Study: More Viewers Start Their TV Viewing with a SVOD Service Than Live TV

Less than one third of viewers start watching TV with a live TV service; 40% begin with an SVOD service like Netflix

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

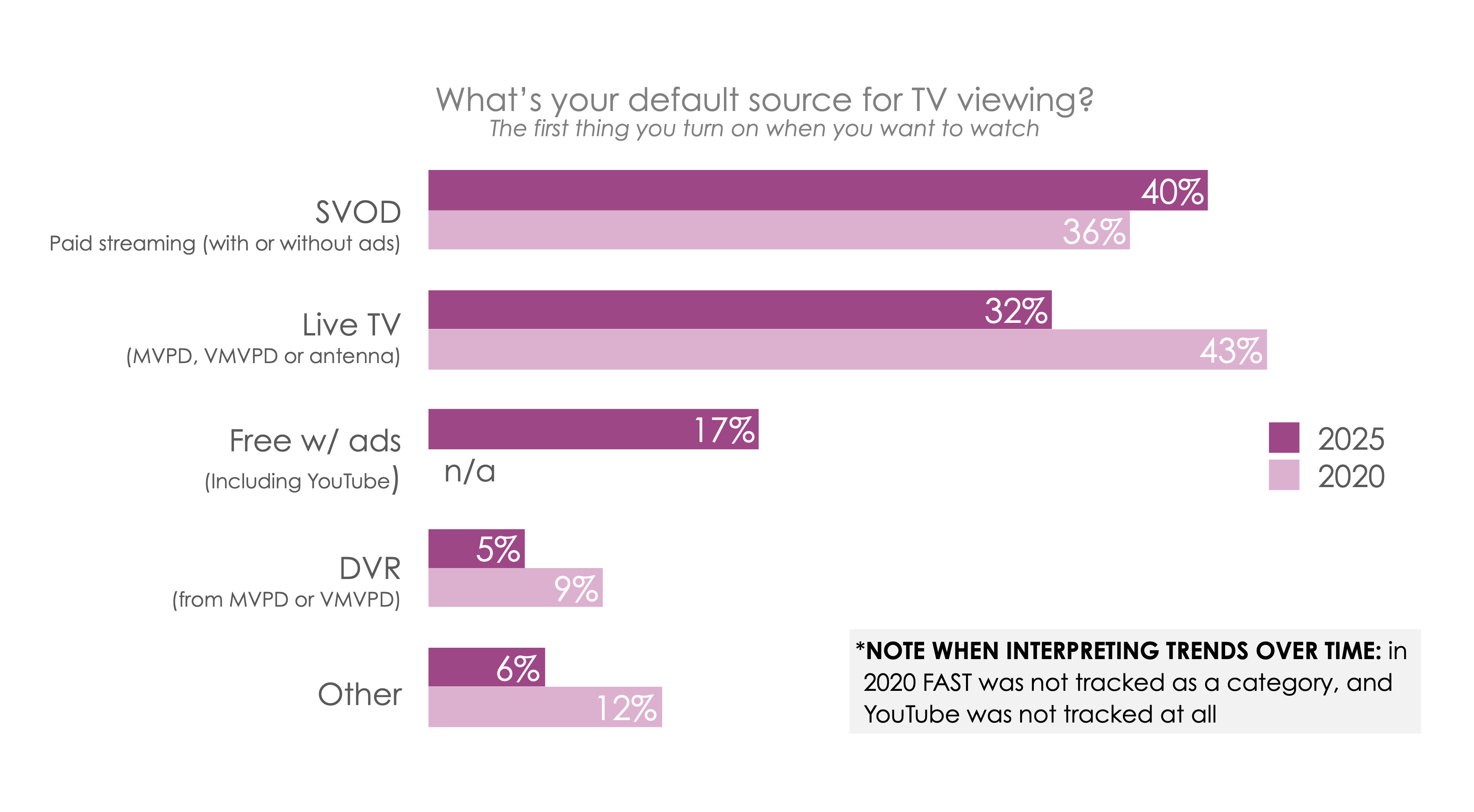

PORTSMOUTH, N.H.—As linear TV channels battle streaming services for viewers, Hub’s annual “Decoding the Default” survey found that many viewers began watching TV using a SVOD services like Netflix and that a significant majority (57%) begin by using a streaming service.

The survey found that an SVOD service was the “first thing” they turn on for 40% of viewers, a much higher figure than the 32% who began by watching live TV from the pay TV provider, live streaming from a virtual MVPD, or live broadcast networks from an antenna. Another 17% start watching on a free streaming service (usually YouTube).

