Global Online Video Subs to Hit 2B in 2027

Pay TV will remain relatively flat at 1B subs, about half the number of online video customers according to Omdia

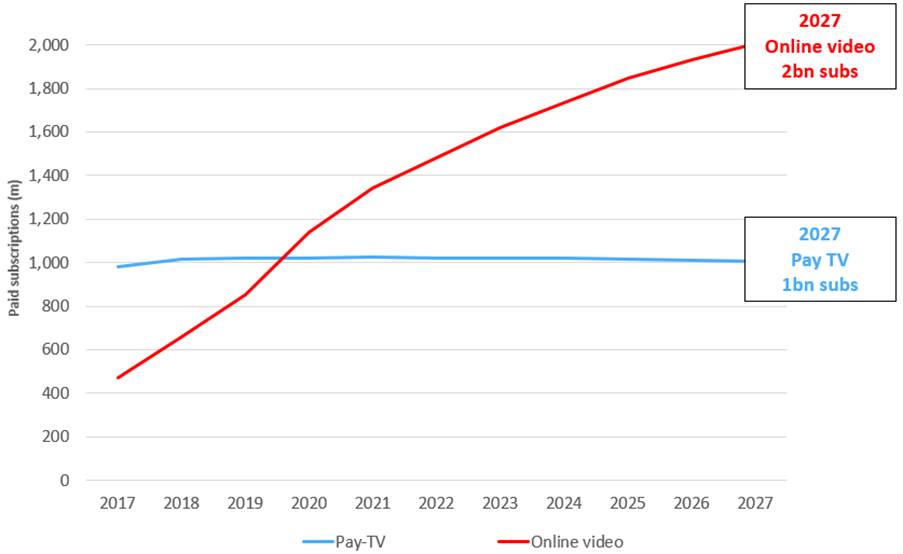

LONDON—Researchers at Omdia are forecasting rapid growth for online video subscribers, which are projected to hit 2 billion by 2027 and slight declines for pay TV, which will have about 1 billion subs in 2027, for a total of 3 billion pay TV and OTT subs worldwide.

Omdia’s new Global: Pay TV & Online Video report finds that online video subs increased from 1.14 billion at the end of 2020 to 1.34 billion at the end of 2021, up 17.7% year-on-year.

Omdia is forecasting a further 10.5% growth in 2022 to take the figure to 1.48 billion by the end of 2022.

With new services continually entering to market and major players still only part of the way through their respective global expansion efforts, Omdia is predicting that the market will continue to expand for several years, with online video subs in 2027.

“Online video services are continuing to experience impressive growth levels and there is a lot more to come,” explained Adam Thomas, senior principal analyst in Omdia’s TV & Online Video team commented. “Disney+ has enjoyed an incredibly successful launch but there are several more attractive territories for it to enter over the next couple of years. And the same goes for Paramount+, Peacock and several others. The prospects for the alliance of HBO Max with Discovery+ also looks exciting. There are numerous reasons to be positive for online video’s prospects over the next few years which are reflected in our forecasts.”

Meanwhile, global pay TV subscription numbers grew by 0.6% in 2021, from 1.02 billion to 1.03 billion. With competition from online video intensifying, Omdia expects the pay TV market to exhibit slow decline looking ahead and forecasts subscription numbers to drop from the 1.03 billion figure to one billion in 2027, down by 1.9%.

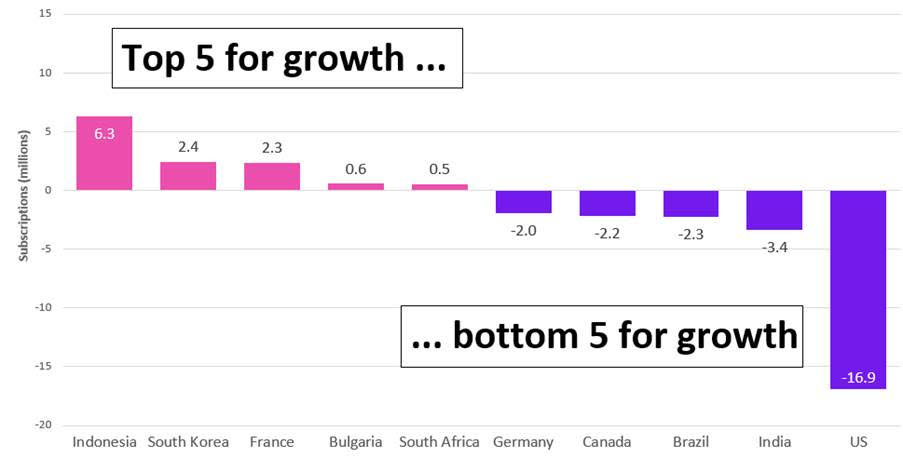

While online video subscription numbers are growing just about everywhere, the outlook for pay TV varies a great deal from country-to-country. Of the 101 pay TV markets that Omdia tracks in most detail, the outcomes show significant fluctuations, with 55 countries still reporting subscription growth, 41 reporting decline and five essentially static, Omdia reported.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Over the next five years Omdia expects those contrasting fortunes to continue, with countries like Indonesia continuing to post solid increases, while others – most notably the U.S. – seeing ongoing decline.

“The one small note of caution I would add is that with pay TV as a whole plateauing, the TV and video business is becoming increasingly reliant on growth from online video,” Thomas said. “But with that business having been built on high content investment aligned with low subscription prices, a price-sensitive public has come to expect a lot of bang for their buck. The content costs versus pricing balancing act is a tricky one to navigate and we’ve already heard from Netflix that it expects to lose 2 million customers in this quarter. It is quite clear that constant growth for online video is by no means guaranteed.”

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.