Study: Consumers See ‘Strong Value’ in Streaming But Are ‘Very Concerned’ About Economy

The newest Hub survey highlights the impact that economic uncertainty could have on the streaming industry

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

PORTSMOUTH, N.H. —A new study shows that the post-pandemic economic strain and rising prices continue to rattle U.S. consumers, who are keeping an eye on their spending and streaming video price increases. Yet, the results of Hub Entertainment Research’s semiannual “TV Advertising: Fact vs. Fiction” survey also indicate viewers still consider streaming to be a good value.

“Consumers are still feeling aftershocks from the economic disruption of the pandemic, and that anxiety isn’t going away. If anything, recent economic news has made many of them more skittish,” Hub Senior Consultant Mark Loughney said. “Over the past three years, though, we’ve seen viewers saying TV is better than ever, providing a great deal of value for the cost. So, the positive news for streamers is that even if consumers continue to worry about the economy, video subscriptions will be among the last places they look for savings. If the streaming services are judicious with price increases, they can hold on to subscribers through uncertain economic times.”

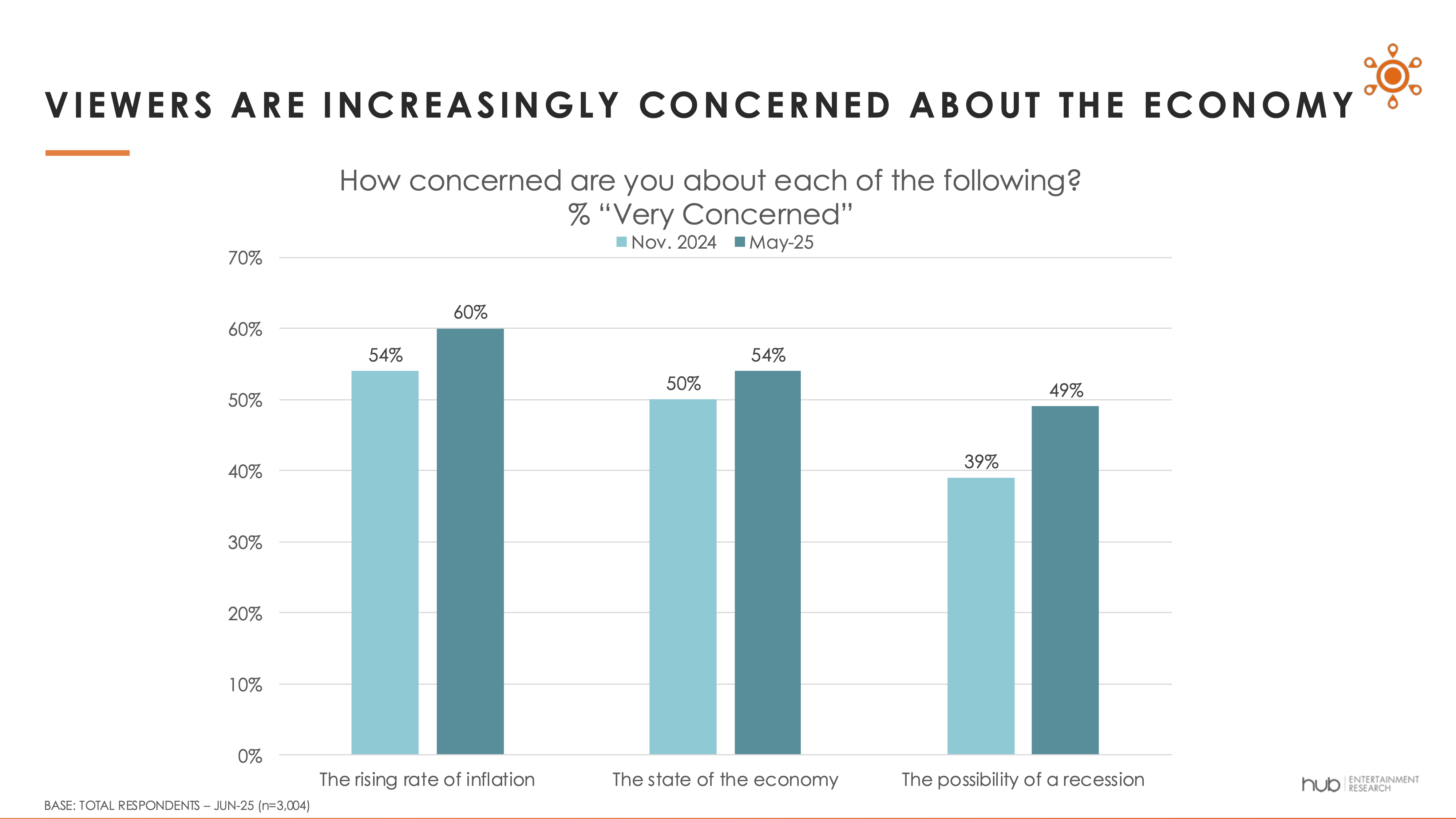

The study found that the majority of viewers are “very concerned” about the economy; significantly more so than last November.

Hub has been asking viewers about their economic concerns since fall 2022. Throughout that time, most viewers have said they are “very concerned” about the state of the economy. From November 2024 through May 2025, though, consumers expressed significantly more concerns about the economy overall, and specifically about the rate of inflation and the possibility of a recession, the study found.

