Study: 18-to-34-Year-Olds Spend More for Streaming, Churn More Often

36% of demographic at risk of canceling cite cost as a key factor

LONDON—A new survey puts a spotlight on the streaming behavior of 18-to-34-year-olds finds those viewers pay more for content than other age groups, but are more likely to churn if they fail to get what they crave, according to Ampere Analysis.

The Ampere study described the demographic’s subscription streaming behavior as “subscribe, stack, churn, repeat” and stressed that the survey data showed that younger viewers want more from SVOD streaming platforms than they currently get.

“The growing signs of indifference among young consumers towards subscription OTT services signals a need for platforms to rethink their position,” Isabelle Charnley, consumer analyst at Ampere Analysis, said. “While viewers subscribe to more SVOD services than ever, loyalty is increasingly reserved for a select few. Many turn to social media for quick, frictionless content to avoid decision fatigue. To stay relevant, streamers must either position themselves as lean, cost-effective complements to premium services, with a clear and defined role in the content stack or elevate their core value proposition to justify a higher price point. Players must deliver deeper, more consistent value through engaging content, flexible access, and a compelling user experience that keeps audiences coming back.”

Thirty-six percent of those thinking of dropping an OTT service cited cost as a factor, Ampere found. For young people, though, the research also showed access, variety and convenience as important features in a streaming service. The study also highlighted how streaming platforms can tap into the needs and expectations of this profitable audience to earn their loyalty.

Key findings included:

- Among consumers aged 18 to 34 at risk of churning from their streaming service, 36% cited cost as a factor in considering cancellation within the next 12 months.

- But this is not simply just a cost-conscious group: They subscribe to more streaming services than their average peer (4.2 vs. 3.3) and are also more likely to rent (+29%) or buy (+15%) films and TV.

- Instead this reflects a deliberate cycling behavior—young consumers are significantly more likely to subscribe, cancel, and resubscribe to video-on-demand services depending on whether appealing content is available. More than half (58%) reported this behavior, compared to a global average of 40%.

- When it comes to loyalty among young people, social media sets the standard. While 85% of 18-to-34-year-olds use a social video service daily, only 52% return to subscription OTT platforms each day—highlighting a clear engagement gap that premium streaming services have yet to close.

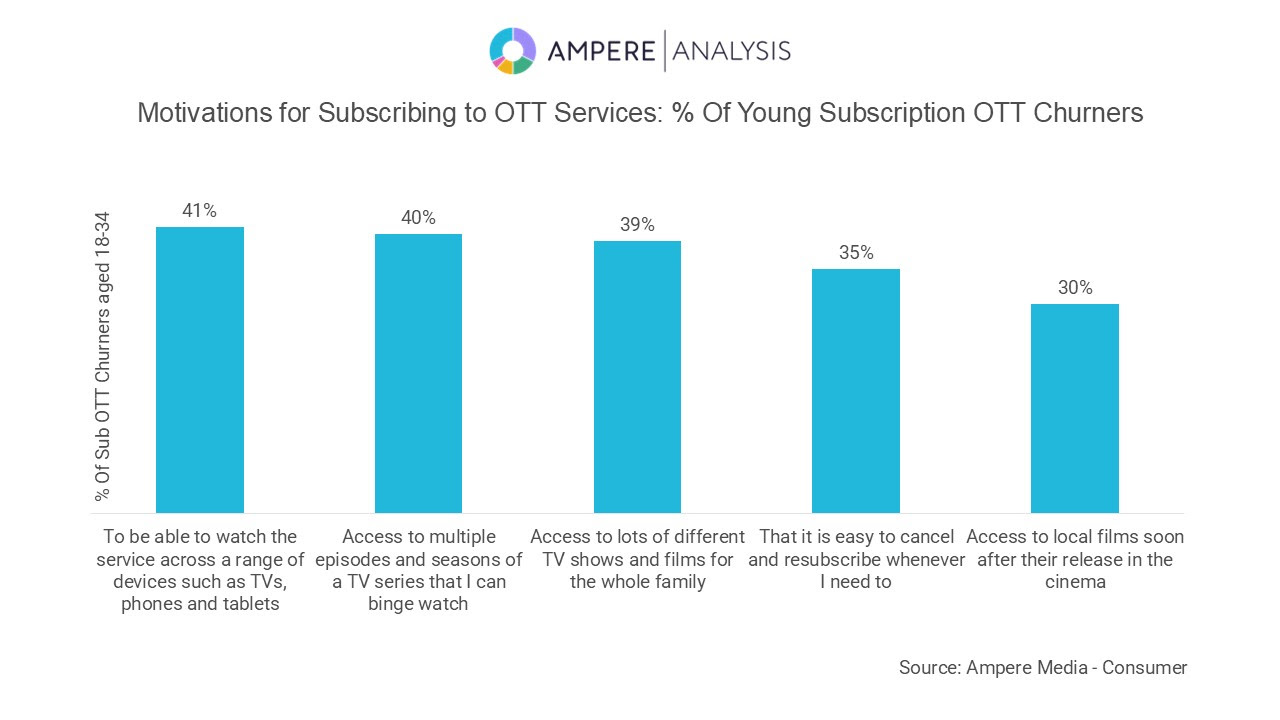

- For younger viewers, value for money is not just a question of price; they want access, variety, and convenience. 41% find value from a platform they can watch across multiple device types, 40% from bingeable series and 39% from a wide range of content.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.