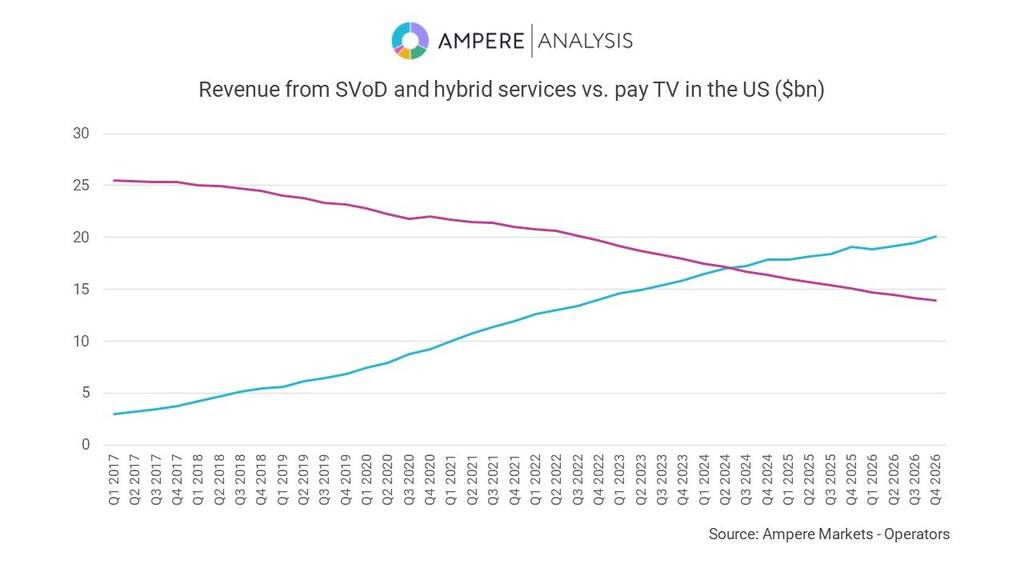

LONDON—Total revenues from streaming services are expected to overtake revenues from pay TV subscriptions in the U.S. for the first time later this year, bolstered by ad revenues from hybrid streaming subscription tiers, according to researcher Ampere Analysis.

With the eclipse expected to take place by Q3 2024, streaming will continue to race ahead as traditional pay TV declines, with the value of pay TV in 2028 expected to fall to half the value it saw at its peak in 2017, Ampere said. The new analysis comes from Ampere’s continuously updated Markets Operators data service.

Although the number of streaming subscriptions overtook pay TV in 2016, it’s taken almost eight years for revenues to catch up due to streaming lower average revenue per user (ARPU), which is currently around 1/10th that of pay TV, Ampere said.

The average American household spends approximately $46 per month on streaming services. When it comes to pay-TV, however, the majority of households bundle services with their local broadband provider, making it harder to estimate the cost of monthly pay-TV subscriptions. However, consumers can expect an average of anywhere between $60 and $140 per month for a pay-TV service (without broadband included).

Ampere says the decline in growth of subscriber numbers in the U.S. and U.K. has forced streamers to shift their focus towards revenue growth, and eventually, profitability. Although ad-supported versions of popular streaming services have only been around for about 3-4 years, revenues from those services are expected to pass $9 billion in the U.S. this year, bolstered by Amazon Prime Video’s new advertising tier which launched this quarter.

Increased revenue from advertising and a boost in subscriber growth, alongside the decline in traditional pay TV, has led to this important inflection point being reached, Ampere said.

“Most major streaming services in the US have launched their hybrid advertising tiers, which, along with increasing clamp-downs on password sharing, have been successful at reigniting growth in the streaming market,” said Rory Gooderick, Senior Analyst at Ampere Analysis. “There is still a way forward for pay TV, however. Disney and Charter’s recent deal in the US, which gave almost 15 million Charter subscribers access to Disney+’s advertising tier, shows how the two businesses can work together to maximise streaming’s reach to domestic subscribers, and highlights the importance of traditional distribution platforms as service aggregators. Longer term contracts and the reduction in churn makes this an attractive proposition for streamers, while control over the billing relationship also means there’s something in it for the pay TV provider too.”

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.