Survey: Consumers Are Reaching `Peak TV’

Many consumers are either at or near their maximum number of TV services and do not plan to spend any more money on subscriptions, according to the Hub

PORTSMOUTH, N.H.—Amid growing signs that the era of “peak TV” may be coming to an end, a new survey from Hub indicates that many consumers are now either at or near their maximum number of TV sources, and are not actively looking to spend more money on video entertainment.

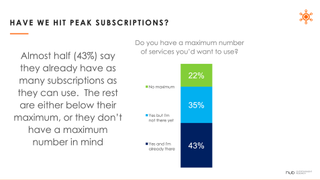

The Hub’s annual “Monetization of Video” survey found that nearly half (43%) of those surveyed are already at what they claim is the maximum number of services they want, which is an average of seven TV sources. Among the one third of viewers who have not yet reached their limit, the survey found that seven services is also the optimal number of services.

“The video ecosystem is clearly at an inflection point. Gone are the days when providers could reliably count on revenue growth from new subscribers,” said Mark Loughney, senior consultant to Hub. “This leads to a quandary: how to deliver the volume of content necessary to keep subscribers loyal, while at the same time controlling production costs. Reconciling this dilemma will be the key to long term success in the video marketplace.”

The good news for providers is consumers are still spending more: Nearly half of consumers (44%) say they are spending more on TV than a year ago, and that’s up from 34% who said the same in 2020. This is despite the fact their actual average spend of $85 per month is 25% more than what they consider “reasonable” for video services, the Hub survey found.

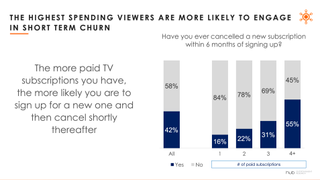

The bad news is the highest spenders are the most likely to churn: The more subscriptions a household has, the more likely they are to cancel a new subscription within 6 months of acquiring it. The majority of those with 4 or more subscriptions say they canceled a new service within six months.

Another key finding is that consumers are looking for value: While low price is the strongest driver of the value of a particular video service, it is not the only thing consumers include when considering value. They also want price stability, and for a service to have a large library of content, the researchers said.

The survey also found that bundling SVODs with MVPD subscriptions provides value: Among the substantial segment of consumers who do not have an MVPD subscription, two thirds say integrating SVODs into an MVPD (i.e.. traditional pay TV) set-top-box would make a Pay TV service more valuable to them (up from 59% last year). In an environment characterized by subscription churn, such bundles could serve to reduce cancellations.

Get the TV Tech Newsletter

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

These findings are from Hub’s 2023 “Monetization of Video” report, based on a survey conducted among 1,602 US consumers with broadband, age 16-74, who watch at least 1 hour of TV per week. Interviews were conducted in June 2023 and explored consumers’ attitudes toward what they pay for TV services, and the value delivered by providers. A free excerpt of the findings is available on Hub’s website. This report is part of the “Hub Reports” syndicated report series.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.