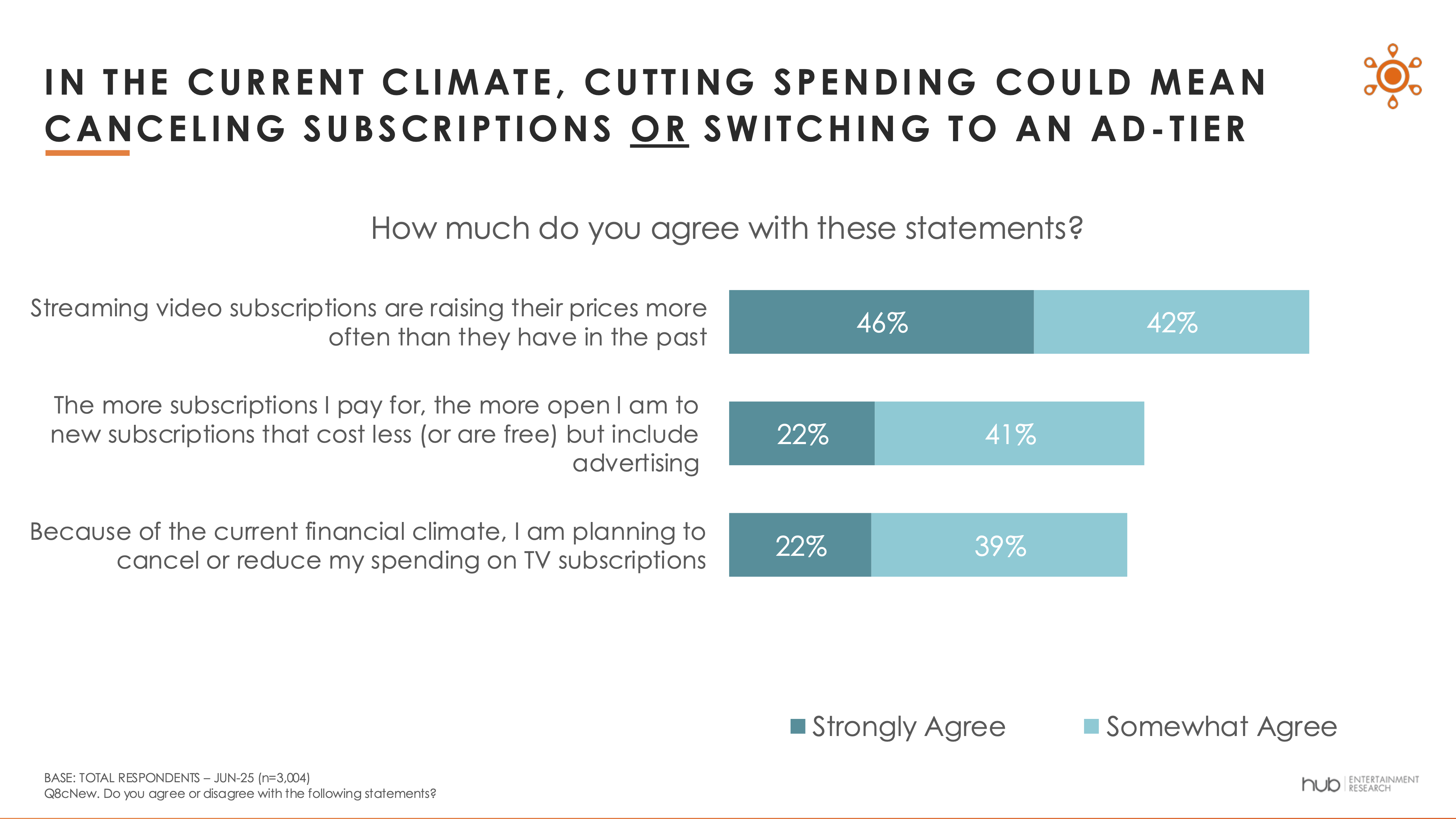

The data also indicated that during a time of economic uncertainty, viewers are sensitive to the frequency of subscription TV rate increases. Nearly nine in 10 agree that these increases are coming more often than in the past. As a result, many consumers are considering canceling subscriptions or switching to lower-cost, ad-supported offerings, Hub reported.

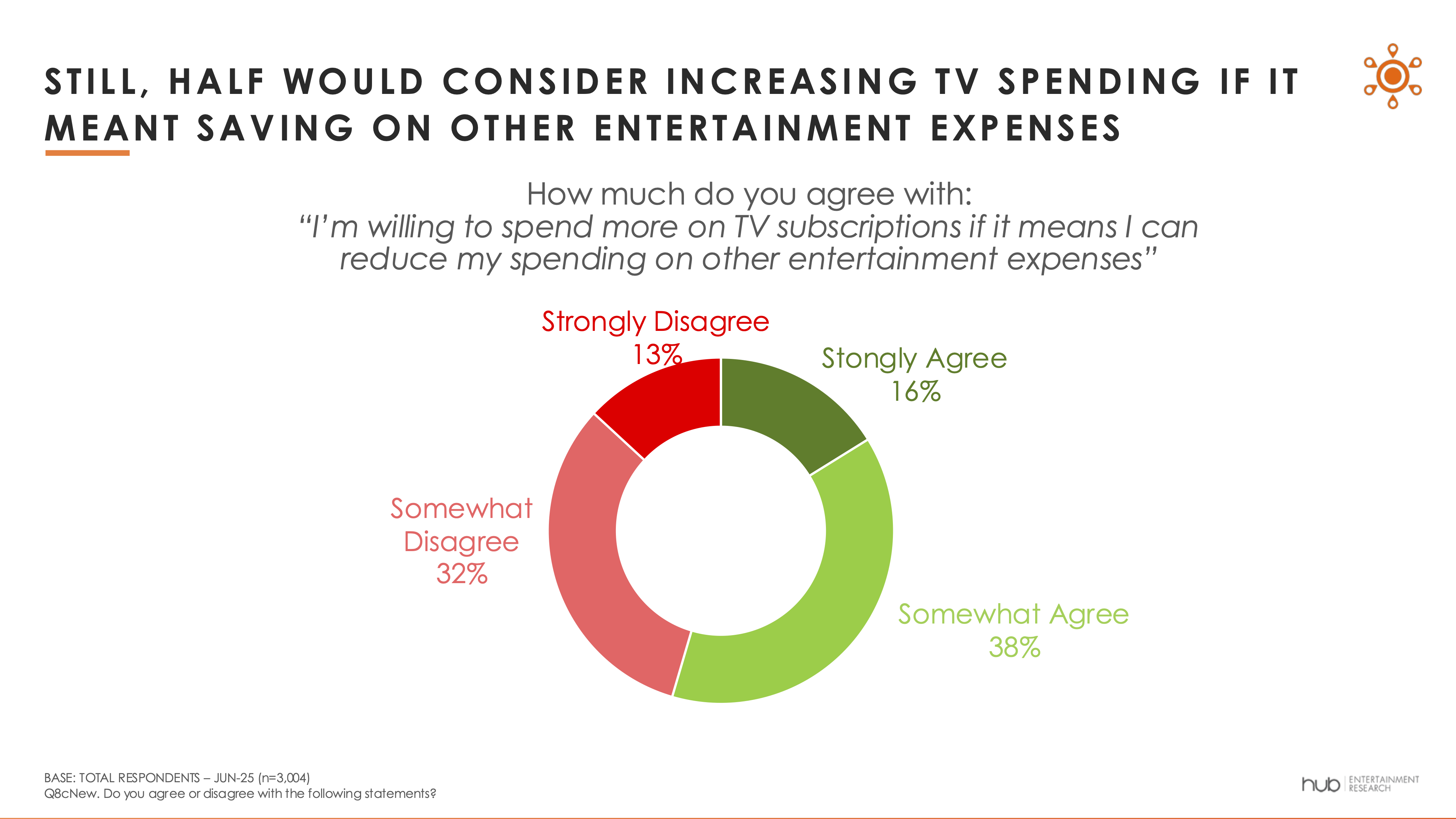

But when viewers are then asked to consider video subscription costs in the larger context of all entertainment alternatives, TV proves to be more resistant to cost-cutting than other activities. More than half of TV viewers would consider spending more on video subscriptions if it meant they could reduce spending on other entertainment, the study found.

