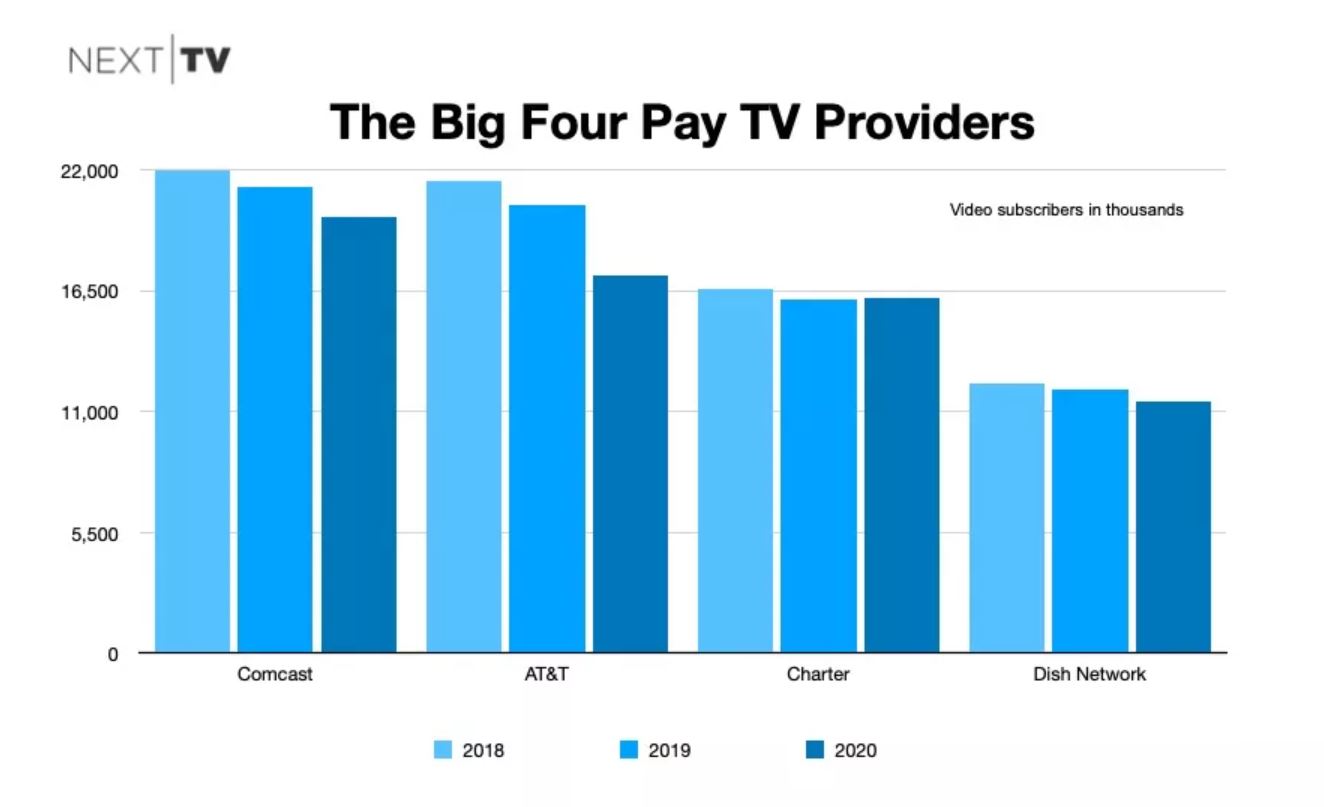

Cord Cutting Nearly Doubled for the Big Four U.S. Pay-TV Providers in 2020

Yeah, we already knew it was bad, but still … Comcast, AT&T, Charter and Dish collectively lost nearly 5.1 million customers last year vs. 2.6 million in 2019

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Cord-cutting for bundled pay-TV services in the U.S. is now a widely accepted fact, with cable companies largely emphasizing broadband connectivity, and media companies having mostly moved onto emphasizing direct-to-consumer streaming.

But the pace of change has to be concerning.

With Dish Network’s reporting of fourth-quarter earnings Feb. 22, we can tally the trajectory of the four biggest providers of pay TV service in the U.S. and say decisively that the velocity of the erosion is increasing ... at a rate that was 92% faster in 2020 than it was in 2019.

While Charter’s Spectrum TV service actually gained 56,000 subscribers in 2020 amid a massive expansion of the cable company’s high-speed internet customer base, Comcast, AT&T and Dish Network each experienced accelerated pay-TV customer losses.

Combined, the Big Four operators lost 2.63 million customers in 2019. In 2020, they lost 5.06 million subscribers.

Including its DirecTV satellite platform, its sunsetting U-verse service, it’s IP-based AT&T TV product and its discontinued AT&T TV Now virtual MVPD, AT&T lost nearly 3.2 million pay-TV customers in 2020.

Comcast, meanwhile, shed nearly 1.4 million TV customers.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

And Dish Network lost a combined 508,000 subscribers across its satellite and Sling TV vMVPD platforms. In fact, Sling TV lost 118,00 customers in 2020.