Ampere: Major Streaming Operations to Be Profitable in 18 Months

Disney will be the first to reach profitability in Q1 2024, followed by Warner Bros. Discovery in Q3 2024, according to Ampere

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

After a difficult two years when streaming companies have been under mounting pressure from Wall Street to staunch their eye-watering losses, a new study from Ampere Analysis suggests that their painful efforts to cut costs and boost prices will soon start paying off.

The new Amprere study argues that a significant turnaround for studio direct streaming is just around the corner and that all major studio streaming divisions (excluding sports operations) are set to start turning a consistent profit within 18 months.

The shift to profitability has wide-ranging implications for content production and the wider entertainment landscape with a reversal of negative investor will likely to come sooner than previously predicted, the researchers said.

Ampere predicts that Disney is likely to reach profitability first, as early as calendar Q1 2024 (two quarters earlier than the company itself has predicted). Warner Bros. Discovery will be a close second, reaching consistent profitability by calendar Q3 2024 with both Paramount and NBCU not far behind, achieving the goal by Q1 2025.

They study finds that not only have all the major studio streamers now laid the groundwork for profitability in relatively short order. They all also look likely to turn streaming services into significant sources of profit in upcoming years.

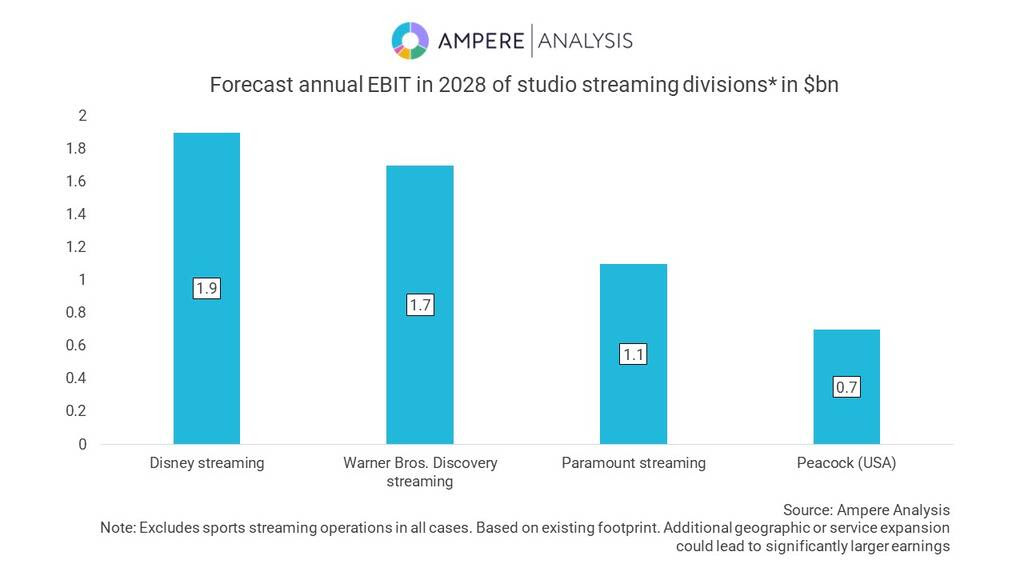

By 2028, studios will earn between $1 billion and $2 billion in earnings before interest and taxes (EBIT) a year from streaming based on current market footprint alone. Additional geographic expansion would lead to even more upside, the researchers said.

“The analysis shows that streaming direct is not a broken business model but an important revamp of an existing content exploitation window,” executive director at Ampere Analysis Guy Bisson said. “Understanding that this model is on the point of consistent and notable profitability is crucial as the ability of streaming to continue driving content origination and investment has wide implications for the creative sector. Additionally, with studios now able to position streaming correctly as a profit-making direct subscription window that is complimentary to theatrical exhibition, transactional and free television, sectors that had previously been deprioritized should also see a boost. The rationalization of streaming is already seeing renewed support among studios for the theatrical window and revisiting of the content licensing model.”

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

The analysis found that the shift in fortunes has been driven by two major factors: cost rationalization (particularly the two major cost centers of content and staff) and the move to embrace advertising dollars. Advertising also provides a wild card opportunity for significantly more growth and profit than currently predicted by the models, which are based on known existing operations.

Profitability of the streaming direct model (much of the growth in which will be driven by advertising) will also see an acceleration of free streaming, including Free Ad-supported Streaming Television (FAST) channels, the study found.

“A confluence of factors as varied as the end of Covid-19 lockdowns, geopolitics and the cost-of-living crisis created the environment that forced the studios to reassess the return on investment of the streaming direct model,” Bisson concluded. “The cost rationalization of the last 12 months has now positioned the industry for genuine streaming profitability in relatively short order. Passing that milestone will impact multiple windows within the entertainment value chain. It will enable a return to flexibility and experimentation and a realization that existing models are already in place to fully exploit studio output when streaming direct takes its rightful place as one window in the broader value chain.”

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.