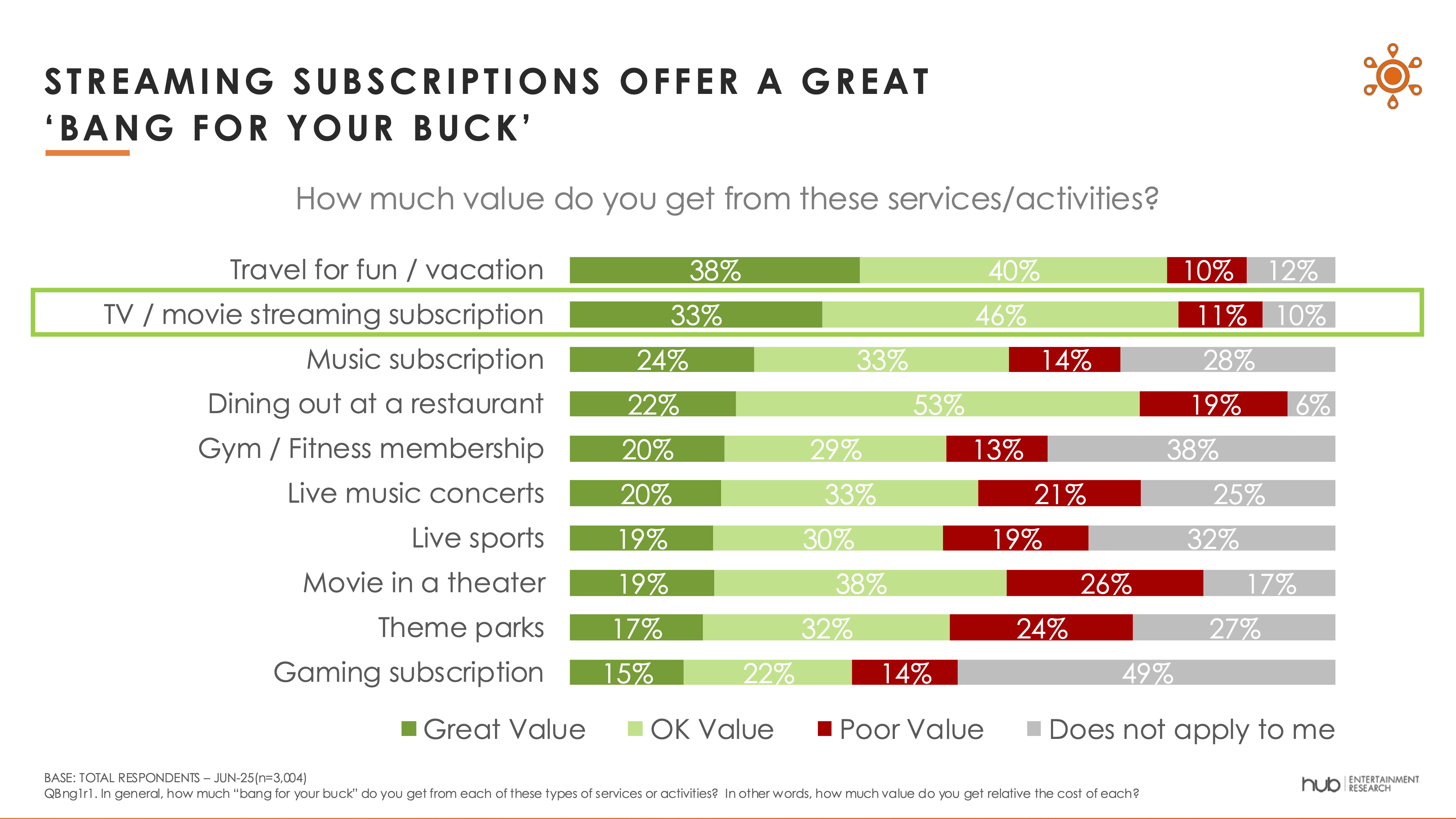

The reason viewers are willing to spend more on TV and movie streaming subscriptions is they perceive them to be a better value than all of the other entertainment alternatives considered, apart from vacations, the study found.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

