Ukraine Invasion Prompts Magna to Reduce U.S. Ad Forecast

Media owners’ U.S. ad revenues should still grow by 11.5% this year to pass the $300 billion milestone and local TV will see a 16% pop in 2022 according to Magna

NEW YORK—Responding to the economic uncertainty caused by supply chain issues, inflation and the Russian invasion of Ukraine, Magna has reduced its forecasts for growth in U.S. advertising by one percentage point from 12.6% growth to 11.5%.

Even with the downward revision. media owners will see U.S. advertising revenues grow by +11.5% to reach $320 billion, passing the $300 billion milestone for the first time in 2022, Magna predicts.

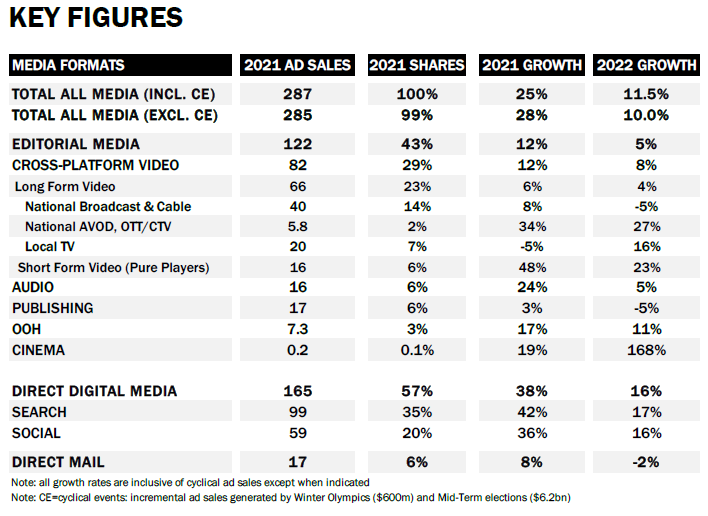

The company also released its final 2021 ad estimates showing that U.S. advertising revenues grew by a record 25% to reach $287 billion. As expected, the pace of growth continued to slow in the fourth quarter, which was up 14% YoY compared to +26% in 3Q21 and +46% in 2Q. All media types benefited from the strong economic environment and spending recovery, notably Search (+42%), Social (+36%), Audio (+24%) and Video (+12%).

For 2022, the geopolitical crisis prompted Magna to anticipate lower-than-expected economic activity, continued supply issues and protracted inflation.

On the other hand, organic growth drivers remain strong and Mid-Term elections will bring $6.2 billion in incremental ad revenues (+41% vs 2018 cycle), Magna reported.

National TV ad revenues (cross-platform national long-form video) will stabilize around -1% (traditional ad sales -5%, AVOD/OTT/CTV +27%), Magna is predicting.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Local TV ad revenues (cross-platform local long-form video) will grow by +16% in 2022, thanks to record political spending and despite the continued weakness of one key vertical, car dealers.

Magna is forecasting that Technology, Telecoms, Entertainment, Travel and Betting are among the industries expected to grow advertising spending the most, while Automotive continues to struggle with supply issues.

Most media types will grow advertising revenues including: Search (+17%), Social (+16%), OOH (+11%) and Cross-Platform Video (+8%).

“The Ukraine crisis has already hit consumer and business confidence,” explained Vincent Létang, executive vice president Global Market Intelligence at Magna and author of the report. “It will slow down economic growth in 2022 and fuel the inflationary trend. It is too early to assess the depth and length of economic repercussions, but Magna believes the U.S. economy is strong enough to weather this new challenge. Looking at marketing and advertising, the macro-economic headwind will be mitigated by continued organic drivers (innovation, emerging verticals, ecommerce) and stronger-than-expected political fundraising (leading to at least six billion dollars in incremental ad spend). Balancing all factors, Magna reduces its 2022 advertising revenue growth forecast by one percentage point, as media owners’ ad revenues will grow by +11% this year to pass the $300 billion milestone for the first time.”

Before the invasion of Ukraine and the geopolitical crisis it triggered, the 2022 forecast consensus was another year of robust economic growth in the U.S. with 3.7% growth for real GDP. Economists predicted a mild slowdown in economic activity, compared with the v-shaped recovery of 2021 (GDP +5.5%), with the main economic indicators remaining above the pre-COVID long-term averages, while inflation would gradually slowdown from the 2021 spike as supply chain issues would fade away, Magna said.

However, since the war broke in Ukraine, uncertainty and volatility have come back. The stock market was hit; oil prices grew from $90 to $130 before stabilizing – for now – around $110; regular gas averaged $4.30 a gallon on 03/14 compared to $3.50 mid-February and $2.80 in March 2021. The economic sanctions against Russia will also hurt the global economy and rekindle the global supply crisis. Pre-Ukraine, U.S. consumer inflation was expected to slow from 7% in 2021 (headline CPI inflation) to +3.8% this year, but now prices, costs and wages are likely to stay inflationary (5% to 7%) for at least one more year, Magna is predicting.

As for economic activity, Magna said that economists have already revised their 2022 GDP growth expectations downward between half a point and a full percentage point. Goldman Sachs, for instance, revised its forecast from +2.9% pre-Ukraine to +2.1% in early March. The combination of higher inflation, stock market volatility and economic uncertainty already hit consumer confidence, which fell to index 59.7 in early March, its lowest level in more than ten years (lower than any point into the COVID crisis).

Despite the geopolitical crisis and stress on energy markets, the U.S. economy’s fundamentals remain strong for now, with low unemployment, stronger savings than pre-COVID, and consumer mobility expected to resume its recovery as we emerge from the Omicron wave of January 2022, Magna said.

The major cyclical driver in 2022 will be the November elections. With $5.7 billion already raised by February according to the Federal Election Commission (+72% vs 2018 at the same stage), Magna now expects incremental advertising revenues generated by political campaigns to reach $6.2 billion for media owners for the entire cycle. This would represent an increase of +41% vs the previous mid-term cycle in 2018 (the previous forecast was +31%). Local television may get $4.2bn (+26% vs 2018), Direct Mail $600 million, and Digital Media formats close to $1.5 billion.

In addition to political spending, ballot measures will bring millions of dollars into local and digital media. Already 77 statewide ballot measures are scheduled for the November election, on various topics including abortion, marijuana, sports betting, environment and voting rights, Magna reported.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.