The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

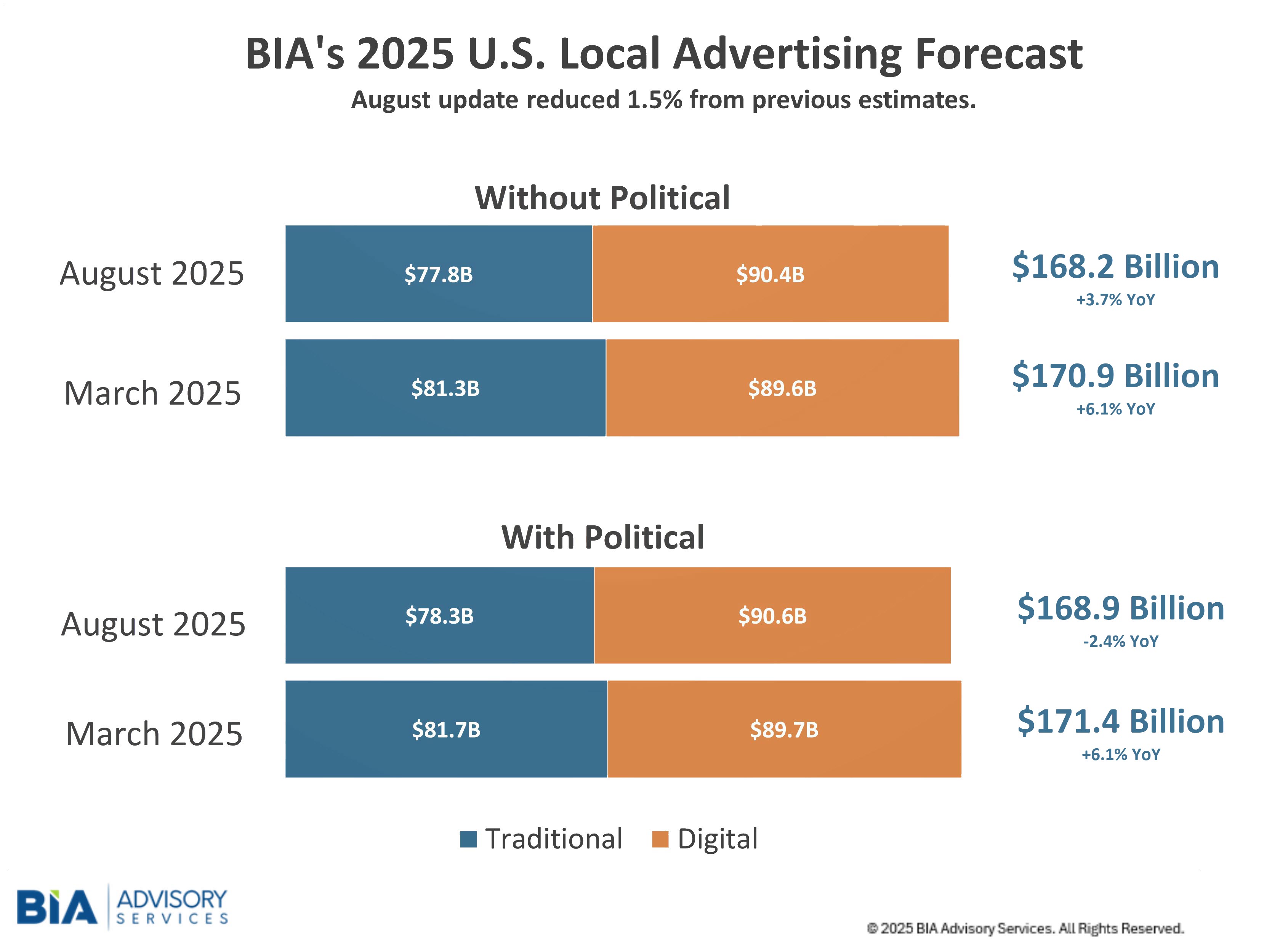

CHANTILLY, Va.—BIA Advisory Services’ has revised its 2025 U.S. Local Advertising Forecast down to $169 billion this year, reflecting a 2.4% decline compared to the previous year. This updated forecast is a 1.5% decrease from the company’s earlier estimate of $171.4 billion.

Excluding political advertising, the updated forecast for the year is $168.2 billion, representing a 3.7% growth compared to last year. This amount is a decrease from the previous forecast of $171 billion, the researcher said.

Economic factors such as consumer sentiment, tariffs, high interest rates, and tight credit conditions are exerting increased pressure on local advertising budgets across all sectors, leading to these revised projections. The forecast considers an expected minimum tariff environment of 10%, its impact, and the necessary budget adjustments.

We are now noticing a shift in the advertising landscape for 2025."

Senan Mele, BIA

“Following a solid performance in 2024, driven by significant political advertising and spending from key sectors such as Legal Services, Healthcare and Quick Service Restaurants, we are now noticing a shift in the advertising landscape for 2025,” stated Senan Mele, VP of forecasting and data analysis. “Ad growth has slowed down slightly as businesses implement more cautious spending strategies and optimize their channel allocations. This change underscores the necessity for agility in responding to the rapidly evolving economic environment.”

Within the total local ad spend, BIA has raised its forecast for digital media spending by $855 million this year, highlighting its increasing influence in the advertising landscape. Digital media is expected to account for 53.7% of total advertising spending, which amounts to $90.4 billion. In contrast, traditional media spending is projected to make up 46.3% of total ad revenues, totaling $77.8 billion, reflecting a decrease of $3.5 billion from previous estimates. This shift is attributed to a growing focus on lower-funnel channels and the ongoing fragmentation of the media landscape.

When analyzing the forecast without political advertising, several media types are projected to experience growth. Connected TV (CTV)/Over-the-Top (OTT) is expected to increase by 29.3%. PC/Laptop follows closely, growing 12.1%, and mobile advertising is expected to rise by 9.4%. Additionally, TV digital advertising is estimated to grow by 3.7%, while both out-of-home (OOH) advertising and direct mail are projected to see a growth of 1.6%.

“The impressive growth of CTV and OTT services from 2024 to 2025 is largely attributed to ad-supported platforms now capturing 73.6% of TV viewing,” said BIA Managing Director Rick Ducey. “This transition from traditional broadcasting to streaming reinforces the business case for TV broadcasters to implement CTV/OTT strategies, enabling them to reclaim audiences and enhance their targetable ad inventory. However, despite increasing viewership and advertising spending, streaming providers face significant challenges in achieving profitability in a fragmented market."

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

BIA’s local advertising forecast also provides insights into ad spending by local verticals. Key takeaways include:

Top Three Fastest-Growing Categories Year-Over-Year:

- Real Estate (+10.4%)

- Restaurants and Food (+7.8%)

- Finance and Insurance (+4.0%)

Key Categories (Excluding Political) Declining Year-Over-Year:

- Media (-2.2%)

- Healthcare (-0.5%)

- General Services (-0.3%)

Mele remarked: “Despite the challenges faced by the media sector, there are promising opportunities this year, particularly with the holiday shopping season expected to kick off in early November. This extended time frame allows for a more strategic approach to targeted advertising. We’re excited to explore these trends further and provide our clients with insights that can help them capitalize on the growth in fast-growing categories while also navigating the declines.”

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.