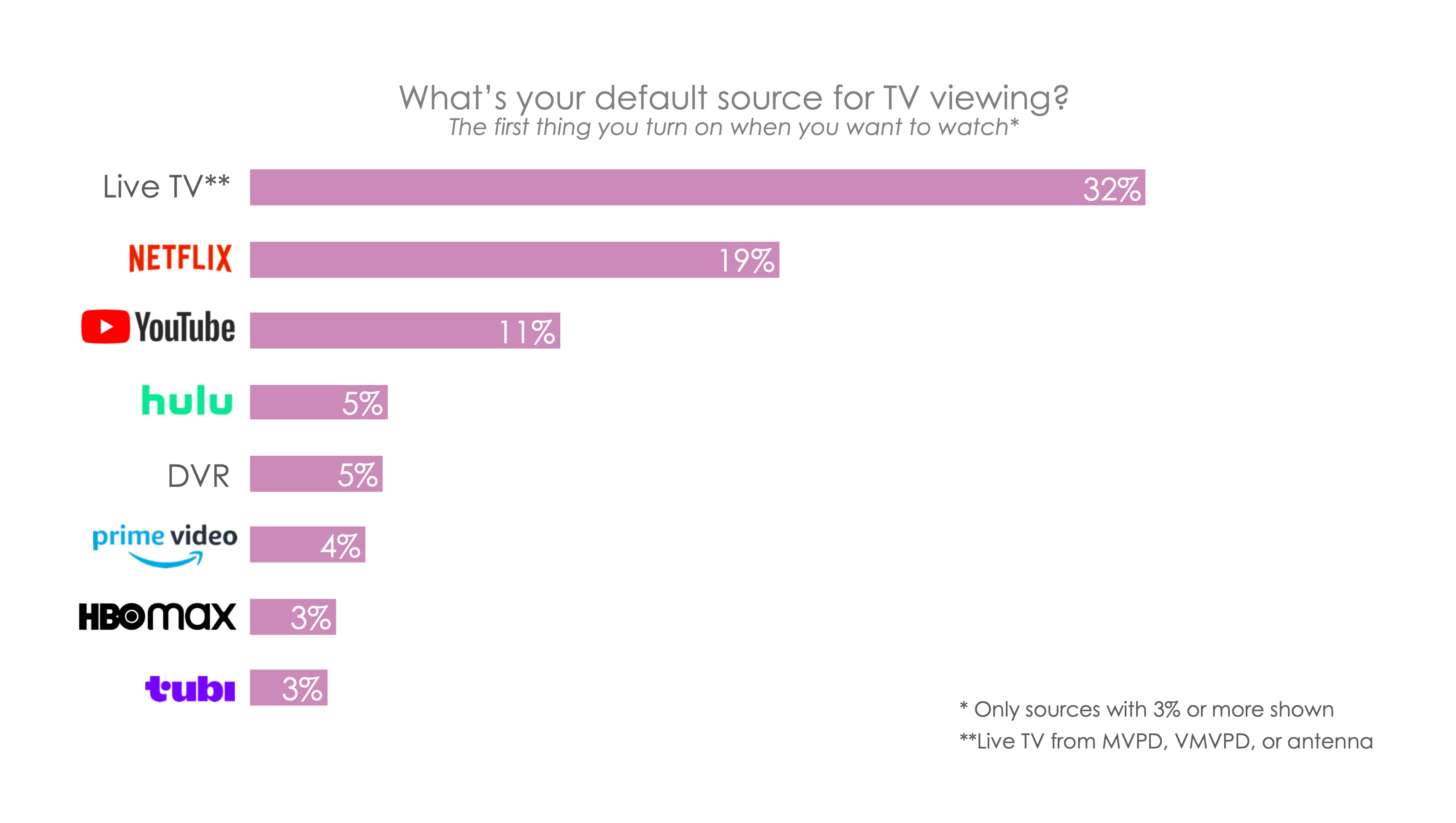

The survey also found that more viewers start watching on Netflix than any other streamer. But alternative platforms (especially YouTube) are beginning to cut into that lead.

“This year’s findings underscore how crowded and competitive the TV ecosystem has become,” said Jon Giegengack, founder and principal at Hub and one of the study authors. “Netflix is the dominant streaming platform and now offers something for everyone: scripted and unscripted TV, original movies, live events and now sports. But this opens an opportunity for the legion of smaller, more specialized services that focus on super-serving specific audiences.”

