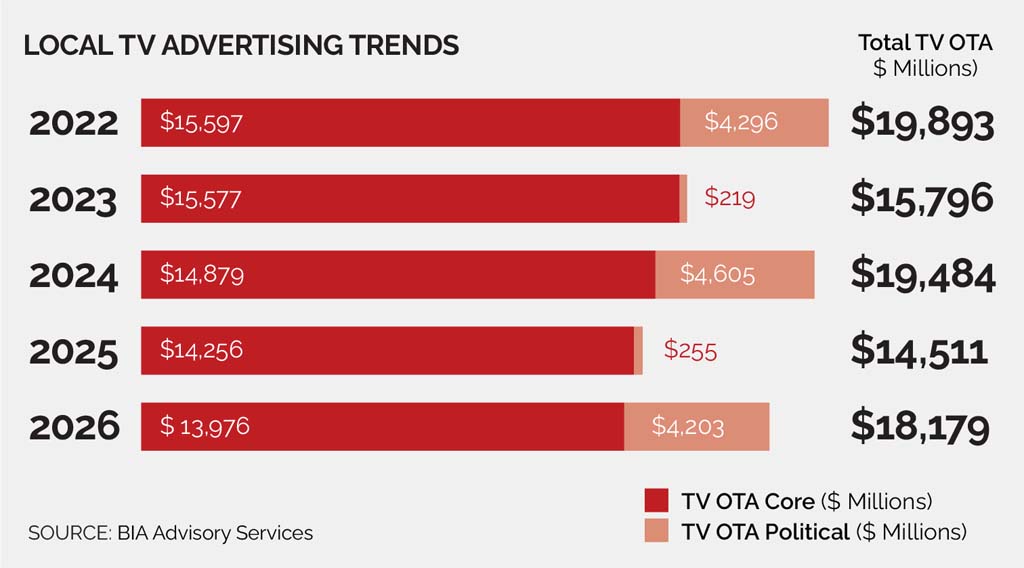

Not surprisingly, analysts and top station executives predict a similar pattern for 2026, which will see a burst of spending around the midterm elections, the Winter Olympics and the FIFA World Cup. BIA Advisory Services, for example, predicts the $14.51 billion in local TV over-the-air (OTA) ad revenue in 2025 will grow 25.5% to $18.18 billion next year.

Smoothing out the spikes of political advertising, S&P Global Market Intelligence’s Kagan Research predicts a cumulative annual growth rate of 1.48% between 2025 and 2030 for TV station ad revenue.

Even so, most analysts readily admit that the prognosis for a healthy ad market over the next year or two is particularly uncertain. While the rollout of NextGen TV and industry-wide consolidation could boost revenue several years down the road, they are unlikely to have a major impact on the 2026 ad market, which could easily be derailed by a variety of economic issues.

“Who knows what will happen with tariffs?” Rick Ducey, managing director of BIA Advisory Services, explained. “Who knows what will happen with inflation and interest rates? Who knows about employment…and consumer confidence and AI spending, which has been a key driver of the economy?”

“The economy is really a big wildcard,” added Brian Wieser, principal at Madison and Wall and a financial analyst of the global advertising, technology and marketing services sectors. “Unless you believe that everything economists have said in the last 100, 200 years is wrong, there are real risks. And it’s not just uncertainty. It’s the certainty that bad economic policies have consequences.”

Political Uncertainty

Even political advertising, which has been reliably breaking records year after year for decades, is potentially more volatile than ever. Ducey noted that the Supreme Court’s upcoming decision in the National Republican Senatorial Committee v. Federal Election Commission case, challenging existing spending limits, could increase or tamp down political advertising. Likewise, efforts to gerrymander congressional districts in Texas, California and other states could also have a major impact on spending.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

“In terms of political advertising, we are anticipating about $3.8 billion next year, up about 10% from the last midterms,” Justin Nielson, head of Kagan Research at S&P Global Market Intelligence, said. “That is not as high as it was in 2024 but relative to the midterms, very healthy.”

BIA is predicting a slightly higher $4.2 billion local OTA TV political ad spend.