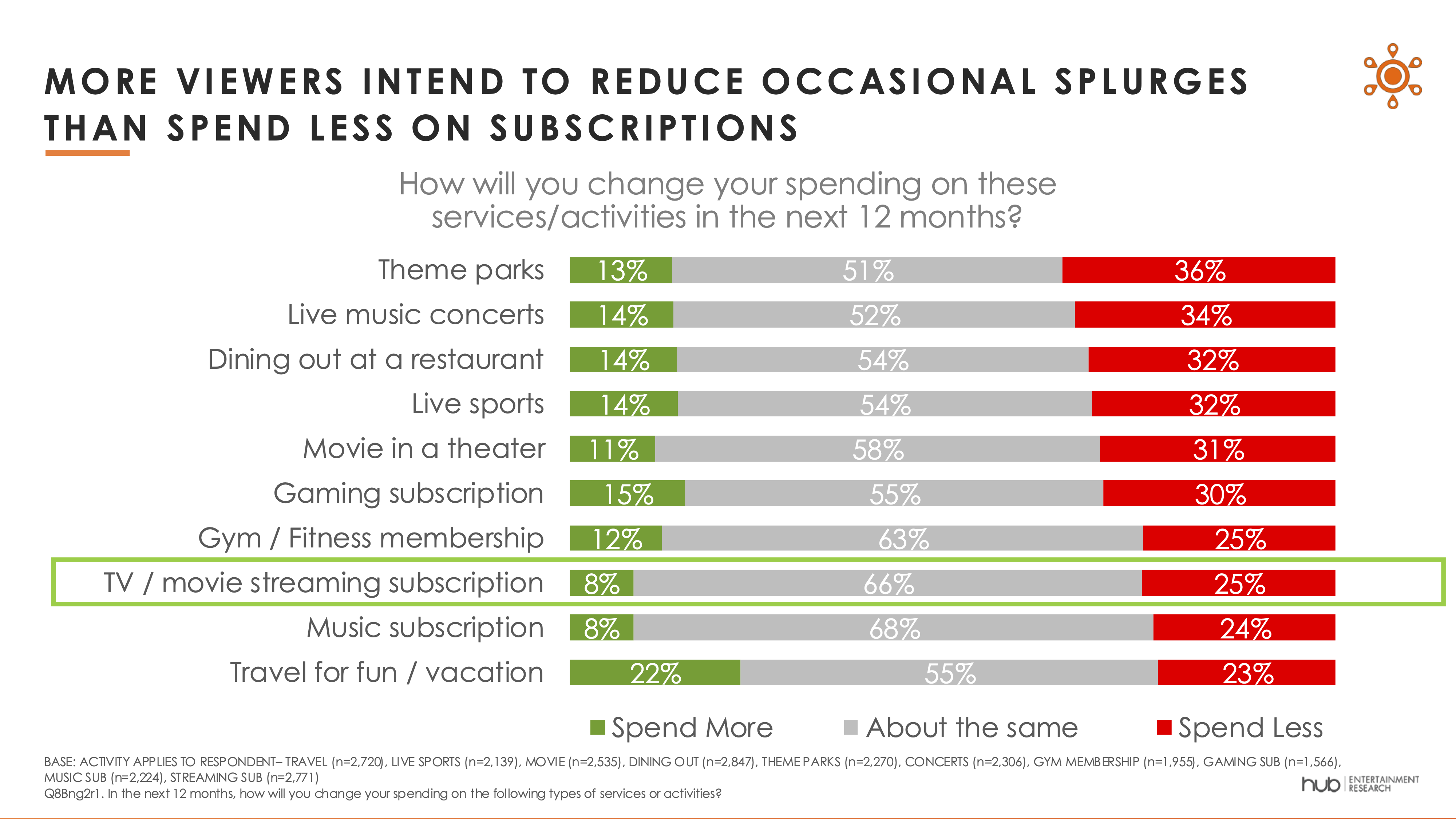

When asked to specifically consider reducing spending on entertainment sources in the next year, streaming subscriptions are near the bottom of the list to be cut, the researchers reported. The entertainment sources most vulnerable to reduced spending tend to be one-off experiences like theme parks, concerts, and restaurant dinners.

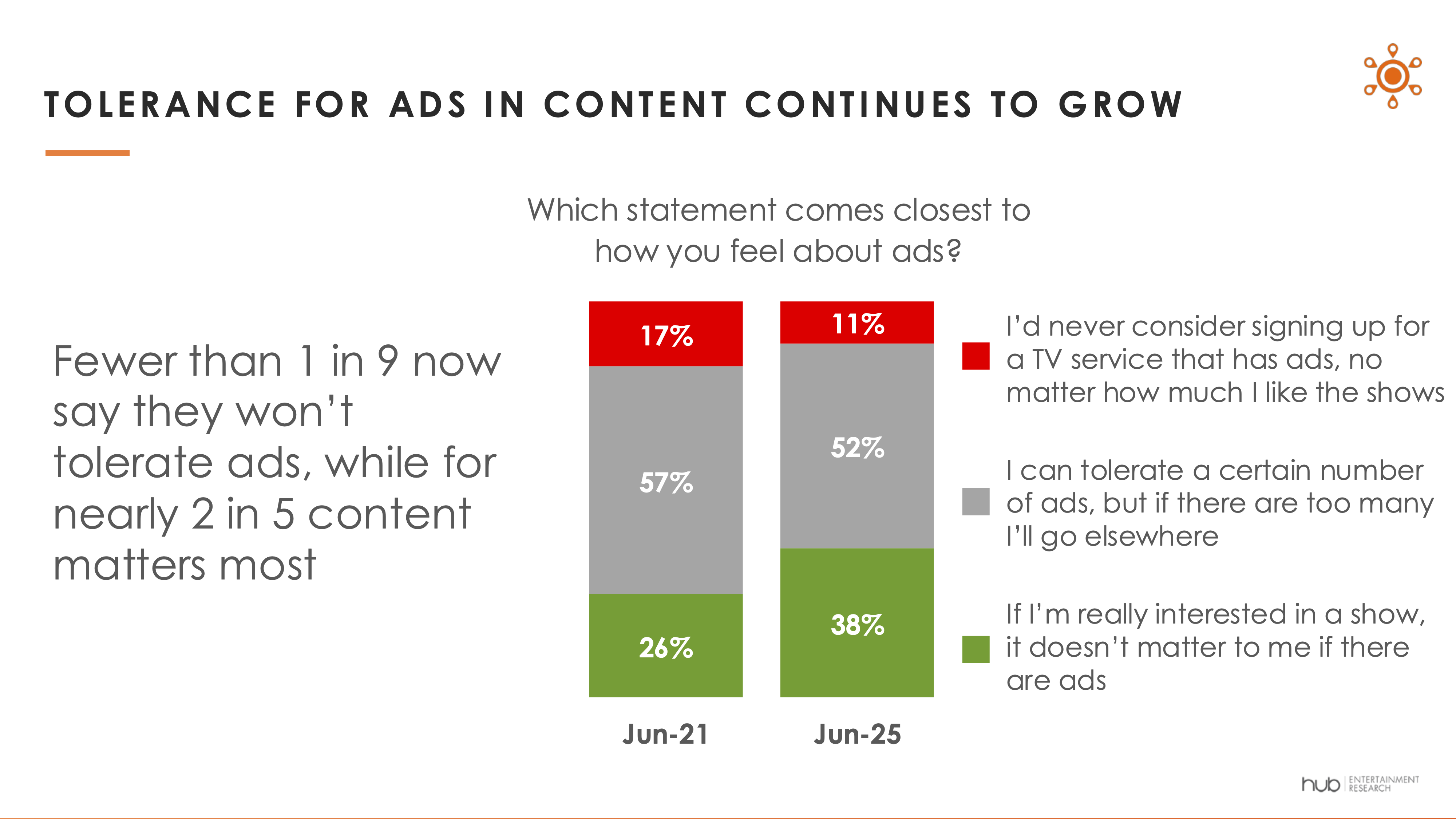

Over the past four years, Hub also reported that their surveys have seen a gradual decline in the number of people who declare they cannot tolerate ads in TV content. In the latest wave, only 11% described themselves as ad-intolerant, down from 17% four years ago.