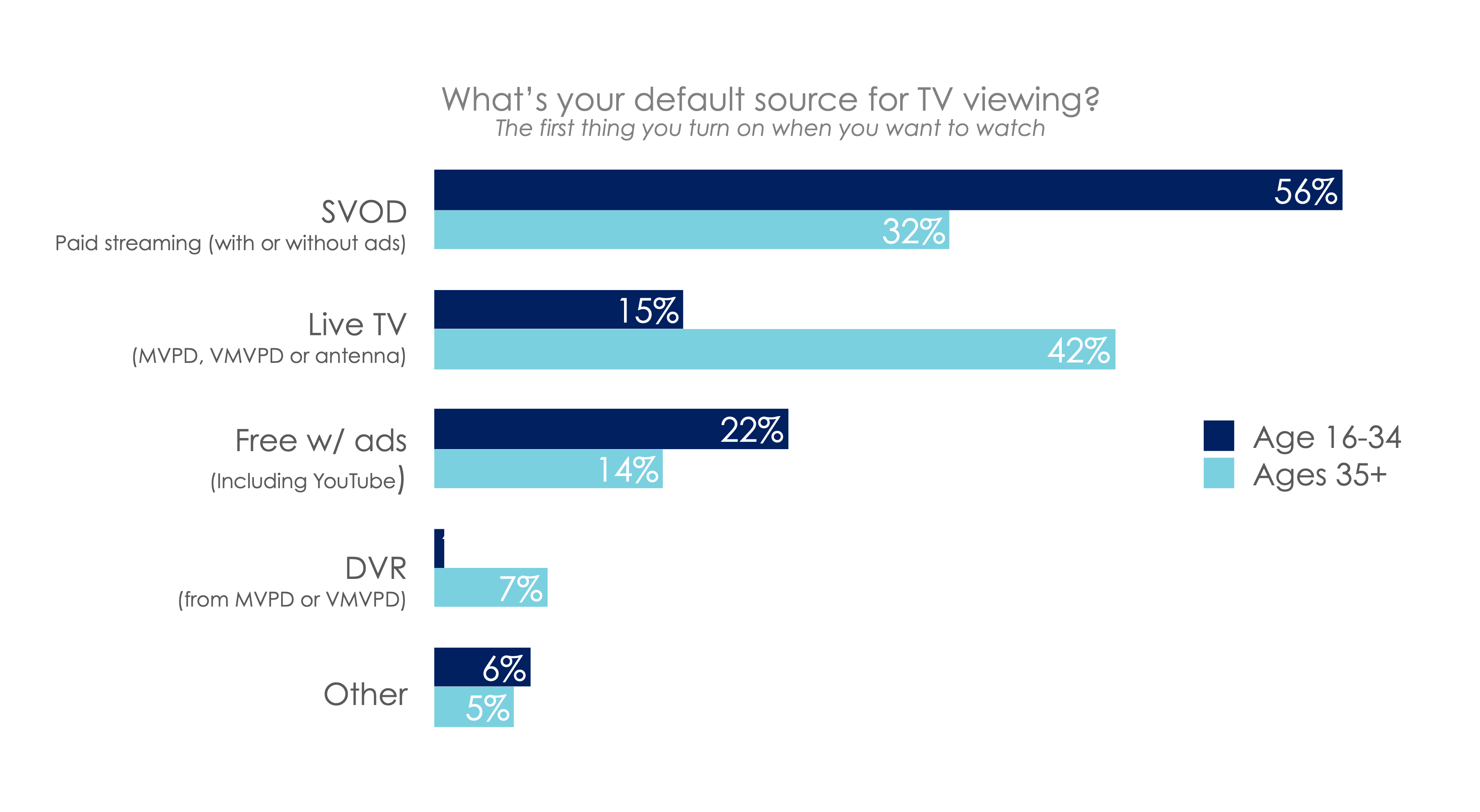

Almost 80% of younger viewers default to streaming sources, the researchers reported, with 56% of viewers under 35 defaulting to a paid streaming service. Another 22% start watching on a free streaming platform. Only 15% default to watching live TV.

Netflix dominates other streaming platforms but the competition is getting tighter, the survey found.

The survey found that a fifth (19%) of respondents say that Netflix is their starting point for TV – almost twice as many as default to YouTube (11%), and 4x the next highest paid streaming service (Hulu, at 5%). But the numbers also show the collective investment in competing streamers is eroding Netflix’s lead.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

In aggregate, more viewers (21%) said their default was a paid SVOD service *other* than Netflix. The percent of viewers who say that Netflix is their default has fallen from 23% in 2020 to 19% in the most recent survey.

More young viewers start watching on YouTube than on live TV. according to the study. More than one quarter (26%) of viewers under 35 start watching on Netflix, and a fifth (18%) start with content on YouTube.

Only 15% say their default source is live TV (one third the rate of viewers 35 and up).

