Netflix to Earn $1.7B in U.S. Ad Revenue by 2027

The launch of an ad-supported tier could earn Netflix $5.5B in global annual ad revenue in five years according to Ampere Analysis

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

LONDON—The upcoming launch of Netflix’s new ad-supported tier could be a financial bonanza for the company, according to a new report from Ampere Analysis that predicts Netflix will earn $1.7 billion from advertising in the U.S. market by 2027 and pull in $5.5 billion in global ad revenue.

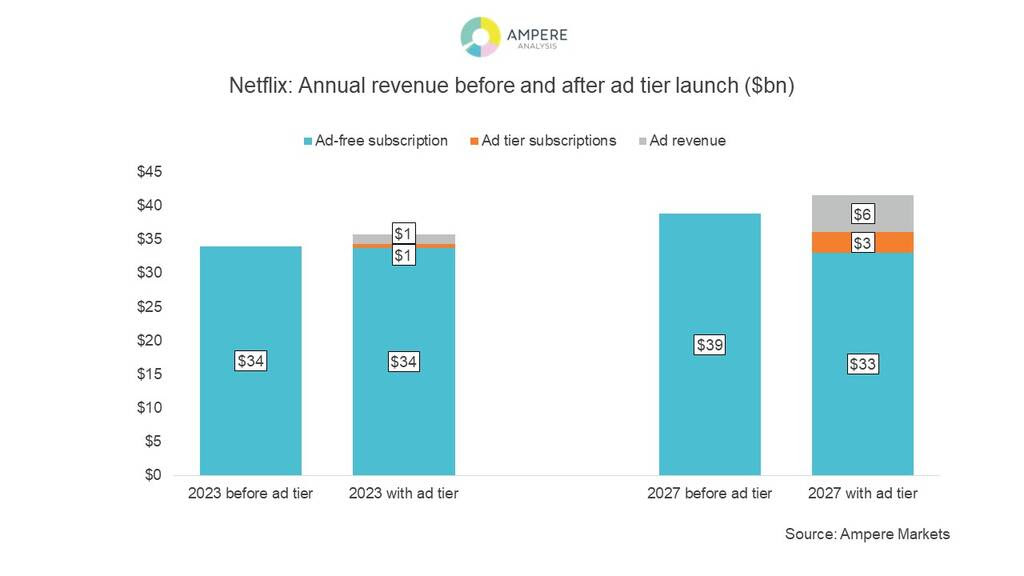

Overall, the new ad revenue and the subscription fees for the ad-supported tier will boost Netflix's global revenue by about $8.5 billion.

The U.S. will be the largest single contributor to a global advertising income of $5.5 billion by 2027, the researchers said.

Overall, the ad tier is expected to increase the group’s revenue by 4.9% in 2023 and 7.1% by 2027 compared to the current business model, with the ad-supported tier will adding $2.2 billion in additional revenue by 2027 than the streamer would see if it stuck with its subscription-only model.

The impact will depend on the pricing Netflix chooses for the new tier, however.

Assuming that the ad tier launches at $5.99 in the U.S., with pricing adjusted on a relative basis globally, and based on price elasticity analysis, Ampere calculates that the ad tier will see a 3.2% subscriber uplift, with the remainder of ad tier customer migrating from the existing customer base.

The price elasticity analysis in the US shows that if the ad tier launched at $2.99, the uplift would increase to 4.8% but at the expense of subscription revenue. If the ad tier cost $7.99, the uplift would drop to 2.2% and provide a smaller increase in revenue.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

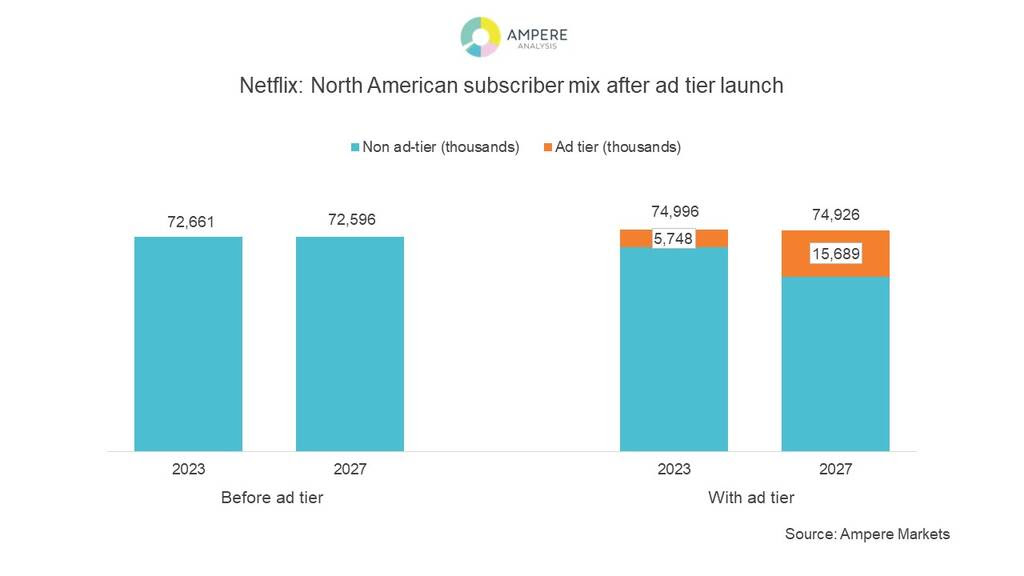

Using ad tolerance and price sensitivity data from Ampere’s consumer survey, Ampere is projecting that one in five Netflix users will be on the ad tier by 2027.

Ampere is also predicting that most of the ad tier customers will come from the existing customer base and that the ad tier will serve to stabilize the more saturated markets of North America and Western Europe.

Overall, the U.S. market will account for $1.7 billion of ad revenue by 2027 (31% of the global total), and a total of $2.6 billion including subscription income, according to the study.

In the U.S., the ad supported tier will serve as primarily a hedge against lower engagement and flat subscriber growth, the researchers predict.

Analyst at Ampere Analysis Ben French explained that “The ad tier is primarily a customer retention tool in the US, with sign-ups coming largely from Netflix’s existing subscriber base. The US ad tier will be an effective measure against a shrinking and less engaged audience rather than a new customer acquisition tool. Increasing advertising rates will grow total ad income over time, offsetting the negative impact of a fall in viewing.”

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.