Content Monetization Drives Broadcasters’ Move to OTT

Data aggregation and management, combined with artificial intelligence, are advancing adoption

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

In the current evolving device and platforms-based media world, the smart TV was the means for viewers to watch not only linear television but also streamed channels, primarily video-on-demand, and interactive services. Increasingly, as more people watch home entertainment via OTT, smart TVs are now part of an overall connected TV system, all based on streaming with integrated TV, VOD, internet connectivity and gaming access.

Because of this, MediaKind Principal Technologist Tony Jones said, CTV can be viewed in two different ways.

“One is from a device perspective for streaming in general terms, and what that means for broadcasters, amongst others,” he said. “The other is about streaming services that CTV vendors provide themselves. There is the question of whether there’s a difference between, for example, Samsung’s own service streamed to a Samsung TV and BBC services streamed to a Samsung TV. I think in principle they’re the same, but having consumer electronics vendors coming in with their own streaming services has a commercial disruptive impact on the market.”

Actionable Inventory

Samsung, with its TV Plus platform, LG Channels, Vizio WatchFree+ and others, including the Roku Channel, are further expanding an OTT landscape established by Netflix, Prime Video and YouTube that is also seen as the future for linear broadcasters. Driving this, as Imagine Communications CEO Steve Reynolds observes, is data-gathering, which in turn underpins the commercial potential of these platforms.\

Broadcasters today are not just competing with other TV networks, they’re competing with every app on a user’s phone.”

Tobias Fröhlich, Qvest Engage

“Data is a big part of it, because it’s what makes the inventory in these CTV systems so valuable,” he says. “It’s a combination of the data you can get around viewership and then how it can be used to make the audience and the inventory more valuable to whoever is controlling that inventory. But what it really comes down to is monetization. The customers we’re working with are doing anything around CTV as an enhancement of their monetization strategy.”

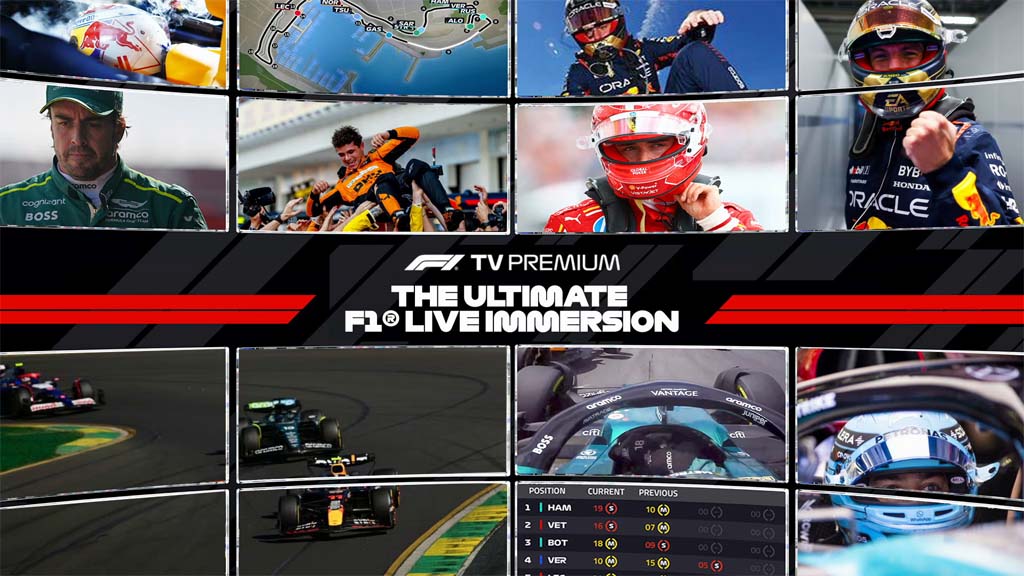

This is very much the approach of organizations, notably in the sports market, with in-house media operations that give them control of how they present coverage of their events. Formula One (F1), for example, expanded its streaming channel in March of this year, launching the F1 TV Premium tier that offers UHD, HDR, multiview and personalized viewing options.

