DEG: U.S. Consumer Subscription Streaming Spending Topped $30B in 2022

AVOD/FAST channel ad revenue approached $17B

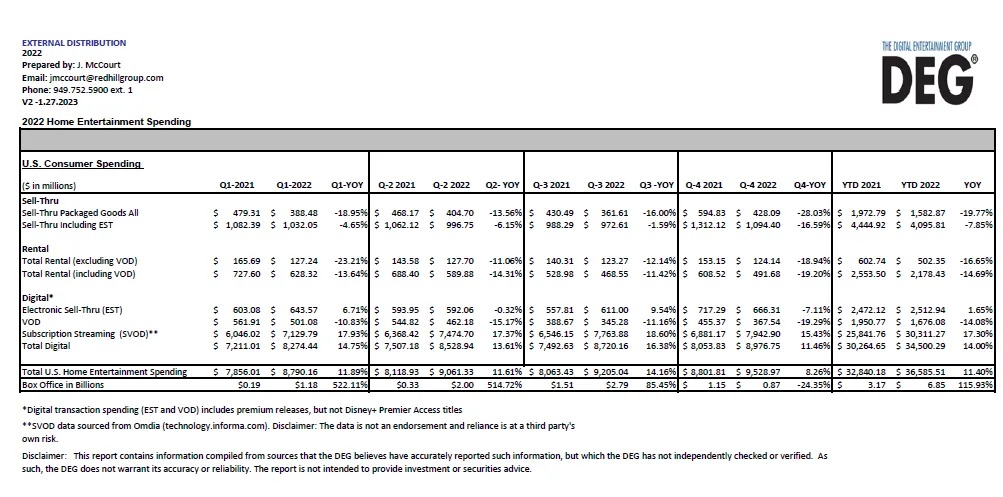

LOS ANGELES—Despite wide-spread fears of an imminent streaming slowdown and shakeout that have hammered stocks of major streamers and media companies over the last year, new data from the Digital Entertainment Group shows that consumers continue to embrace the medium in record numbers, with consumer spending on subscription streaming video services rising by $7.9 billion in Q4 2022 and full year SVOD spending jumping by 17% to $30 billion.

Ad-supported AVOD and FAST channels also saw record revenues, hitting $16.8 billion in 2022, up 40% from 2021, according to data from Omdia cited by DEG.

The data suggests that the U.S. market for streaming isn’t headed for a recession anytime soon and that the market continues to see relatively impressive growth compared to the overall economy.

Overall U.S. consumer spending across digital and physical home entertainment formats in 2022 was more than $36.5 billion, an 11.4 percent increase from the almost $33 billion consumers spent in 2021, driven by a raft of strong franchise properties coming from theaters and television.

Consumers spent $34.5 billion on digital entertainment purchases (EST2), rentals (VOD2) and subscriptions for the full year, a jump of 14 percent over full year 2021. Spending on subscription streaming rose more than more than 17 percent for full year 2022, topping $30 billion.

In the year’s final quarter, overall consumer spending rose 8.3 percent, representing just over $9.5 billion, even though box-office spending on the titles released to the home in the fourth quarter fell almost 25 percent from the year earlier period. New theatrical releases are historically a key driver of home entertainment spending. Consumers spent almost $9 billion on digital entertainment purchases (EST), rentals (VOD) and subscriptions in the fourth quarter of 2022, an increase of 11.5 percent.

Other highlights for Q4 2022 and the full year included:

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

- Digital purchases (EST) were up 2 percent for the year, with spending on theatrical content up 11 percent and spending on TV content down 13 percent, DEG reported.

- After strong gains in the first three quarters of the year, digital purchases (EST) of theatrical content were down 16 percent in the fourth quarter. This was due to smaller box office titles released, including less favorable home entertainment genres like horror and comedy.

- The surge in theatrical new releases in the first three quarters also benefited premium physical formats, with spending on 4K UHD Blu-ray titles ending the year with 20 percent growth. The most in-demand 4K UHD titles of 2022 reflect many of the year’s biggest titles overall, including “The Batman, Doctor Strange in the Multiverse of Madness”, “Jurassic World: Dominion”, “Spider- Man: No Way Home” and “Top Gun: Maverick”.

- Digital purchases (EST) of TV product experienced declines of 12.8 percent for the full year, but only 2.2 percent in the fourth quarter, which was driven by strong demand for the most recent season of the megahit series "Yellowstone", along with previous seasons and the spinoff "1883".

- U.S. consumer spending on subscription streaming rose to $7.9 billion in Q4 2022, with growth slowing slightly to 15.4 percent. Spending on subscription streaming for the full year was $30 billion, an increase of more than 17 percent.

- In parallel, ad-supported premium AVOD and FAST content reached an estimated advertising revenue of $16.8 billion in 2022 according to estimates from Omdia4, as more major streamers diversified their offerings to include lower cost subscription plans with ads. Omdia estimates show ad revenue grew by more than 40 percent for the full year, DEG reported.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.