Broadcasters Up Engagement Factor With Football Fans

Behind the scenes, distribution conflicts intensify

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

A football season unlike any other is taking shape in a conflicted broadcast environment where big-game producers are delivering unprecedented viewing experiences digitally as TV station owners count on the sport’s popularity to help them weather a weakened ad market.

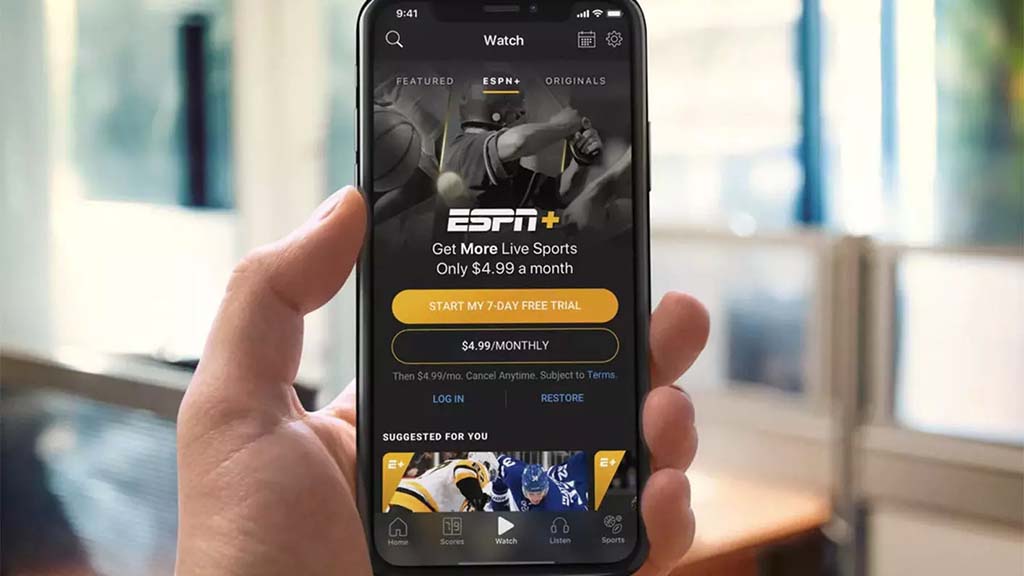

The challenges were highlighted by The Walt Disney Co. CEO Bob Iger during an early August earnings call, when he discussed the now-launched ESPN direct-to-consumer streaming service, which encompasses all content delivered over the seven ESPN cable channels and online assets, including ESPN+.

While stressing that Disney views what it’s doing with ESPN as part of its TV business, Iger acknowledged, “the features and functionality of the ESPN app will have more on them or in the app than obviously any linear channel can provide. It will really be a sports fan’s dream in terms of everything they’ll be able to do and watch on that channel.”

ESPN-NFL Deal

Adding to the drama, the NFL and Disney also announced a landmark deal that, if approved, would give the league an unprecedented 10% stake in a media partner in exchange for ESPN’s takeover of NFL Network, with the addition of more games and other benefits. A taste of what’s in the offing on the ESPN service, which launched Aug. 21, can be found on the NFL+ streaming service, which remains under the NFL’s control, delivering all its games, but is available in the deal with ESPN for bundling with the latter’s streaming service.

It happens that the advanced in-game betting, personalized fantasy team features and other data-rich enhancements available on NFL+ are supported by technology from Genius Sports, which has also been supporting features on ESPN+. While declining to go into details of what his company is bringing to the new streaming service, Matt Fleckenstein, chief product officer at Genius Sports, says the arc of development on ESPN and NFL+ is parallel.

Specifics are “just a question of whether we’re working directly with NFL+ or ESPN,” he says.

The Genius BetVision app—a single-screen display of betting options supported by all the major sports-betting books, with video lagging just two to three seconds behind real time—is an especially noteworthy example of game-changing aspects to what ESPN might be offering.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

With nearly all major pro and college football games now available on streaming services, the stakes couldn’t be higher for the broadcasters whose distribution via cable, satellite and OTA accounts for the lion’s share of the football audience. As they’ve done before, station group owners in their latest earnings reports cited football as a significant counterforce to economic headwinds impacting ad revenues.

During Sinclair’s Q2 earnings call in early August, Chief Operating Officer Rob Weisbord, acknowledging the overall advertising environment “remains rough,” said that with “larger buys coming down the pipeline … we’re cautiously optimistic as we move through the summer months into September with the return of college football and NFL.”