Tariffs are another wildcard. “Tariffs have had an impact in terms of consumer spending, but not to the point where it’s made a huge difference in terms of the advertising marketplace,” Nielson said. “Advertising has still been coming in pretty heavily,” and some industries like auto are seeing a spending rebound.

An even bigger worry is the longer-term shift of ad dollars from linear TV and local TV to digital and streaming.

Next year’s generally bright local TV ad forecast includes some notable risks broadcasters will be watching closely:

- Economic Uncertainty: A bust in AI spending, higher inflation, tariffs, job cuts, interest rates, declining consumer confidence and even foreign wars are among the many factors that could derail already sluggish economic growth.

- Political Ad Boom: Broadcasters are betting heavily on a big haul from political ads, but an upcoming Supreme Court case, redistricting efforts that could produce less competitive races and the shift to CTV could reduce growth.

- Regulatory Hopes and Realities: FCC ownership-rule changes could lead to a wave of swaps and mergers that could strengthen ad sales efforts in specific markets, but a Trump administration proposal to limit pharmaceutical ads could devastate a lucrative category.

- Bellwether Industries: Beyond the political sector, analysts believe quick-service restaurants (QSRs in ad parlance), auto, legal services and pharma could be strong categories

in 2026. - Shift to Digital Media: Even with the political advertising boom, the longer-term shift to digital media might reduce core advertising in 2026 and beyond unless stations adopt new business models and strategies.

— George Winslow

Core Concerns

Excluding political from the 20206 numbers, “we actually have a year-over-year decline [in core OTA TV ad revenue] because dollars are shifting to CTV and digital,” noted Senan Mele, vice president of forecasting and data analysis at BIA. This decline would actually be worse, he added, without the beneficial impact of the Olympics and other special events in 2026 like the World Cup.

“Agencies and advertisers want to be able to report the ROI on ad investments and it’s easier to do that with a digital platform compared to TV over the air,” he concluded.

Reversing that trend is a major priority for broadcasters, both with better measurement tools and revamped cross-platform sales strategies.

“We want to make sure that we bring in unique content to the viewers, and that’s really helping us,” Gray’s Steber said, pointing to efforts like the programming produced by its InvestigateTV unit and the content available on its Local News Now 24/7 free streaming channel. “People are hungry for content that’s unique.”

No Simple Cures

Analysts, however, had mixed reactions to broadcasters’ hopes that the rollout of ATSC 3.0, broadcast ownership deregulation and a wave of M&A activity will have much of an impact on 2026 ad revenue.

Most noted that ATSC 3.0’s impact is several years away, given the limited penetration of sets, and were skeptical that deregulation and the creation of larger station groups would immediately strengthen their ad business.

“Advertisers want to make sure that they’re reaching folks no matter where they are, and they want a very cohesive plan,” Ronna Steber, senior managing vice president at Gray Media, said. “So, we’ve worked really hard to be able to offer them complete plans, linear, digital, social” while deploying better measurement and analytics to “make sure that those ad campaigns are delivering on all the analytics that the advertisers want.”

“While digital spend is going up and spending is shifting away from linear media like radio and TV, some of that shift now goes back in their pockets because they’re selling different inventory,” Ducey added. Efforts by local broadcasters to acquire more sports and boost original programming have helped their ad sales, he added.

“It certainly won’t help them compete with bigger platforms,” Wieser said. “Marketers are shifting away from television because of what digital platforms can offer…The reality is that with less fragmentation, you may even have less diversity in the business model, which is a surefire way to amplify the current trends [of ad market share losses]. Size isn’t what’s causing budgets to shift.”

Mele at BIA agreed that consolidation in itself won’t reverse shifts towards CTV but added that it “could help with ad revenue at a station level in specific markets because…there will be fewer sellers.”

Even so, analysts at BIA and other firms highlighted some positive trends.

“The two big highlights for me in terms of positive impact to the ad market have been local sports rights in certain markets and their increasing ability to offer a full suite of linear, digital and social packages to advertisers,” Nielson said. “Being able to offer [a unified, one-stop] advertising business model and investing in local programming is producing an encouraging ROI.”

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.