Satellite and TelcoTV Continue to Take Cable Subscribers

NEW YORK: The migration away from cable television continues, according to the Television Bureau of Advertising. Alternative delivery systems such as satellite and telcoTV are eating into the subscription landscape formerly dominated by wired cable.

The TVB’s motivation for tracking the numbers involves the ratings numbers used to sell local advertising, a substantial revenue category for TV stations. However, the trend may also give cable operators leverage in other areas. E.g., the evidence of increasing competition may help Cablevision in its legal battle to restrict access to content it owns; and Comcast in its pursuit of clearing the NBCU merger.

The TVB says penetration by alternative delivery systems--subscription TV services that are not wired cable--reached 29.8 percent in February. The reach was an all-time high, though up just 0.8 of a percent from a year earlier. ADS now represents nearly one-third of all pay TV subscriptions.

From the TVB perspective: “Advertisers who buy cable locally need to know that local wired cable systems’ ability to deliver commercials continues to erode. In fact, in 34 markets, a majority of those paying for video programming are now getting that programming via ADS rather than from a wired-cable system,” said the TVB’s Susan Cuccinello. “Local cable commercials are not seen in ADS homes, and so local advertisers need to deduct the ADS percentage of the audience if they are included in the cable systems’ submissions.”

The TVB said that in late 2003, Nielsen Media Research made hard-wired local cable numbers, excluding ADS homes, available via its Total Viewing Sources DVD. However, it said, some third-party processors are still adjusting their software to use the DVD. Hard-copy Nielsen books do not break out the numbers separately, so some advertisers still need to make ADS deductions manually.

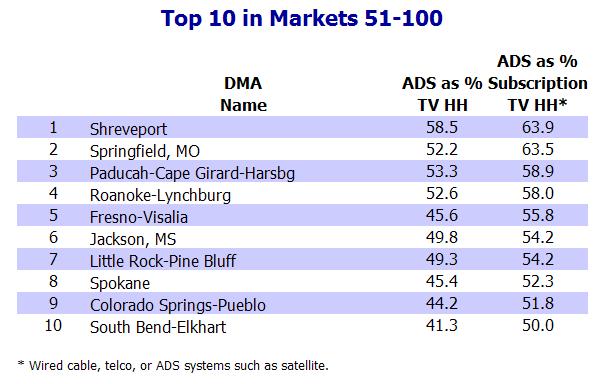

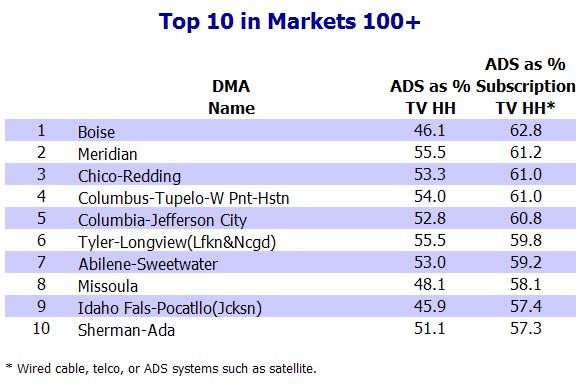

Below are the leading markets for ADS penetration in the top 50 DMAs, DMAs ranked 51-100, and DMAs 101 and higher, according to February 2010 Nielsen Media Research/NSI data:

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.