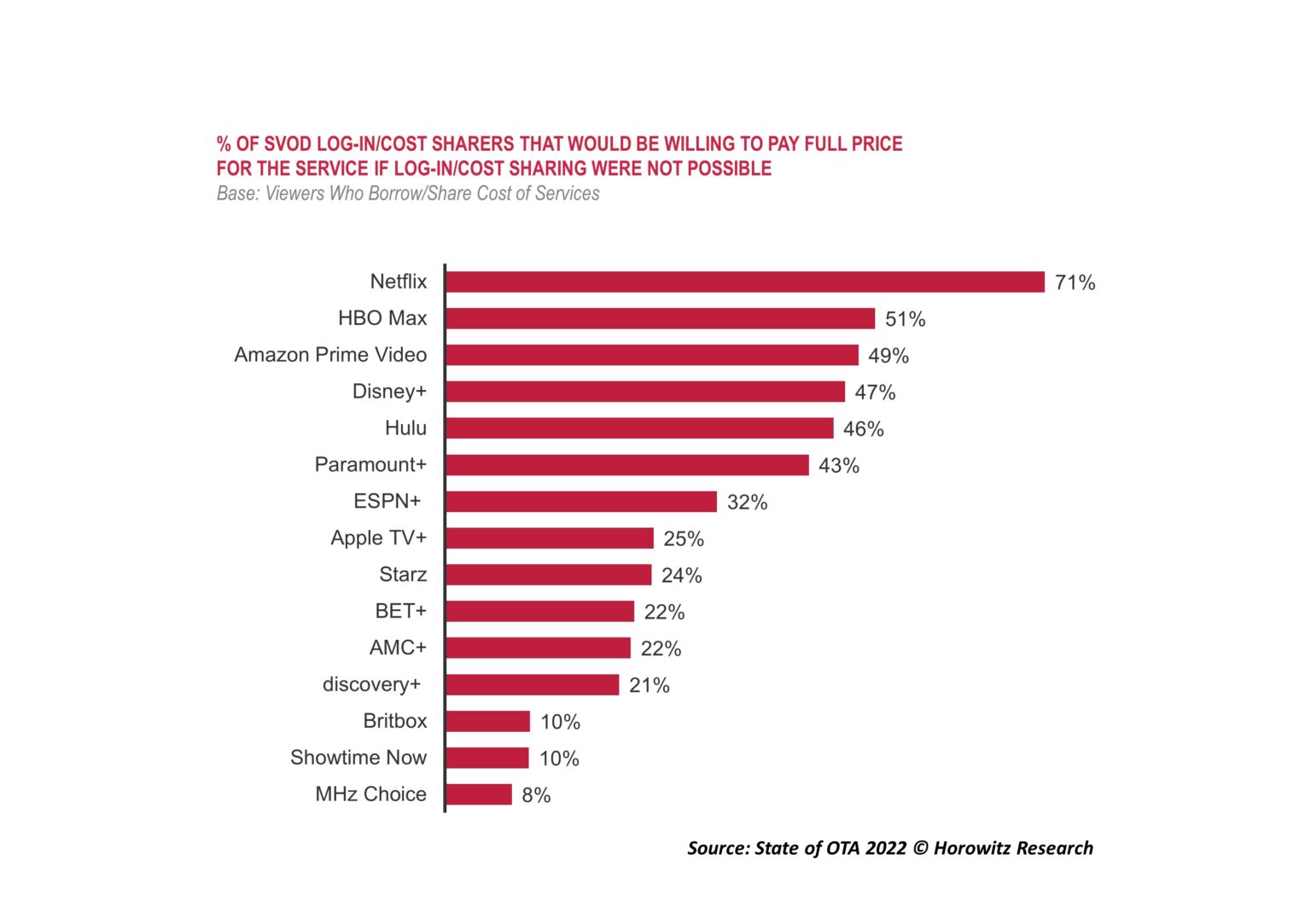

Streaming Password Crackdowns: 70% of Netflix Users Willing to Pay Full Price

Other streaming services may not fare as well, however, a new survey from Horowitz suggests

As major streaming services scramble to improve their profits and eye crackdowns on password sharing, a new survey from Horowitz Research suggests that Netflix’s efforts to prevent users from password sharing may not spell doom and gloom for the service.

Horowitz’s latest State of OTA 2022 report, released late in 2022, found that 7 out of 10 Netflix users who password share would be willing to pay full price for the service if they could no longer share access.

In an earlier 2022 study (State of Viewing & Streaming 2022), Horowitz found that the average streamer uses 7.1 streaming services in a typical month—4.3 of which are subscription services. The average streamer now pays $75.8 a month for their streaming services, up from $49.3 reported in 2021, according to the firm’s State of Pay TV, OTT, and SVOD 2022 study.

With so many subscription streaming services (SVODs) now available and consumers struggling to handle rising subscription costs, the new Horowitz State of OTA 2022 report confirms that SVOD users are increasingly engaging in the practice of sharing passwords with others in order to offset costs.

The survey found that there is some degree of log-in/cost sharing across all the subscription streaming services tested in the latest survey.

For example, 18% of TV content viewers share access to Netflix while 42% pay for the service themselves; 15% share access to Amazon Prime Video with 44% paying for the service themselves, Horowitz reported.

This translates to about 1 in 3 Netflix users and 1 in 4 Amazon Prime Video users sharing access to those services. The numbers are similar among users of other popular services such as Hulu, Disney+, and Paramount+.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Notably, the study shows that the lower the penetration of the service, the more likely it is that users are sharing passwords. For example, 11% of consumers surveyed have Showtime Now, and a full 60% of Showtime Now subscribers share their passwords, as do 51% of Britbox and 47% of Starz users.

How crackdowns on password sharing might impact subscriber counts has been a hotly debated topic in the media industry.

The new Horowitz study provides some important insights and answers to that question.

The survey found that the more valuable the service is perceived to be, the less likely it is that consumers will share their passwords.

For example, 83% of Netflix users and 81% of Amazon Prime Video users think the respective services offer excellent value for the money, compared to 63% of Showtime Now users and 60% of Britbox users who feel that way about those services.

“Netflix and Amazon Prime Video have long proven their value for the money to their subscribers, Netflix because of its extensive library of both syndicated and original content, and APV with its tie-in to other Amazon Prime benefits,” explained Adriana Waterston, chief revenue officer and insights and strategy lead for Horowitz Research. “As such, while Netflix’s crackdown on password sharing will likely lead to subscriber loss, the majority of subscribers will stay with the service. However, Netflix will need to keep its perceived value high in order for consumers to continue to justify the investment. This will certainly be a challenge for Netflix moving forward as their programming costs continue to increase and as they add commercials. Also, other services considering a similar crackdown will need to justify this move by finding ways to add value to their services, making them stickier for consumers.”

The full State of OTA 2022 report tracks the evolving market for new and potentially disruptive technologies that could be game-changers, including over-the-air (OTA) antennas, wireless 5G home internet services, and piracy and password sharing.

The survey was published in November 2022 among 1,600 adults, with an oversample that resulted in 855 antenna owners. Data have been weighted to ensure results are representative of the overall TV universe. The report is available in total market, FOCUS Latinx, FOCUS Black, and FOCUS Asian editions.

More information is available here.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.