The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

NEW YORK—Video’s transition to the future is accelerating, with half of advertisers already using Gen AI to build video ads, according to IAB’s “2025 Digital Video Ad Spend & Strategy Full Report.”

Created in partnership with Advertiser Perceptions and Guideline, Part Two of the report provides insights into the impact of GenAI on ad production, what advertisers are demanding from CTV and live sports, the focus on business outcomes, and more. Part One of the report was released in April.

“The economics of advertising are being transformed. As the costs of production fall, the opportunities for advertisers multiply,” said David Cohen, CEO, IAB. “The pool of potential advertisers is growing, as it is easier than ever to plan, buy, optimize, and creatively connect with consumers utilizing new technologies across all forms of media. The democratization of advertising and marketing is entering an exciting new phase, and the outlines of a new future are coming into view fast.”

GenAI Is How Video Ads are Being Created

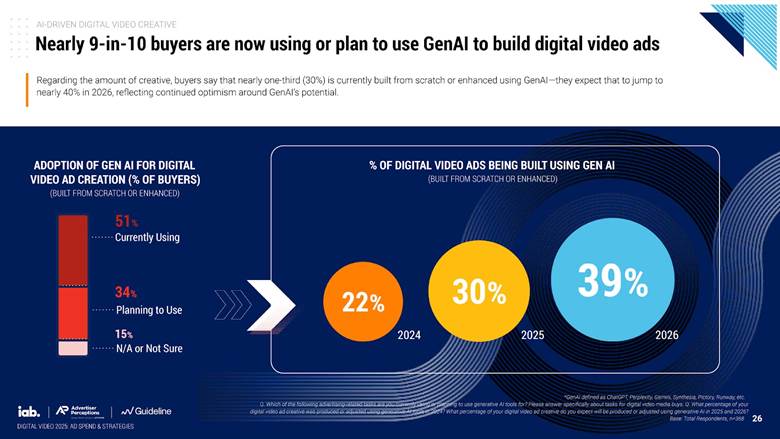

Generative AI is rapidly becoming a cornerstone of video ad creation, transforming how campaigns are developed, tested, and scaled, according to IAB, adding that GenAI is now essential for video ad creation, with 86% of buyers using/planning to use it to build video ad creative.

“The economics of advertising are being transformed. As the costs of production fall, the opportunities for advertisers multiply."

David Cohen, IAB

Buyers project GenAI creative will reach 40% of all ads by 2026, with small and mid-tier brands (SMBs) adopting it faster than the largest brands. SMBs are tapping into GenAI’s ability to help them create high-quality digital video ads quickly, affordably, and at scale, bypassing the need for large teams or expensive production—capabilities that were once exclusive to bigger brands.

Advertisers are also using GenAI creative enhancement capabilities to create versions for different audiences (42%), visual style changes (38%), and contextual relevance (36%).

“Marketers are increasingly looking for partners that not only provide access to GenAI solutions but also help them unlock its full strategic and creative potential,” added Cohen.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Advertisers Expect More From CTV

IAB’s latest report also indicates that buyers expect 47% of CTV inventory to be biddable, up from 34% last year. Three out of four (74%) have built or are planning to build internal teams to manage self-serve CTV activation in-house.

While CTV has a bigger role, buyers want more options and more controls on inventory, according to IAB. With the rise of live content on streaming platforms, 60% of buyers expect more from these platforms than linear TV. One-third want unique interactive experiences and real time data.

“Buyers are excited about sports and other live content coming to streaming,” said Chris Bruderle, Vice President, Industry Insights & Content Strategy, IAB. “They expect to see new and better capabilities than they can get in linear.”

When activating CTV programmatically, more than 80% of digital video buyers want human assistance from their sell-side partners. For CTV platforms offering self-serve activation tools, this underscores the ongoing need to continue to engage directly with buyers.

“Being available programmatically is table stakes. Being a strategic partner who delivers ideas and results is becoming what’s vital to win ad spend,” added Jamie Finstein, Vice President, Media Center, IAB. “As digital video democratizes advertising for small and mid-sized businesses, many of these brands struggle with measurement complexity, standardization, cross-channel data, and scalability."

Buyers Are Focusing on Business Outcomes

CTV is rapidly closing the gap with social video as a performance-driving channel with buyers now holding both to similar expectations for driving business outcomes, including sales and offline store visits. With this year’s economic uncertainty — tariffs, geopolitical conflict, and shifting consumer sentiment — these outcomes have become even more critical, IAB says.

Advertisers have always wanted results, but increasingly — especially in CTV — they are demanding them right now. Bruderle concluded, “Driving bottom-funnel business outcomes is now far and away the most important KPI for video buyers. Deliver, or you’ll get cut.”

According to the report, digital video buyers stated the top reason they reduce or remove spend with streaming partners is failure to deliver business outcomes.

The IAB 2025 Digital Video Ad Spend & Strategy Full Report can be accessed here. The report was released on July 15 during the IAB Media Center’s Video Leadership Summit.

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.