Study: 33% of US Internet Households Subscribe to a Direct-to-Consumer Sports Streaming Service

D2C sports service viewers are the heaviest spenders on streaming video services shelling out an average of $111 per month on all streaming subscriptions according to Parks Associates

DALLAS—A new study from Parks Associates highlights the appetite for sports content on streaming services and documents their importance to the industry with survey data showing these consumers are the biggest spenders for subscription services.

Parks’ newly released new research, “Streaming Live Sports: Where Opportunity Meets Complexity”, which was done in partnership with InterDigital, explores the business and technical challenges of streaming live sports and outlines strategic insights for navigating this rapidly evolving landscape.

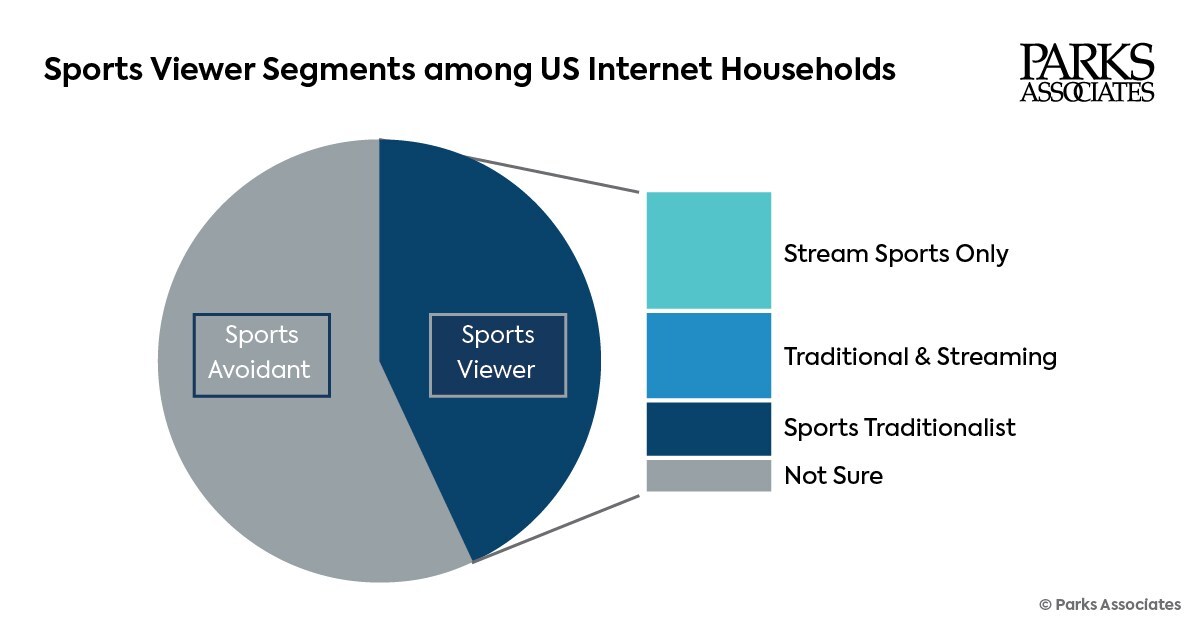

The survey finds that one third (33%) of U.S. internet households subscribe to a direct-to-consumer (D2C) sports-specific streaming service. Forty-three percent of consumers in U.S. internet households classify themselves as "Sports Viewers," and 40% of them watch sports only via streaming services.

"The sports media landscape is transforming, as sports programming transitions from traditional broadcast and cable networks to streaming," said Michael Goodman, senior analyst, Parks Associates. "Sports fans now have more ways than ever to engage with their favorite teams or sports. Many niche sports and out-of-market matches, previously unavailable, are now easily accessible, which can expand the sports audience, and providers have new opportunities to engage viewers in interactive activities, such as multicasts, live chats, and in-game betting, provided the experience is easy and seamless."

The study also stressed that as games and events shift online, streaming services must navigate a complex web of technical challenges that can impact the viewing experience, many of which overlap. These include, but are not limited to, bandwidth limitations, latency, buffering, scalability, and device/platform compatibility, the researchers said.

"Sports viewers should not have to deal with technical issues when watching their favorite sports teams. The broadcast and streaming ecosystem needs to work together to alleviate pain points or risk damaging their reputation for future events," said Lionel Oisel, head of video labs, InterDigital. "While streaming services need to think holistically about the challenges that come with live video streams, more advanced video codecs can significantly reduce buffering and latency and improve the overall user experience."

The study also included these findings:

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

- Among "Sports Viewers," 40% watch sports only via streaming services, including general SVOD (subscription video on demand) services, sports-specific D2C services, streaming pay TV services, and social networks. An additional 30% watch sports content via both streaming and broadcast/antenna or traditional pay-TV services.

- 89% of US internet households subscribe a subscription-based streaming platforms, and 33% subscribe to a D2C sports-specific streaming service, such as NFL+, NBA Leage Pass, MLB TV, ESPN+, UFC Fight Pass, DAZN, Willow, and F1 TV.

- D2C sports service viewers are the heaviest spenders on streaming video services; they spend an average of $111 per month on all streaming subscriptions.

"As traditional pay-TV services continue to shed subscribers, the economics of sports broadcasting are changing. Streaming creates new revenue opportunities for both sports leagues and streaming services," Goodman said.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.