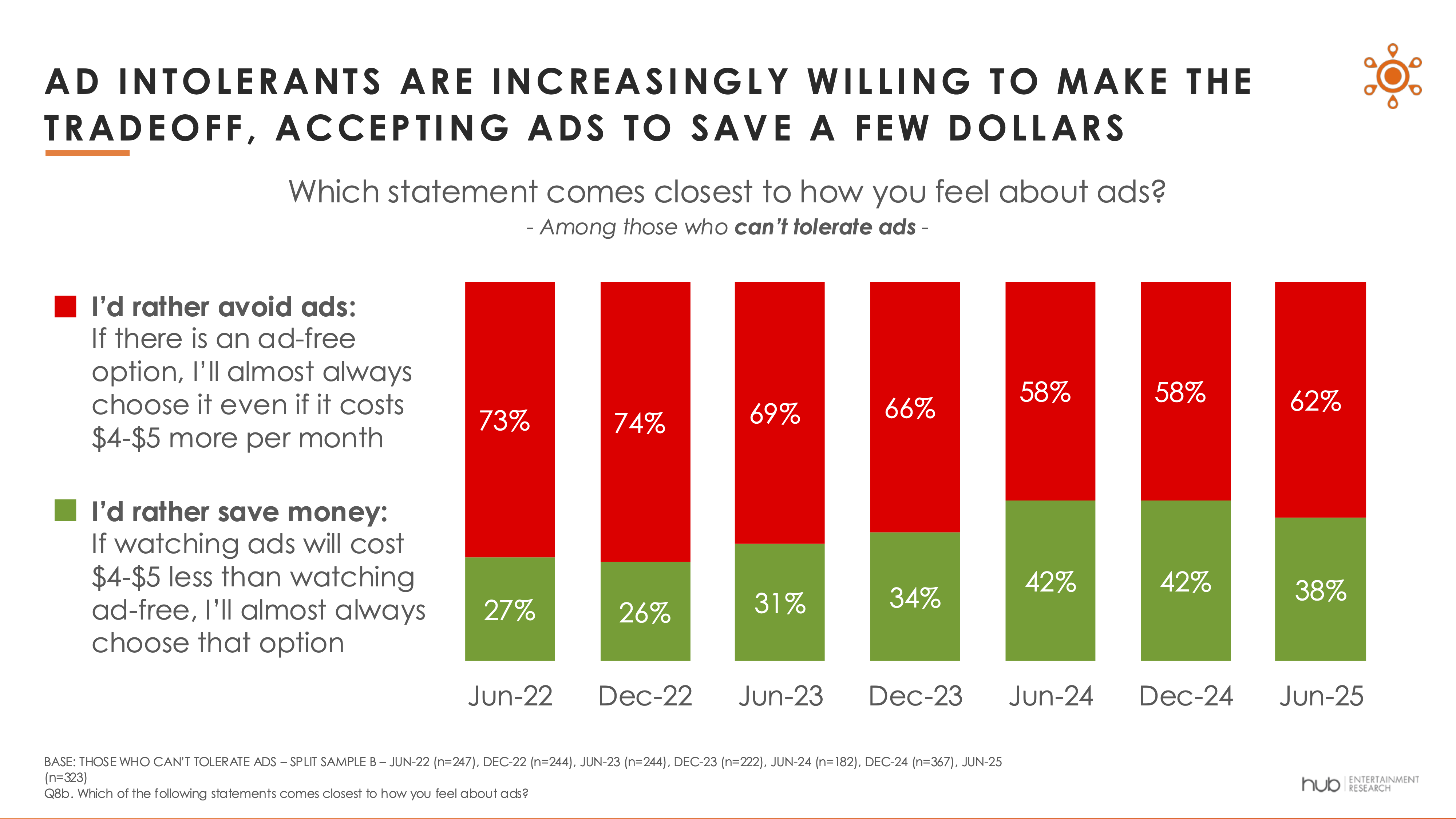

Among those who say they can’t tolerate ads, there has also been a growing number of people expressing a preference for saving $4-5 per month on subscriptions with ads compared to an ad-free service at a higher price.

