The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

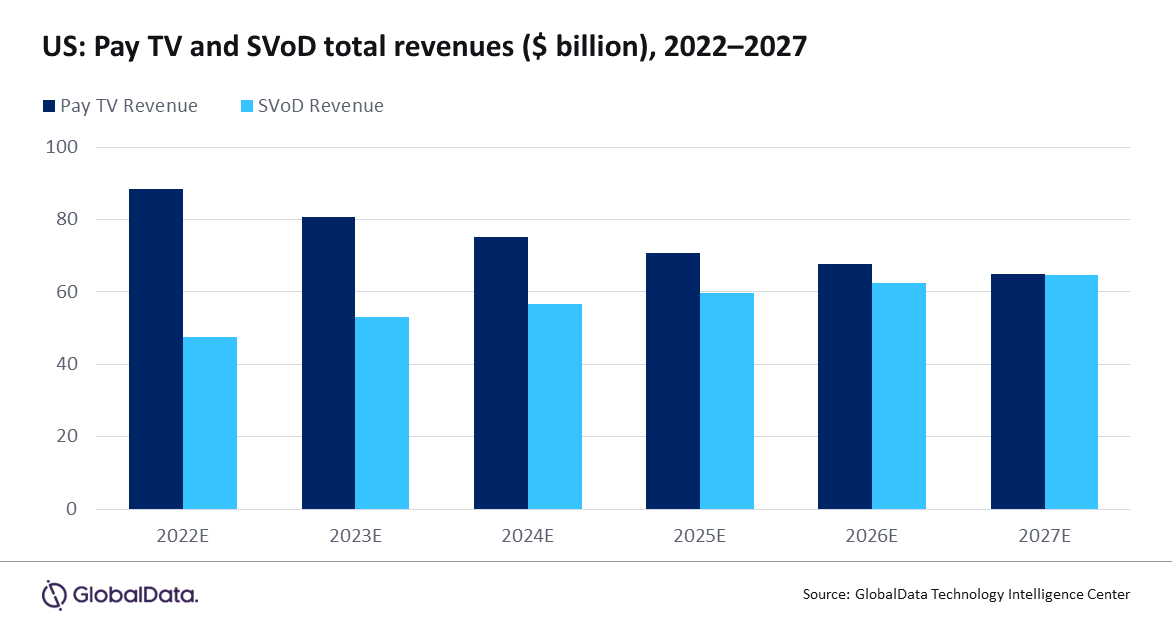

Annual revenues of U..S subscription video on demand (SVOD) services will nearly equal those of traditional pay TV in 2027, marking a critical tipping point in the ongoing decline of cable TV, IPTV, and satellite TV services as over-the-top video streaming rises to dominate the media landscape.

That’s the conclusion of a new report from GlobalData that predicts that revenues from SVOD services such as Netflix, Amazon Prime, and Hulu will increase from nearly $47.6 billion in 2022 to $64.6 billion in 2027, recording a compound annual growth rate (CAGR) of 6.3%.

This growth will come at the expense of traditional pay TV in the US, as the research firm estimates that pay-TV revenues will plummet from $88.5 billion in 2022 to less than $65 billion in 2027, registering a negative CAGR of 6.0%. SVOD’s household penetration, having already reached a whopping 260% in 2022 thanks to households subscribing to multiple SVOD services, will jump to 312% in 2027.

Meanwhile, pay TV’s U.S. household penetration rate will slide from 47% in 2022 to 33% in 2027, with ongoing declines registering across cable TV, broadband-delivered IPTV, and direct-to-home (DTH)/satellite TV subscriptions as the ranks of “cord-cutters” and “cord-nevers” grow unabated. Young adults who have never subscribed to cable or satellite TV make up the cord-nevers, while older users who are turning away from traditional pay TV in favor of streaming services are considered "cord-cutters."

“SVOD was already on an impressive upward trajectory, but the addition of live sports programming is changing audience viewing habits even more, helping drive additional pay-TV cord-cutting and SVOD growth. Just this month, the National Football League and NBCUniversal announced that the Peacock streaming service will air the first-ever exclusive live streamed NFL postseason game in January 2024, when it presents an NFL Wild Card Playoff. Even ESPN is reportedly eyeing a standalone direct-to-consumer (DTC) streaming version of its flagship channel.”

There is some good news for traditional pay-TV service providers, as GlobalData anticipates their monthly average revenue per subscriber (ARPS) will remain strong. US pay-TV ARPS reached $113.49 in 2022 and is expected to rise to $118.34 in 2027, thanks largely to price increases by cable TV and satellite TV providers.

Domestic SVOD providers, meanwhile, will see low, but stable ARPS over the next few years, as the sector’s monthly ARPS of $12.16 in 2022 will increase just slightly to $12.79 in 2027. SVOD price increases will be reined in due to heated competition, as well as the increased use of ad-supported tiers, plans with limited content, and monthly and temporary discounts, GlobalData says. Additionally, as inflation moderates, there should be less pressure on SVOD providers to dramatically raise prices.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

“GlobalData expects Netflix to continue to dominate SVOD revenue market share, attracting about three times as much revenue as Amazon Prime, and twice as much as Hulu (SVOD only, without live TV) each year through 2027,” Parker added.

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.