LONDON—To the surprise of virtually no one, the majority of scripted movie and TV series programming on subscription video on demand was based on adaptations, franchises and other forms of pre-existing intellectual property (IP) in the first half of 2022, according to Ampere Analysis.

According to Ampere’s report, “How original are SVoD Originals?” 64% of such programming was based on characters and storylines viewers are already familiar with. Including Unscripted Originals, the share of IP-based commissions stood at 42% of new movies and First run Originals in the U.S. during the period, compared to 28% for their international commissions, reflecting the competitiveness and maturity of the groups’ native U.S. market, Ampere noted. SVoD players have increased their share of IP-based commissions in North America by seven percentage points over the last two years.

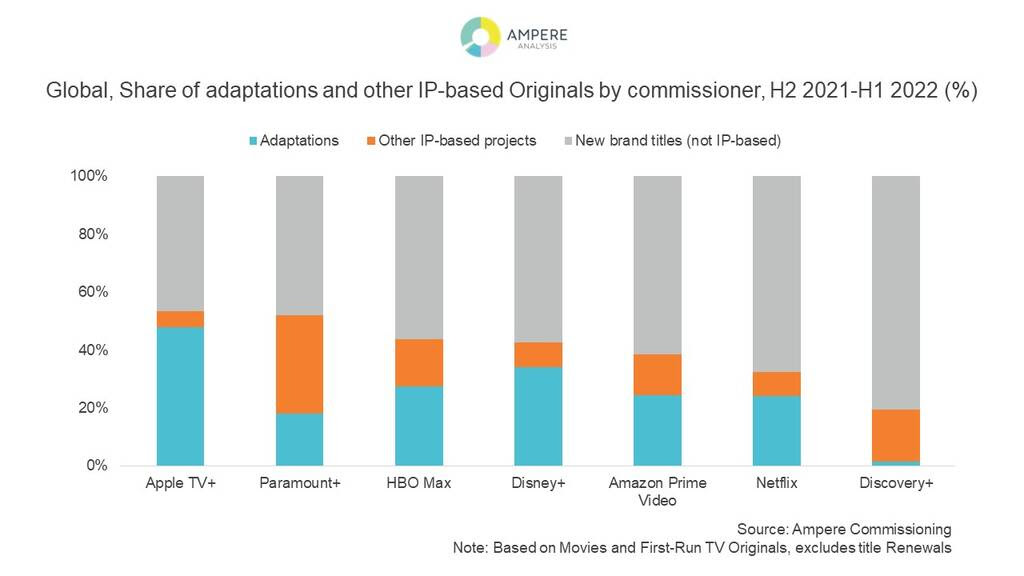

While Apple TV+ taps most heavily into pre-existing IP (53% of total new Originals in the year to end of H1 2022) as part of its high-budget Originals strategy, IP-based commissioning is generally the highest for studio-backed platforms like Paramount+ and Disney+ as they turn to internal—and primarily US-based—IP and franchises for their new commissions. But Ampere says this share is slowly decreasing for these studio platforms as they gradually increase their international footprint. For Disney+, IP-based titles represented 35% of its global new Originals output in the first half of 2022, down from over 60% in 2020.

The two leading independent SVoD players, Netflix and Amazon Prime Video, have the lowest share of IP-based projects, according to Ampere. While leading by Originals spend level and commissioning output, Netflix has the lowest share of IP-based titles at 32%, a share that is steadily on the rise in the US market. The streaming giant is primarily drawing on book adaptations as the IP base, but also increasingly in a position to tap into some of its own hit titles and franchises to develop new Originals (e.g. its Stranger Things spin-off).

Warner Bros. Discovery’s platform Discovery+ has the lowest rate of IP-based titles (19%) due to its primarily Unscripted Originals slate. Overall, the share of IP-based titles is lower for Unscripted than Scripted commissions, although an increasing proportion of Unscripted Reality and Entertainment content is drawing on pre-existing formats for remakes, spin-offs or reboots for example, Ampere concluded.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.