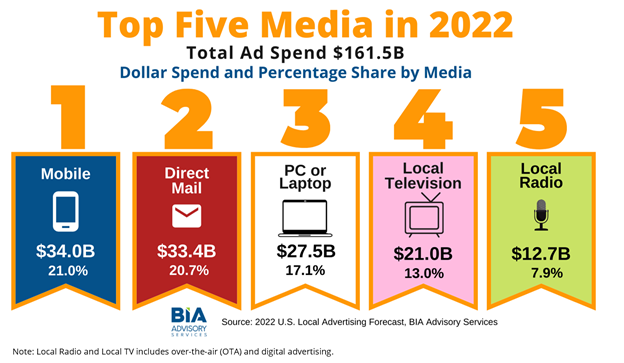

2022 Local Ad Forecast: Mobile Advertising Will Surpass Direct Mail

For the first time ever, mobile will surpass direct mail as the U.S. local ad market grows to $161.5B in 2022, the BIA is forecasting

CHANTILLY, Va.—BIA Advisory Services is forecasting a strong U.S. local ad market in 2022, growing by 10.1% to $161.5 billion as mobile advertising spending surpasses direct mail for the first time ever.

The new forecasts for the entire U.S. local ad market follow the release in late September of the BIA forecasts for local television in 2022. That release forecast that local TV will rise to $19.3 billion in OTA advertising, and $1.7 billion in digital in 2022; a sign of a strong $21 billion industry that delivers its audience for political campaigners, the BIA said.

In BIA’s `U.S. Local Advertising Forecast 2022' released on October 13, the overall local U.S. advertising market is expected to reach $161.5 billion – a 10.1 percent year over year bounce – buoyed by overall strong economic tailwinds coming out of 2021.

The forecast reported that traditional media revenue will account for $84.6 billion and digital media will be close behind at $76.8. BIA also anticipates $7.5 billion of the sum will come from political advertising during a strong election season.

“For a long time, we’ve been talking about direct mail as the king of the share of wallet in local ad spending,” said Rick Ducey, managing director of BIA Advisory Services. “This coming year, for the first time, we pass the crown over to mobile, as its momentum drives it to be the biggest overall piece of the spending wallet – and we expect that to continue in the foreseeable future.”

BIA puts mobile spending at 21 percent of the 2022 forecast and direct mail at 20.7 percent, but the gap between the two will continue to widen, BIA said.

Overall, digital ad spending will reach $76.8 billion, with Google and Facebook controlling over half of the spending. Google takes the lion’s share at $26.8 billion, compared with Facebook’s $14.3 billion, BIA reported.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Ducey points to four reasons mobile has become the number one advertising medium: (1) COVID’s impact on consumer’s increased time spent with mobile and other digital media making digital the place to find and target consumers; (2) digital’s overall momentum in winning more revenue share of media time from traditional media; (3) the rise of virtual consumer channels like delivery, curbside pickup and ecommerce in top categories like retail, restaurants, CPG where physical channels like retail store visits decline; and (4) greater consumer acceptance and use of virtual and ecommerce channels.

Mark Fratrik, senior vice president and chief economist at BIA, added that the firm’s U.S. Local Advertising forecast also sees a rise in local radio advertising revenue in 2022.

Radio is expected to generate $12.7 billion split between over-the-air ($11.0 billion) and digital ($1.7 billion). By 2026 radio digital revenues are expected to reach $2.4 billion, while OTA goes up and down with the even political years and ends at $11.7 in 2026.

“Radio isn’t faring as well as local broadcast TV, and it doesn’t get the same bump as TV in political years,” said Fratrik. “But it is getting close to its pre-pandemic levels as people continue to return to work commutes and traveling by car.”

“I like to refer to our data on local television as our ‘piano key graphs,’ because during even political years it is very apparent that the advertising revenue will rise and then dip the following year,” Fratrik added.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.