Despite the onslaught of new advertiser-supported versions of major streaming platforms, ad spending among six of the top OTT platforms is actually down for the first nine months of 2023, according to MediaRadar.

From January through October 2023, MediaRadar’s data sample showed nearly $1.07 billion in advertising investment on six top OTT platforms: Discovery+, Hulu, Max, Paramount+, Peacock, and Pluto TV (missing from the list are the recently launched ad supported versions of Netflix and Disney). This represents an 8% year-over-year (YoY) decrease from the $1.2 billion spent last year, the researcher said.

“Streaming platforms are confronting steep hurdles around ballooning content expenses, password sharing dilution, and an uncertain economic climate. These factors are fueling downstream subscriber and advertising adversities across the industry.” stated Todd Krizelman, CEO of advertising Intelligence platform, MediaRadar. “As evidence of the challenges, we observed an 8% year-over-year decline in ad spend across six major streaming platforms from January - October 2023. However, the streaming ad market also shows promise – these players alone account for over $1 billion in spend over this period.”

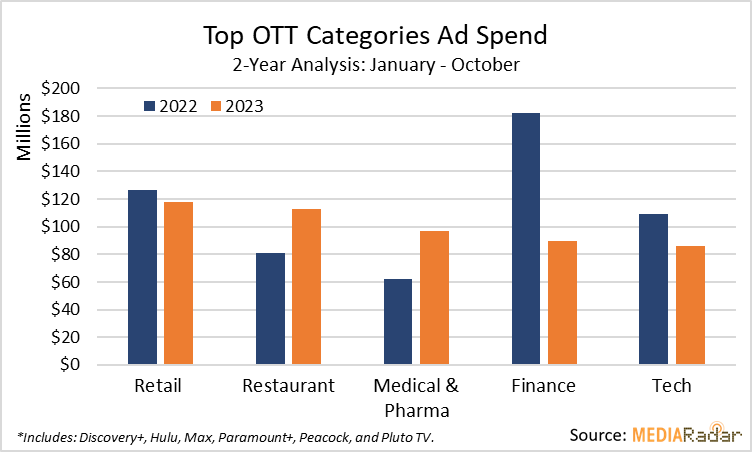

The leading five advertising categories—restaurant, medical & pharma, finance, retail, and technology—constituted nearly $503 million, or 47% of the total ad spend through October. Collectively, these categories saw a 10% decrease in YoY spending.

The finance category, encompassing financial institutions, real estate, and insurance providers, experienced the most significant YoY decrease. Insurance companies, which contributed 68% of this category’s spend through Q3 2022, dropped to 36% in 2023. Major insurers like Geico, State Farm, and Progressive slashed their spend from $123 million to $32.5 million through October 2023, marking a 74% YoY reduction in OTT ad spend.

Among the top categories, restaurants and pharma were the only sectors to register increases in YoY ad spend. Restaurants experienced a 39% increase, while medical & pharma observed a 56% rise. Fast food restaurants, representing 74% of the restaurant category's spend, surged by 38%, with brands like McDonald's, Taco Bell, and Subway amplifying their OTT ad investments. Restaurants were a top category so far this year for Hulu, Paramount+, and Peacock.

“Quick service restaurants are making a strategic move by advertising heavily on streaming platforms,” said Krizelman. “With viewers at home, ads for restaurants are likely to prompt immediate orders, placing these brands right where viewers can act on them.”

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Pharma companies, including AbbVie and GlaxoSmithKline (GSK), allocated nearly $84 million to OTT, achieving a 66% increase in spending YoY. Significant contributions were made in arthritis prescriptions and OTC hair growth products. Pharma advertisers featured prominently in Discovery+ and Peacock’s top categories.

Retail advertisers, spanning from car dealerships to general retailers, accounted for 14% of Discovery+'s ad spend through October 2023, with general retailers like Target and Walmart contributing 28%. Retail also led contributions to Hulu (13%) and Pluto TV (12%), with car dealerships dominating Pluto TV's retail spending.

Technology advertisers, making up 19% of Max's ad spend, were led by telecommunications companies like AT&T and T-Mobile (61%), followed by software firms such as Adobe, Canva, and IBM (24%).

Paramount+ gained nearly 10% of its ad revenue from technology advertisers, totaling over $15 million, with T-Mobile and Verizon as leading spenders.

MediaRadar standalone streaming services data were sampled from the ad-supported streaming packages, across a panel of 2mm people in the US. Data range from January 1, 2022 through October 31, 2023 for six top platforms.

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.