The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

LONDON—Although it’s safe to say that live professional sports could not exist in its current state without television, a new report from Ampere Analysis raises questions about whether the TV industry can continue to afford skyrocketing sports rights in the U.S.

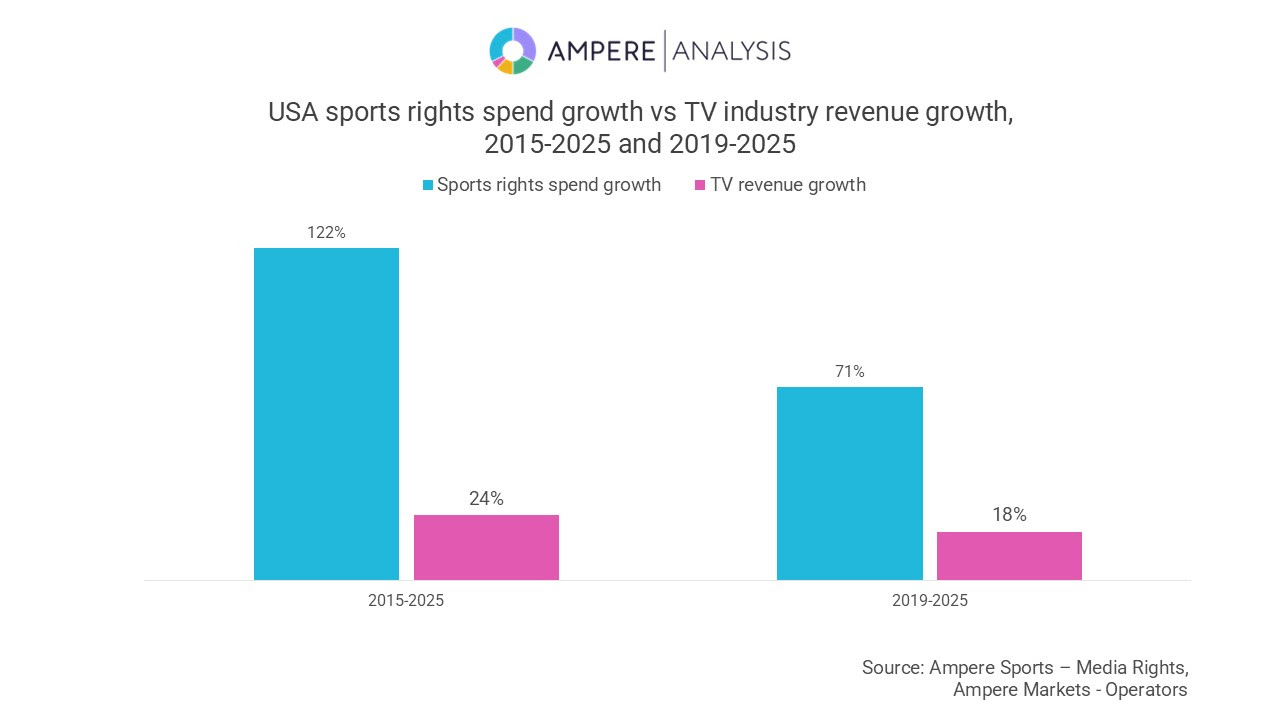

According to a new report from the research firm, spending on U.S. sports rights has surged 122% over the past decade, rising from $13.8bn in 2015 to $30.5bn in 2025. Over the same period, total TV industry revenues increased by just 24%, from $172 billion to $213 billion, meaning investment in rights has grown five times faster than the broader market.

Whereas a decade ago, broadcasters spent 8% of their revenue on sports rights, that figure has now jumped to 14% of total TV revenue, underlining the premium value of live sport as broadcasters battle for subscribers and viewer loyalty in an increasingly fragmented media landscape, Ampere said.

The sports picture in Europe is a bit more optimistic for broadcasters. In the U.K., sports rights spend has grown at twice the rate of TV revenues since 2015, and 1.6 times as fast in Spain. But in France and Germany, the growth of rights has largely stalled.

Between 2019 and 2025, TV revenue growth outpaced sports rights spend across all of Europe’s “big five” markets. The U.S. trend was the reverse, with rights spend rising at four times the rate of TV market growth. Ampere says this could be a result of European broadcasters taking a more cautious stance, reflecting declining viewership and ongoing challenges in driving subscriber revenue growth.

“As TV markets slow, sports rights inflation continues; the huge hikes in NFL and NBA deals demonstrate how live sports continue to deliver unique value as a driver of audience reach and retention,’ says Daniel Harraghy, Research Manager at Ampere Analysis. "By contrast, the more restrained approach in Europe reflects the tough economics of rights investment. Market differences are being driven by several factors, including longer-term rights contracts in the US, business models that place greater emphasis on affiliate fees and advertising rather than subscriptions, and a more competitive rights market.”

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.