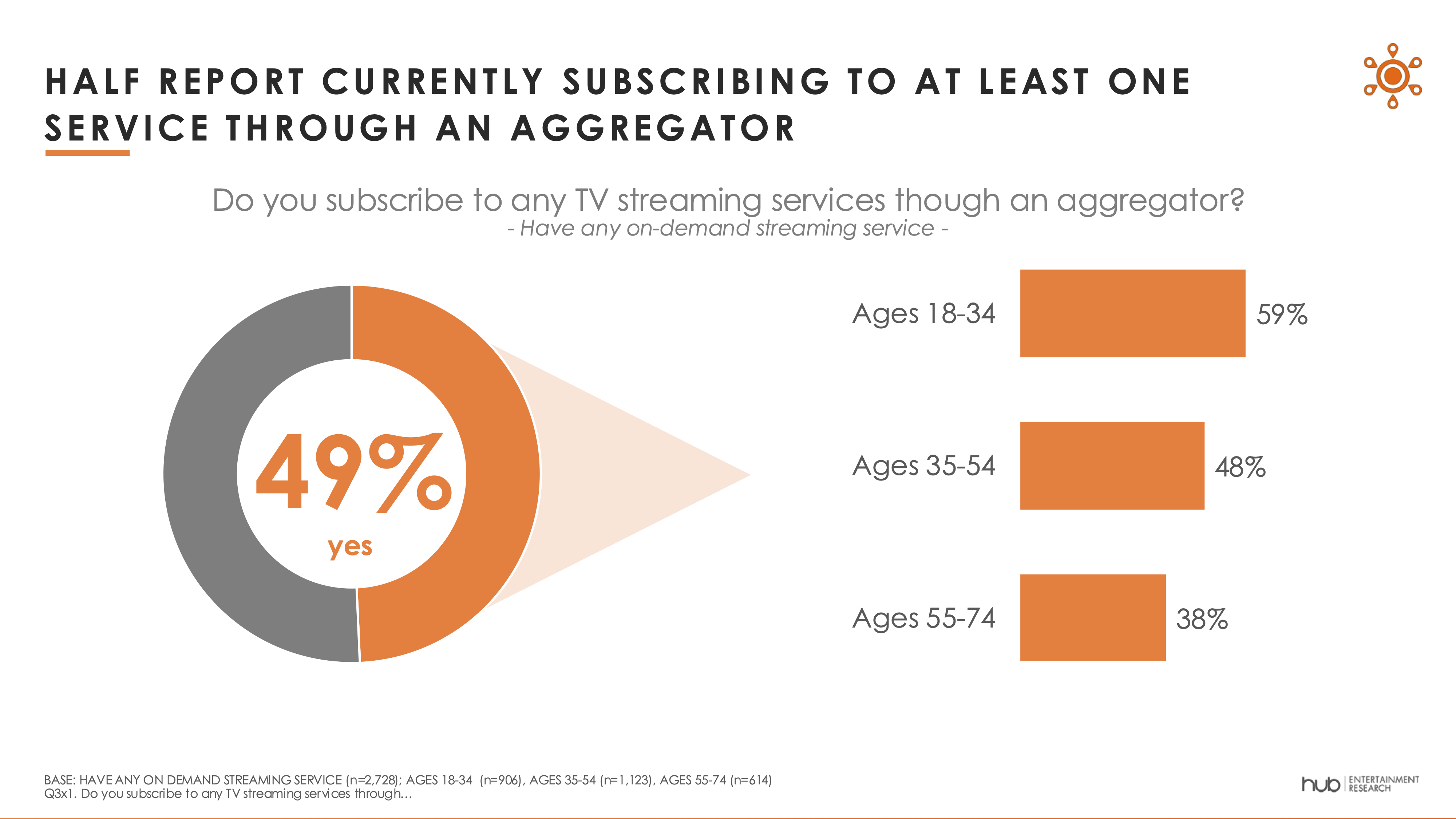

The survey also highlighted the fact that service aggregators like Amazon Prime Video, AppleTV, Roku or YouTube have become important players within the video marketplace. Half of all viewers use an aggregator to organize their streaming subscriptions, and among viewers age 18-34 that figure rises to six in 10.

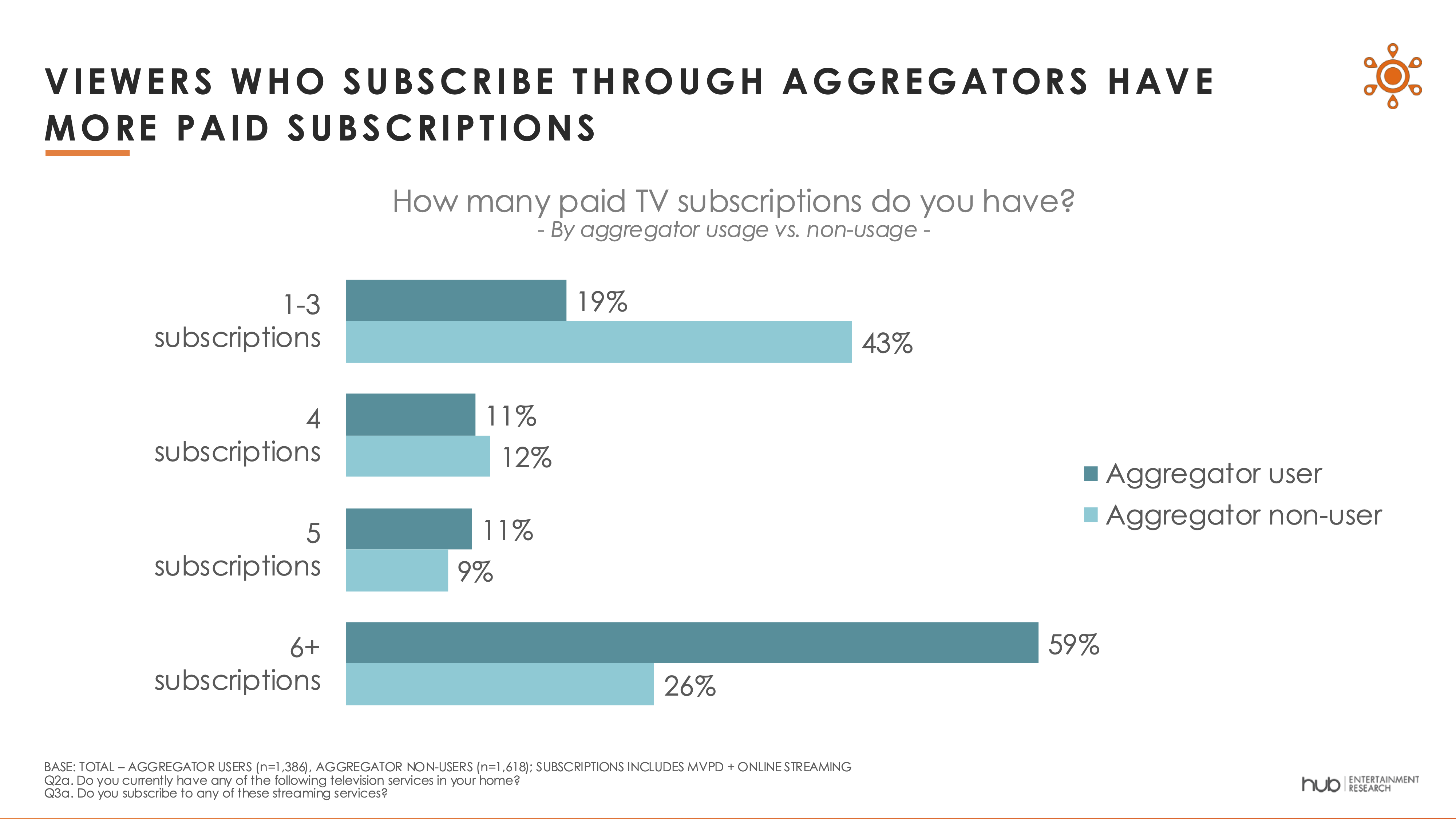

The study also provided data showing the growing importance of aggregators to the overall streaming industry. The half of the TV audience that uses a service aggregator have a considerably higher number of TV subscriptions. Nearly six in 10 of those using an aggregator have six or more video subscriptions. On the other hand, 43% of those who do not use an aggregator have three or fewer subscriptions.