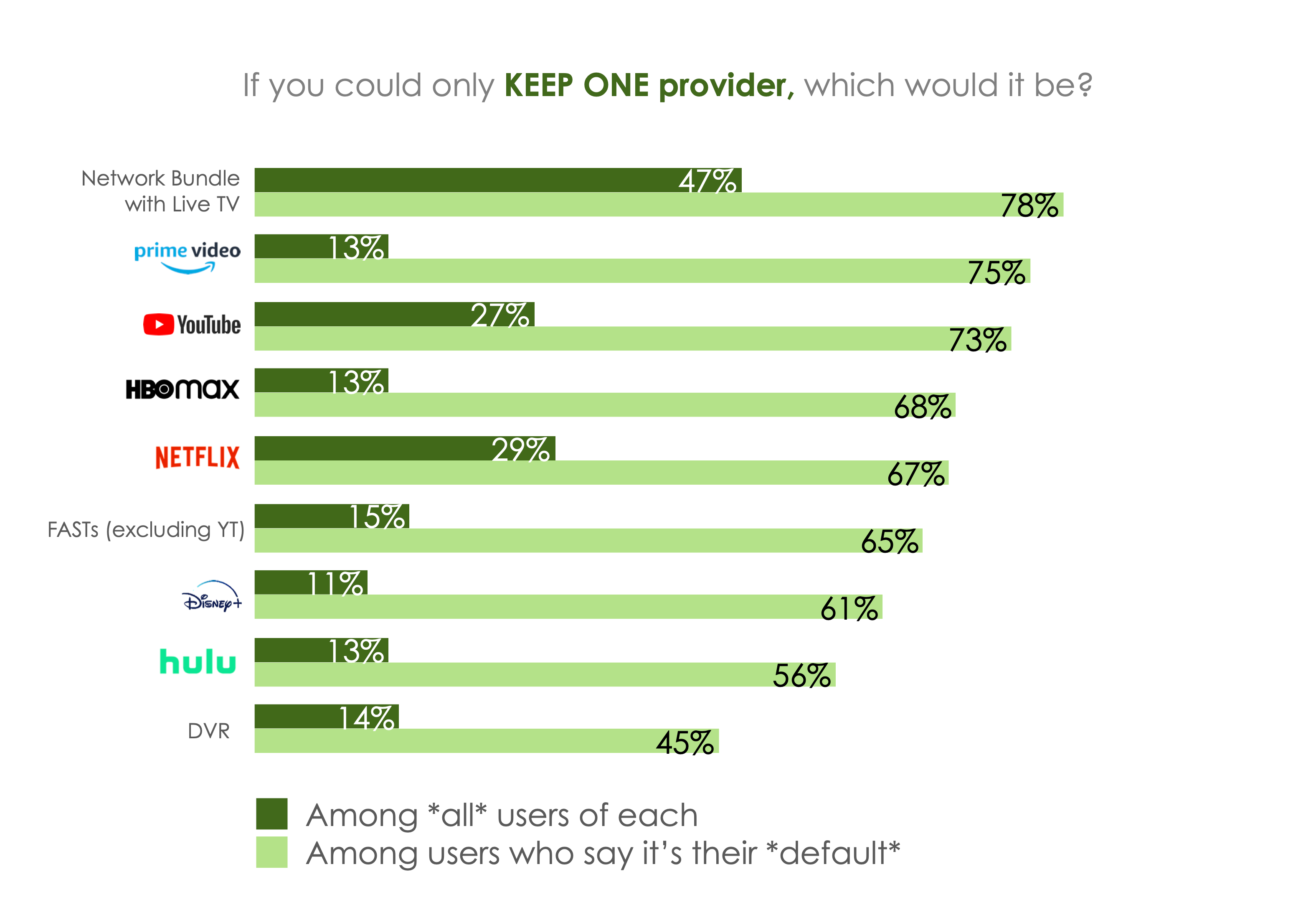

The data on default viewing preferences, the researchers stressed, is important given the high levels of churn facing the streaming industry. Their data shows that in the battle against churn, earning the title of “TV default” is a potent weapon.

In the survey, respondents saw a list of all the services they subscribe to or use. Hub asked “if you had to get rid of all these services except one, which would you keep?” Users who said a given service was their default were far more likely to keep it, compared to users of that service in general – for some brands, as much as 5x to 6x more likely.

“The data is clear: being a viewer’s default dramatically increases the likelihood they’ll keep you,” said Christina Pisano, consultant at Hub and one of the study authors. “First-stop status drives more sessions, more time spent, and higher retention. That’s why the battle for the TV home base is the most important fight in today’s entertainment landscape.”

These findings are from Hub’s 2025 “Decoding the Default” report, based on a survey conducted among 1,600 US consumers with broadband, age 16-74, who watch at least 1 hour of TV per week. Interviews were conducted in August 2025 and explored consumers’ default options for viewing sources and how those have changed over time. A free excerpt of the findings is available on Hub’s website. This report is part of the “Hub Reports” syndicated report series.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.