Nielsen: Streaming Reaches Historic TV Viewing Milestone

Streaming usage is up 71% since 2021 and streaming’s share of total TV viewing is now higher than broadcast and cable combined

NEW YORK—Nielsen is reporting that streaming reached a historic milestone in May of 2025 as its share of total television viewing outpaced the combined share of broadcast and cable for the first time ever.

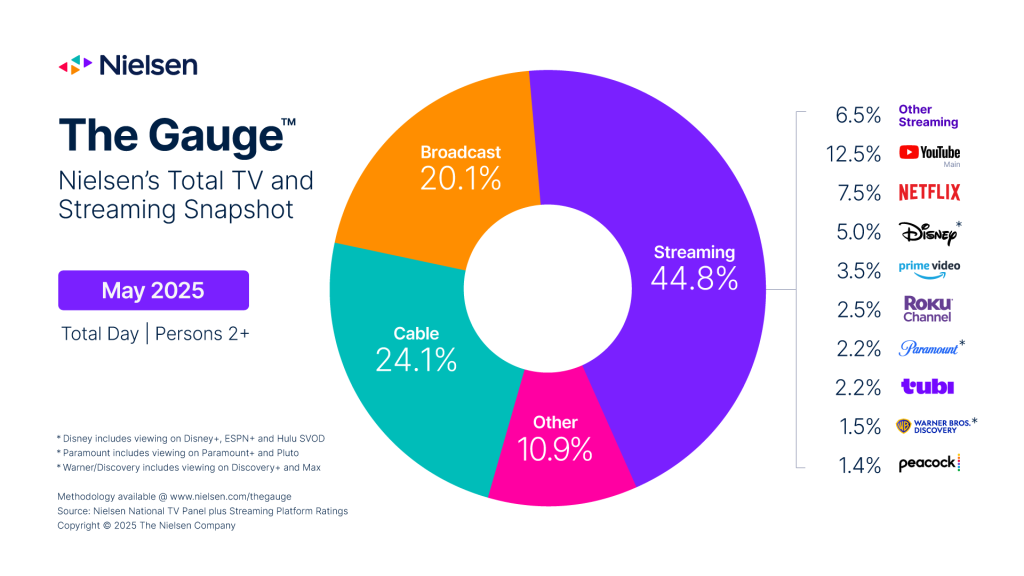

According to Nielsen’s monthly report of The Gauge, streaming represented 44.8% of TV viewership in May, its largest share of viewing to date, while broadcast (20.1%) and cable (24.1%) combined to represent 44.2% of TV.

Nielsen reported, however, that the milestone of streaming exceeding traditional TV viewership is almost certainly not permanent. While the trend is likely to into the summer months, the balance will likely shift back—at least temporarily—as football kicks off and a new broadcast season returns.

Data from The Gauge, which debuted four years ago with the May 2021 report, also highlights how audience viewing habits have rapidly changed, with streaming usage increasing by 71% in the last four years. Meanwhile, broadcast and cable viewing have declined, with broadcast down 21% and cable down 39%.

Along with the 71% increase in streaming usage, six additional streaming services are now reported in the list of platforms that exceed a full share point of TV usage. The original list included Netflix, YouTube, Hulu, Prime Video and Disney+, and has since been expanded by Nielsen to 11 platforms in the May 2025 report.

Among subscription services, Netflix has remained the leading SVOD provider in total TV usage for four straight years. Netflix’s viewership has climbed 27% since May 2021, and the streamer owned the biggest day in streaming history, thanks to two exclusive NFL games it live streamed on Christmas Day 2024.

Nielsen’s researchers also highlighted the fact that many programs—and by extension, other distributors—have benefited from being available on the SVOD giant through The Netflix Effect, where licensed content becomes an even bigger hit when distributed on the platform. This effect is illustrated by such streaming hits like “Suits” (Netflix / Peacock) and “Young Sheldon” (Netflix / Max).

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Data from The Gauge also showed that free services have been a major driver of streaming’s overall success. Most notably, YouTube Main (excluding YouTube TV) has exhibited steady, significant growth and is up over 120% since 2021.

YouTube represented 12.5% of all television viewing in May, its fourth consecutive monthly share increase and the highest share of TV for any streamer to date.

Additionally, FAST services have become increasingly popular, and three have reached the reportable threshold in The Gauge. PlutoTV, Roku Channel and Tubi combined for 5.7% of total TV viewing in May, which is larger than any individual broadcast network this interval, Nielsen said.

The continued transformation of traditional media companies into streaming-first entities has also been a strong contributor to the growth of streaming. Platforms like Hulu, Paramount+ and Peacock have expanded their accessibility to create crucial points of connection with streaming-native audiences, complementing rather than competing with their linear counterparts.

This trend extends beyond original and catalog content, Nielsen noted. It is also demonstrated by successful simulcasts of sporting events like Super Bowl LIX on FOX and Tubi, and the 2024 Olympics on NBC and Peacock. Virtually all subscription-based platforms now have ad-supported components as well, which are creating a critical new element to the television landscape from an agency and advertiser perspective as they seek to reach streaming-centric consumers.

The May 2025 interval included dates 04/28/2025 through 05/25/2025. Nielsen reporting follows the broadcast calendar with measurement weeks that run Monday through Sunday.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.