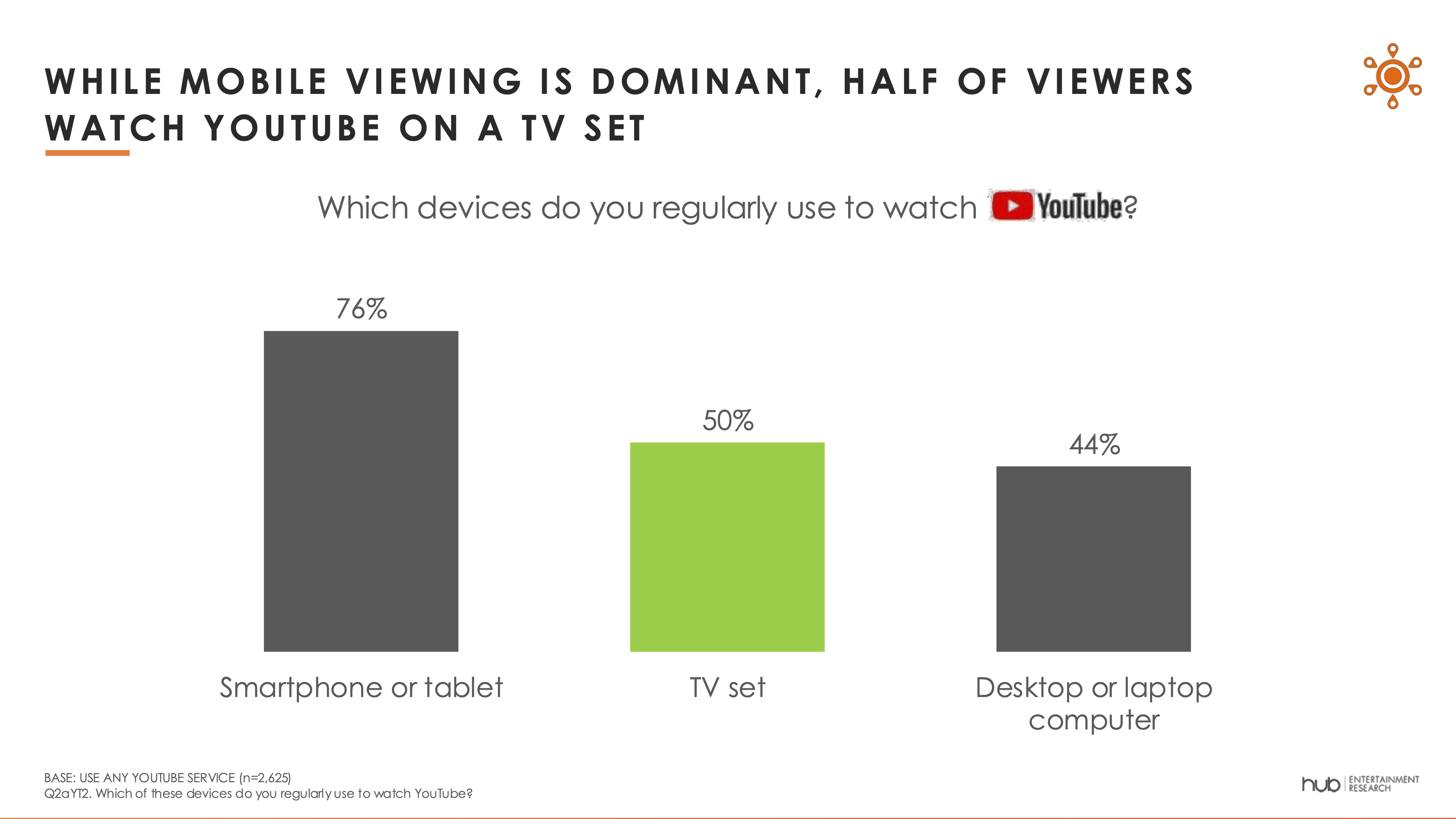

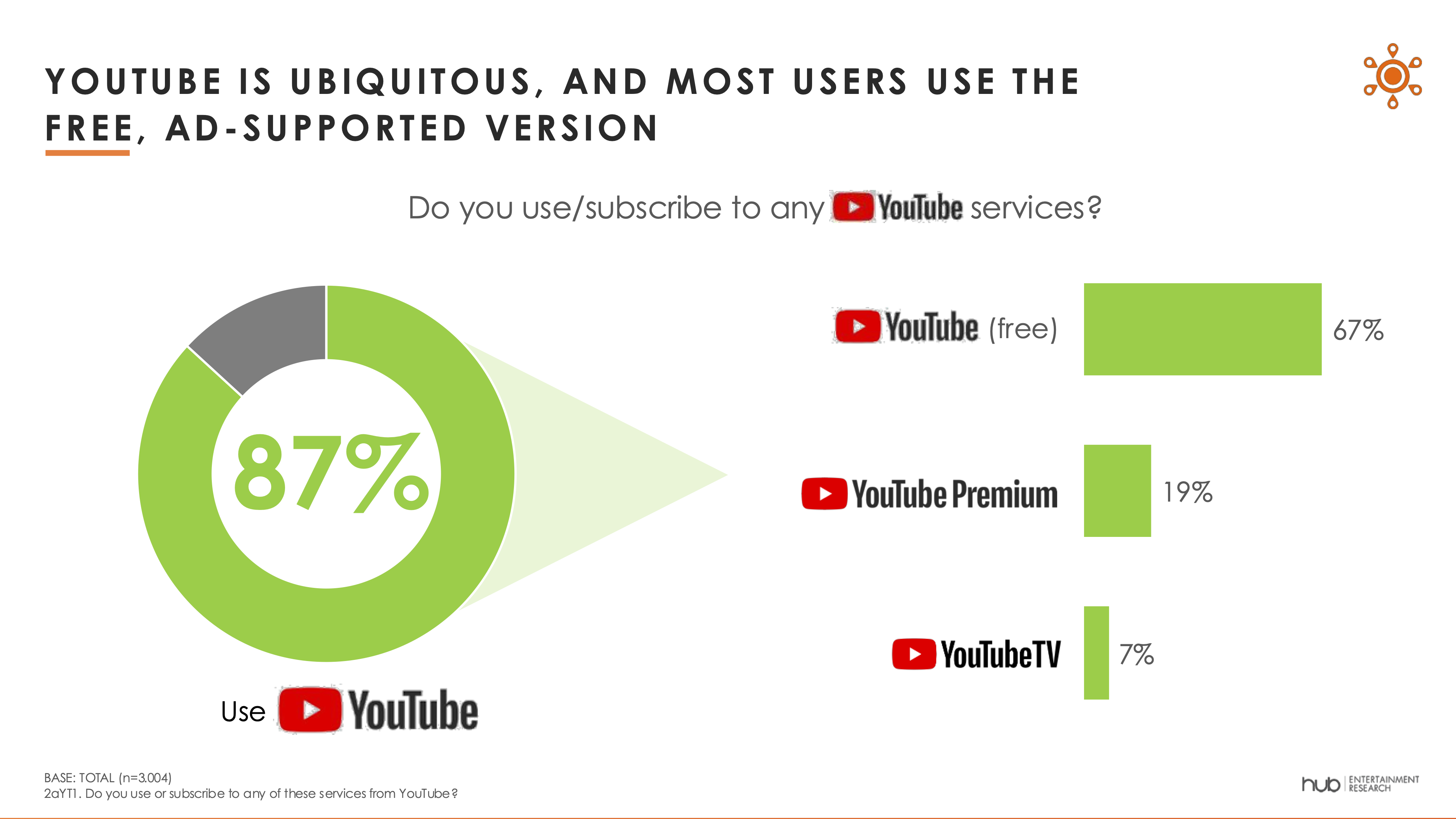

Another notable finding is the growing importance of YouTube. Although more viewers still use YouTube on a mobile phone or tablet, it has evolved to become a formidable competitor on the TV screen. Usage of YouTube services (free, YouTubeTV, YouTube Premium) is almost universal, with just under nine in ten viewers watching or subscribing. That huge audience contributes considerable viewing on big screens, with half of those users regularly viewing the content on a TV, the researchers reported.

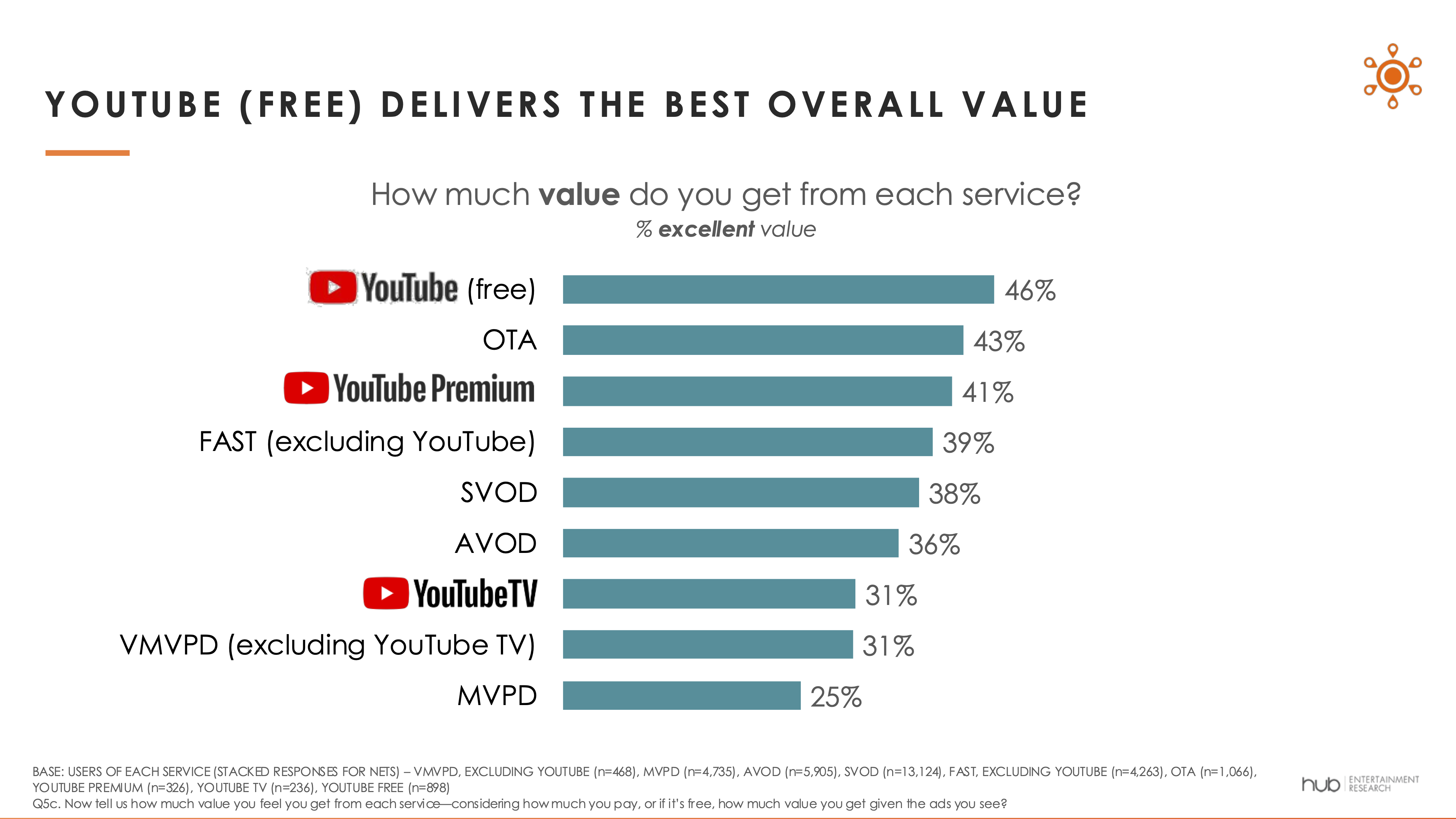

Viewers also appreciate YouTube content, especially its free ad-supported offering, the survey found. It leads not only paid subscription sources like AVOD and SVOD for value delivered, but it also comes out ahead of other free sources like FASTs and over-the-air broadcast.

While the study found that streaming video is more resistant to consumers’ cost-cutting than other entertainment, the researchers also stressed that providers should be cautious about price increases.

The postpandemic years have left most U.S. consumers in a jittery state about the economy, with the 2022 inflation spike leaving a lasting impact that Hub has been able to measure. In the current environment, viewers are even more concerned about the reemergence of inflation and the possibility of a recession.

The good news for TV and streaming video providers is that viewers recognize the entertainment value streaming provides. When asked to consider where they might cut if they need to reduce costs, video subscriptions will be among the last places they will look, the data shows.

Streaming services shouldn’t take that as permission to raise prices more frequently than they have, though. Most consumers already think streaming subscription prices are going up more frequently than in the past, Hub reported, and viewers will consider canceling services if they are no longer receiving value.

These findings are from Hub’s 2025 “TV Advertising: Fact vs. Fiction” report, based on a survey conducted among 3,000 U.S. consumers age 14-74 who watch at least one hour of TV per week. Interviews were conducted in May 2025 and explored consumers’ attitudes toward advertising, how it differs across video platforms, and how ad strategy affects viewer engagement. A free excerpt of the findings is available on Hub’s website. This report is part of the “Hub Reports” syndicated series.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.