S&P: Private Equity Investment In Streaming Companies Slumps

Investments fell by 73% in 2022 and only three deals have been made in 2023, S&P Global Market Intelligence reports

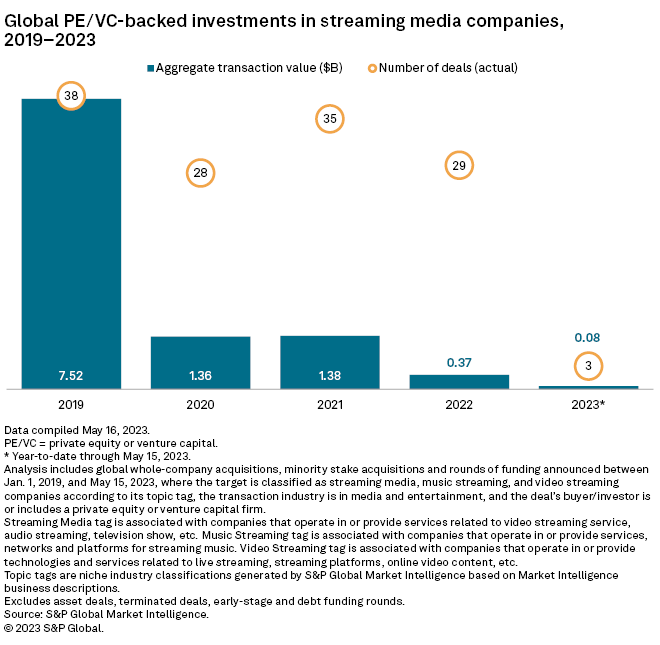

NEW YORK—As streaming media companies struggle to produce profits, private equity investments in the sector have also slumped, with private equity and venture capital firms investing only $370 million into streaming media companies worldwide in 2022, down 73% from $1.38 billion of investments in 2021, S&P Global Market Intelligence data shows.

That marks a significant fall from the $7.5 billion invested in the sector by private equity and venture capital at the height of the streaming boom in 2019, according to S&P Global Market Intelligence.

The number of private equity-backed transactions involving companies that provide video streaming service, audio streaming and television shows fell to 29 in 2022 from 35 in 2021.

So far in 2023, there have only been three such deals announced or completed, explained Joyce Guevarra, a S&P Global Market Intelligence contributor in a blog post. These were funding rounds that involved Rarefied Atmosphere Inc. and Bluestack Systems Inc. in February and Sensei Ltd. in April.

Texas-based Rarefied Atmosphere, a streaming platform for businesses, raised $65 million from investors including Valor Management Corp., Sageview Capital LP and S3 Ventures, the report found.

California's Bluestack raised an undisclosed amount of funding with new investor NTT Docomo Ventures Inc. from Japan and South Korea's Megazone Cloud Corp. Sensei raised $18 million from a group of investors including BITKRAFT Ventures Management LLC, HashKey Capital, Lattice Capital and M13 Ventures Management LLC.

The $83 million in investments year to date through May 15 fell far below the $193.1 million that private equity firms poured into the streaming sector in the first quarter of 2022 and could mean a further year-over-year decline for 2023, according to S&P Global Intelligence.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

The slowdown reflects the fact that many streamers today face growth and profitability challenges amid inflation and rising competition, according to a report from Kagan, a media research group within Market Intelligence.

"In the post-pandemic world, some subscription video on demand players now face customer retention issues and often incur operating losses," the report said, adding that the streaming industry is shifting out of growth mode to target profitability.

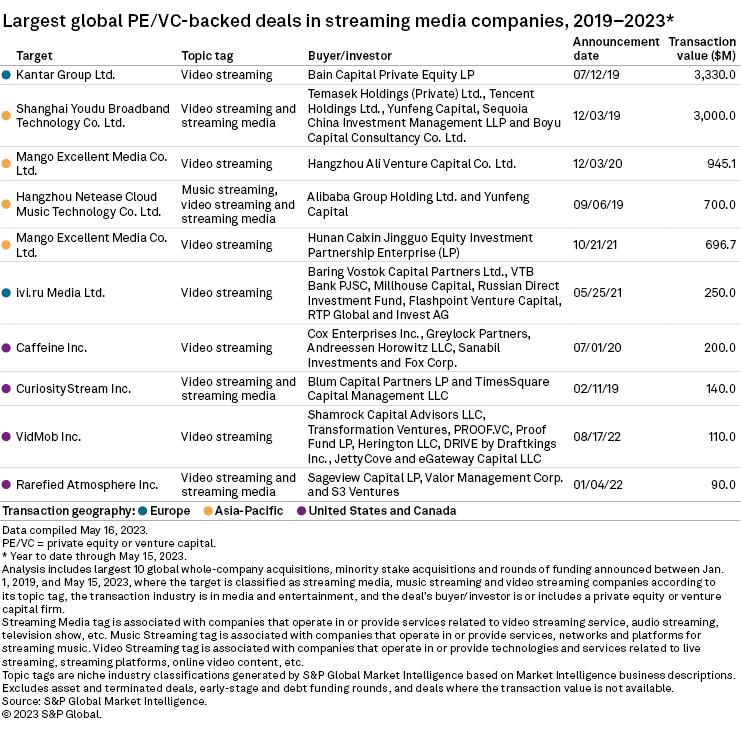

The report found that deal activity in the global streaming industry last peaked in 2019 with the completion of two blockbuster deals each worth at least $3 billion. In one transaction, the largest in at least the last five years, Bain Capital Pvt. Equity LP acquired 60% of the UK's The Kantar Group Ltd. from WPP PLC for $3.33 billion.

China had the second-largest deal, the completion of a $3 billion funding round for Shanghai Youdu Broadband Technology Co. Ltd. with investors including Tencent Holdings Ltd., Boyu Capital Consultancy Co. Ltd., Sequoia China Investment Management LLP, Temasek Holdings (Pvt.) Ltd. and Yunfeng Capital, the report said.

Streaming providers based in Asia-Pacific have received the largest chunk of private equity and venture capital in the last five years. The region accounted for over 50% of the $10.72 billion of investments in the sector globally since 2019, according to S&P Global Market Intelligence.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.