Survey Finds Netflix Crackdown on Password Sharing “Will Be Difficult”

The S&P Kagan survey finds it will be hard to convert password sharers to paid Netflix subs because they are younger and less affluent

NEW YORK—As Netflix prepares to crackdown on people who are sharing password credentials to access to the streaming services, a new survey from Kagan, the media research unit of S&P Global Market Intelligence, offers a detailed profile of this group.

Netflix, which has seen its stock hammered this year by disappointing subscriber numbers, reported in its Q1 2022 earnings call that upwards of 100 million households worldwide, including 30 million in the U.S. and Canada, are using a shared password to access the streaming service for free.

The new Kagan survey provides some answers as to who those people are as well as some insights as to how likely they would be to start paying for the services.

Overall U.S. password sharers have less household income and use fewer subscription video-on-demand services on average, compared to long-term subscribers, according to data from Kagan's U.S. online consumer survey, conducted in March 2022.

Brian Bacon, research analyst and author of the Kagan report concluded that while “Netflix intends to crack down on password sharing” turning the password sharers into paid subs “will be difficult since shared log-in users tend to have less disposable income and are less engaged in online video, especially when compared to recent subscribers."

Other key findings of the report include:

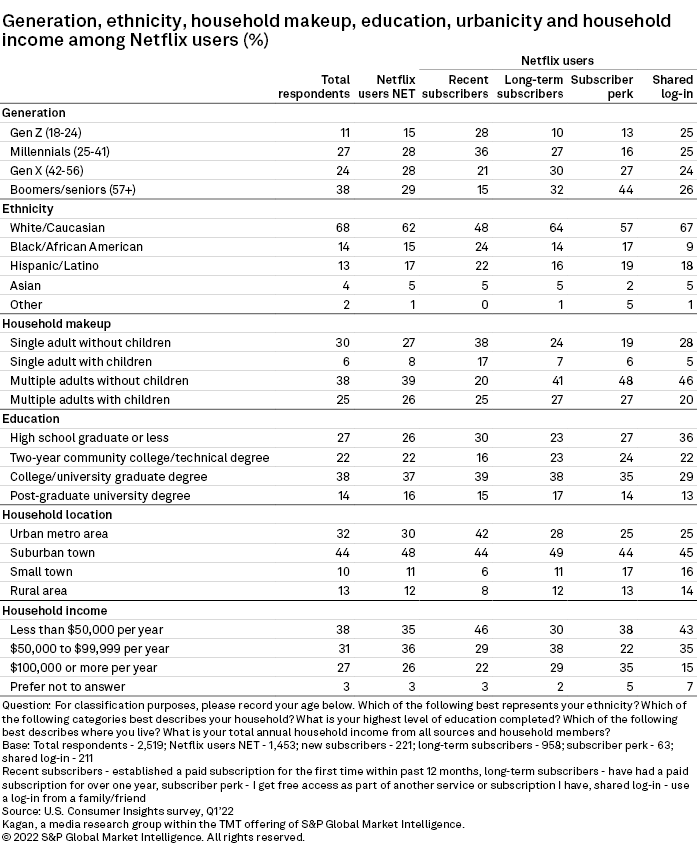

- Shared log-in users on Netflix tended to be younger, with Gen Z at 25% compared to 10% of long-term subscribers. Recent subscribers to Netflix also tended to be younger than long-term subs, with Gen Z at 28% and millennials at 36% of subscribers surveyed who indicated they established a subscription in the past 12 months.

- Households without children represented a larger share of shared log-in users, at 28% for single and 46% for multiple adult households, compared to long-term subscribers, at 24% and 41, respectively. Households of single adults, both with and without children, represented larger shares of recent subscribers, at 38% and 17%, respectively, compared to 24% and 7% of long-term subscribers

- Shared log-in users also skewed more toward less educated and lower-income households, with 36% holding a high school diploma or less and 43% earning less than $50,000 per year, compared to 23% and 30% for long-term subscribers, respectively.

- Including Netflix, total service users surveyed used an average of five SVOD services. Amazon.com Inc.'s Prime Video, Walt Disney Co.'s Hulu and Disney+ were the most likely to be used at 66%, 53% and 47%, respectively.

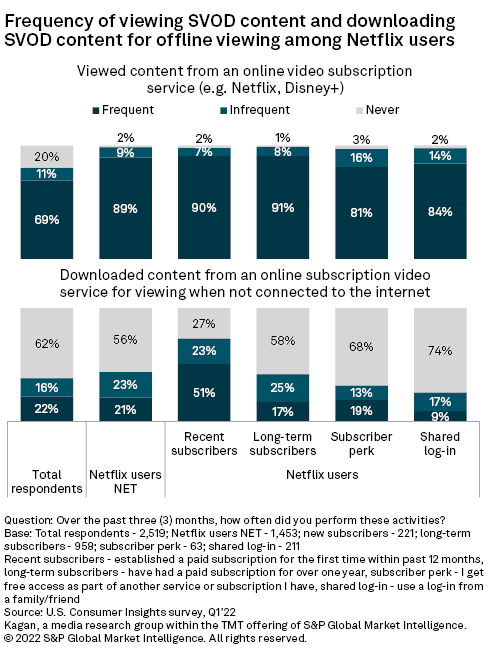

- Netflix users who receive the service as a subscriber perk were the least likely of the Netflix user segments to indicate using several of these popular SVOD services, with Hulu at 43%, Disney+ at 27% and AT&T Inc.'s HBO Max at 25%. Most shared log-in users (84%) frequently stream video from SVOD services (at least once per week) although are less likely than recent and long-term subscribers at 90% and 91%, respectively.

- Recent subscribers to Netflix were the most likely to indicate they use a traditional multichannel service in their household at 74%, while those who share a log-in were the least likely at 51%.

Full results are available at Netflix user profile 2022: Who is (and isn't) using a shared log-in.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.