“Fans can get fully immersed in what F1 is all about [over a race] weekend,” says Stephanie Lone, global leader for solution architecture at Amazon Web Services (AWS), which provided several of its Elemental Media systems, plus Amazon CloudFront, for the new video workflow. “There’s the actual viewing experience—the 4K/UHD/HDR stream itself—but also the way F1 uses data and generative AI in a much more meaningful way for the consumer. It’s not just for monetization purposes but is more about the fan engagement as well.”

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Competing With Apps

This level of technological innovation—and, of course, investment—increases the challenges that linear broadcast companies in particular face as they move further into the streamed domain.

“Broadcasters today are not just competing with other TV networks, they’re competing with every app on a user’s phone,” Tobias Fröhlich, managing director of product at Qvest Engage, said. “To stay relevant, they need to think and act like digital platforms, reimagining the TV experience by combining live and local strengths with the personalization, interactivity and community features that audiences now expect.”

Broadcasters always have opportunities to get more value from their content, especially through free, ad-supported streaming television (FAST) channels and other platforms, says Scott Wall, principal solutions architect at Signiant.

“To take advantage of that,” he said, “you’ve got to move content quickly and get it to the right place, in the right format. Monetization, visibility and security are big [parts of this]. A lot of the monetization in CTV is tied to how quickly you can deliver the right assets with the right metadata, especially for ad-supported content.”

Like their counterparts in the U.S., European commercial broadcasters have been experiencing flat revenue growth in recent years. But companies such as RTL, RTF and Canal+ are seeing ad sales increase through OTT services, said Eric Gallier, vice president of video customer solutions at Harmonic.

“The reality today is that they are investing a lot in their streaming platforms,” he says. “They are seeing growth in CTV, which is fueled by advertising. And at some point we [will] see the shift between traditional linear broadcast to streaming and CTV, which, for me, is streaming.”

Smarter TVs

North American broadcasters are now taking advantage of opportunities given by streaming and CTV to make the most of existing assets. Reynolds offers the example of Canadian broadcaster Rogers Sports & Media, which was able to exploit sports rights it owned as streamed channels.

“We worked with them to set up a public cloud-based infrastructure for native delivery, connecting to consumers on various CTV platforms through smart TVs or [devices like] Roku boxes,” he says. “They had a pretty short window in which to take advantage of those rights and get the integration with the CTV platforms.”

Viewers today have a wide choice of devices on which they can watch films, programs and other video. As MediaKind’s Jones points out, there has long been talk of the PC being a contender in this field, but other technologies are undermining that.

“TVs have become more capable and interactive and that’s eating into some of the territory PCs formerly had,” Jones said. “Interactivity is across all devices and smart TVs are just one [option]. They are at the lower end of capability but they are still the primary screen in the house for viewing content.”

CTV and smart TV capabilities are already being pushed forward today for viewers and for media companies that now have more ways to collect data and commercialize their services. Lone of AWS cites Warner Bros. Discovery, which has customized real-time show and movie recommendations for unauthenticated users.

“The advent of CTV has brought new monetization opportunities, with more interactive ads, shoppable experiences and personalization around the viewing experiences,” she says. “There’s also the capability for enhanced analytics and

real-time viewing metrics, which will allow for programming adjustments in near real time to tailor content to what’s resonating with audiences.”

And what resonates with the audience, both in terms of shows and tech, is now even more important in today’s fluid media market.

Kevin Hilton has been writing about broadcast and new media technology for nearly 40 years. He began his career a radio journalist but moved into magazine writing during the late 1980s, working on the staff of Pro Sound News Europe and Broadcast Systems International. Since going freelance in 1993 he has contributed interviews, reviews and features about television, film, radio and new technology for a wide range of publications.