S&P Report: U.S. Cable Networks on a Downward Spiral

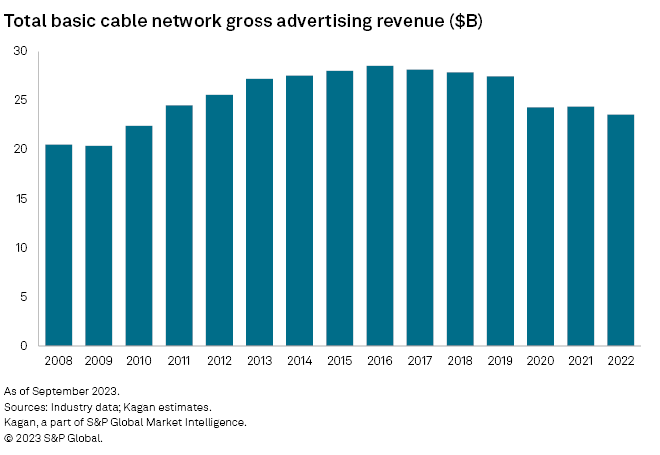

U.S. cable network advertising should fall 4.9% in 2023 and dip below $20B by 2027, the lowest level since 2007

Cord cutting, a tougher TV ad market, competition from streaming services and lower ratings are cutting into cable TV network ad revenue, according to a new report from S&P Global Market Intelligence that predicts ad revenue will drop by 4.9% in 2023 and drop below $20 billion in 2027.

"Linear cable network advertising revenue is under pressure from a multitude of factors including cord cutting and the proliferation of ad-supported streaming services,” Scott Robson, senior research analyst at S&P Global Market Intelligence said. “We anticipate that gross advertising revenue will fall 4.9% in 2023 to an estimated $22.4 billion, and that revenue will decline every year in the next five years, dipping below $20 billion in 2027. Our outlook is not calling for a total collapse of the market, however, as we believe there is still value in cable network ads over the next five years as the industry continues its slow migration to on-demand platforms."

The new report is also predicting that while advertising revenue is projected to do better in the even years with boosts from the Olympics and political elections overall advertising revenue for the cable networks will decline every year in the next five years, dipping below $20 billion in 2027 for the first time since 2007.

In a blog post, Robson also argued that the “fallout from the recent carriage dispute between Charter Communications Inc. and Walt Disney Co. suggests that niche cable networks may be vulnerable to being dropped by more major operators. As a result, these networks may draw fewer viewers in the future, which will result in fewer ad dollars.”

Robson noted that S&P Market Intelligence estimates that cable's gross advertising revenue fell 3.4% in 2022 to $23.6 billion, which is the lowest level since 2010. In addition to declining ratings, linear cable networks are dealing with an increasing amount of competition from ad-supported streaming services looking to take a piece of the pie.

However, live sports remain a very valuable genre, which will allow the sports networks were able to increase combined advertising revenue by 2.8% in 2022 to $4.3 billion, he wrote.

Robson also cited a number of challenges facing cable networks in terms of advertising:

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

- "The future of cable network advertising revenue faces headwinds from cord cutting, which has resulted in fewer viewers and shrinking ratings. This will increasingly negatively impact more niche networks that are dropped by major operators," Robson wrote.

- Advertising on cable networks does not allow for the same level of audience targeting as digital ads, making them less appealing to advertisers because it is difficult to track performance.. However, call-to-action ads are increasingly allowing for better tracking, he noted.

- Another factor reducing the value of cable ads for advertisers is the fact that viewers may be tuned into a TV network during an ad, but in today's age of smartphones, it is hard to know who is paying attention to the ad.

- Linear network advertising revenue will also be challenged by the growth of ad-supported Netflix Inc., Disney+, Max and other on-demand platforms that operated ad-free up until the past few years, he said.

- In addition, he said, free, ad-supported streaming TV services like PlutoTV are rapidly growing advertising revenue, which is stealing share from cable networks.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.