Building on the popularity of football, Sinclair has launched four podcasts devoted to college football programs at Ohio State, Alabama, Texas and Notre Dame, and “will shortly be announcing a landmark events and media partnership” devoted to “producing original content and brand activations,” says Chris King, Sinclair’s vice president of investor relations. This will include a “nationwide tailgate tour during the upcoming college football season” and an exclusive event at February’s Super Bowl in Santa Clara, Calif., he said.

Scripps’ Sports Strategy

E.W. Scripps also touted the importance of football to its second-half expectations following first-half revenue performance that was down just 2% from levels reached in a national election year, marking a “best-of-class” performance that tied “directly back to our sports strategy,” according to Chief Financial Officer Jason Combs. While “there’s a lot of hesitancy out there” in the overall second-half advertising picture, Combs voices “optimism around our ability to monetize football as it starts to kind of roll back in here.”

One aspect to that optimism relates to Scripps Sports’ longstanding relationship with the NCAA Division I Big Sky Conference, which consists of 10 full and two affiliate member universities in eight Western states. The contract with the Big Sky, renewed for another five years in March, makes Scripps responsible for producing and broadcasting at least 12 conference games a year over its seven Montana stations involving either or both of the state’s conference members, Montana State and Montana University, James Raffety, Scripps Sports senior director of sports production, says.

The features and functionality of the ESPN app will have more on them or in the app than obviously any linear channel can provide.”

— Bob Iger, Disney

Scripps is generating coverage that “brings big market, big production to FCS [Football Championship Subdivision] football,” Rafferty says. And Scripps also benefits from the fact that the Big Sky relationship runs deeper than basic game production, he says, with the broadcaster acting as league supporter in event productions like the annual Big Sky Hall of Fame banquet and the Media Day season kickoff. It’s a relationship that goes to the heart of Montana culture with the broadcast of the annual “Brawl of the Wild” showdown between MU and MSU, which Rafferty says draws the biggest statewide audience for any TV program other than the Super Bowl.

Local Ties

Many other station owners benefit from relationships they’ve built with colleges at regional and local levels, in some cases enabling game coverage not supplied by the national networks and, in others, resulting in ancillary programming with games broadcast nationally. Gray Media, for example, is leveraging multiple university partnerships with its launch of regional sports networks, says Robert Folliard, the station group’s senior vice president of government relations and distribution.

“This is a strategic initiative for the company to get into local sports where there’s a ton of advertising and sponsorship opportunities,” Folliard says. “We provide the only platform that can get them into every home.”

On another front, Gray with six other partners in the NextGen TV Pearl TV alliance will be broadcasting college and NFL games in HDR-enhanced 4K, marking a major advance in viewing experience over what consumers typically get through cable and online services. With FCC Chair Brendan Carr voicing enthusiasm for NextGen TV, it looks like “all signals are a go” for expeditious transition to ATSC 3.0, Folliard says, which means TV stations will be in a much stronger position to hold football fans with the combination of superior signal quality and OTA access to interactive game playing and real-time betting.

Nobody is doing more than Fox Sports to keep all its boats afloat, including the new Fox One DTC streaming service, by delivering superior viewing experiences across all affiliated TV and digital outlets. On the big home screen, whether NFL games are delivered via pay TV, OTA or online, Fox is tapping things it introduced at this year’s Super Bowl to enhance the lean-back experience, says Michael Davies, executive vice president of field operations at Fox Sports.

“We’re looking at picking up where we left off,” Davies says. He cites wider use of things like dual SkyCams, Lidar technology for nonobstructive on-screen placements of AR-embellished graphics displays and officials’ Hawk-Eye play-review systems to help commentators with real-time analysis. At some point, Fox Sports anticipates embellishing some NFL broadcasts with output from field-based 180-degree cameras that Fox partner Cosm has deployed to support immersive off-site theatrical viewing of game action.

Fred Dawson, principal of the consulting firm Dawson Communications, has headed ventures tracking the technologies and trends shaping the evolution of electronic media and communications for over three decades. Prior to moving to full-time pursuit of his consulting business, Dawson served as CEO and editor of ScreenPlays Magazine, the trade publication he founded and ran from 2005 until it ceased publishing in 2021. At various points in his career he also served as vice president of editorial at Virgo Publishing, editorial director at Cahners, editor of Cablevision Magazine, and publisher of premium executive newsletters, including the Cable-Telco Report, the DBS Report, and Broadband Commerce & Technology.