Media & Entertainment Firms Are Top Ad Spenders in NFL Pre-Season

Auto, finance and tech companies were the next biggest spenders in ads during 2022 NFL pre-season games according to MediaRadar

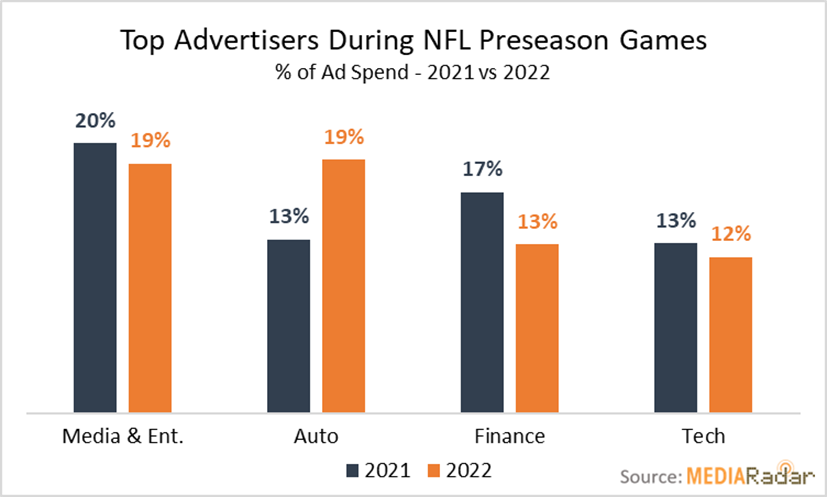

NEW YORK—A new study of the 2022 NFL preseason ad spend by MediaRadar has found that media and entertainment companies are among the top spenders on ads, with auto, finance and tech companies coming in as the next biggest spenders during NFL pre-season games.

The study also found that spending on ads in NFL games increased by 14% last season to over $6.8 billion and it provided a number of insights into past trends in ad spending by various categories that could continue into the 2022 season.

The MediaRadar study analyzed the ad spend from national TV broadcasts, including cable networks for the 2020 season, the 2021 season and preseason games August 2021 and August 2022. This analysis includes the following networks: ABC, CBS, CW, Disney, ESPN, Fox, NBC, NFL Network, and Telemundo and the networks’ sister channels (ex: Fox Deportes, etc.).

“Last year, digital currency players made a splash by making their way to NFL’s gameday advertisers,” said Todd Krizelman, CEO and founder of MediaRadar. “Between top crypto names like Coinbase,Crypto.com, and FTX - there was a combined $67 million ad investment. Separately, we saw a surge in electric vehicle companies entering the ad game, bringing new advertisers like Wallbox showcasing their EV charging solutions during the regular NFL season. Will we see the trend of new players joining the big stage continue into the 2022 NFL season? Looking at the spend at preseason games this year, we anticipate companies like streaming services and financial providers amongst the top advertisers.”

Key findings for the preseason games include:

- Media & entertainment is still the leading category in preseason games despite a decrease in ad investment YoY. This year, subscription streaming services, fantasy football leagues and mobile apps remain top spenders.

- Insurance companies, banks and accountants (taxes) were top finance advertisers in 2022’s preseason.

- Within the tech category, cell providers, web browsers and financial software lead this year’s preseason games.

- Auto manufacturers increased investment to promote their new models this preseason

The study also compared ad spending during the 2020 and 2021 seasons:

- During the 2020 NFL season (Sept. 2020 - Feb. 2021) there was over $6 billion invested in advertising and that spending on ads in NFL games increased 14% YoY during the 2021 NFL season (Sept. 2021 - Feb. 2022) to over $6.8 billion.

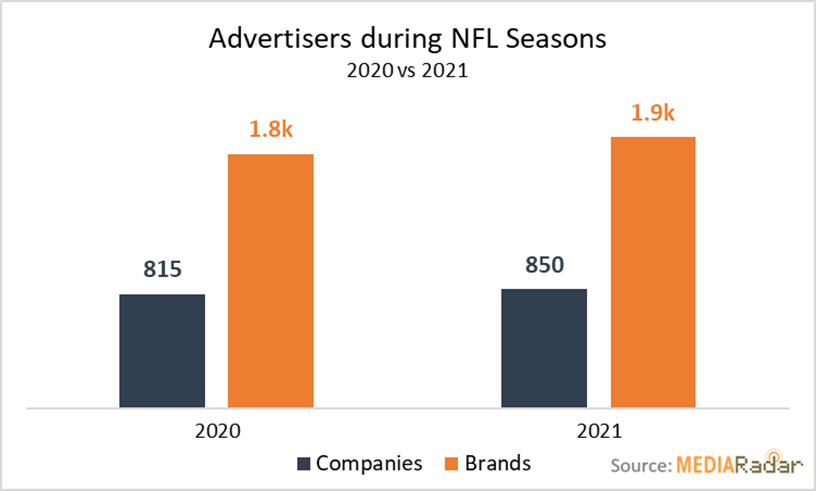

- The 2021 NFL season saw a 4% YoY increase in the number of companies and a 7% YoY increase in the number of brands showcased during the season.

- 60% (510) companies advertised during both 2020 and 2021 NFL seasons.

- Three top advertisers during 2021’s NFL season were Amazon, Apple and Toyota - with a combined spend nearly reached $571 million. Toyota was the only that decreased YoY by 6%. Amazon and Apple were up 5% YoY and 229% YoY respectively.

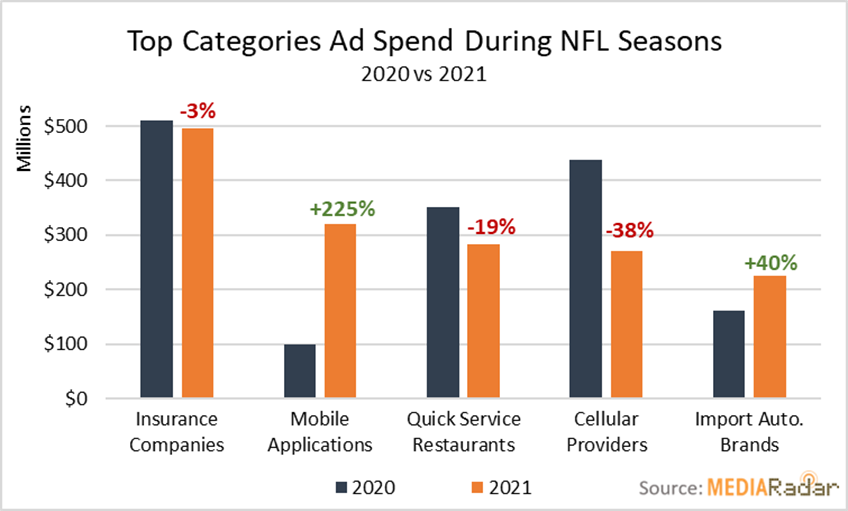

- During 2021’s NFL season the top five categories accounted for 23% (over $1.5 billion) of the total ad investment.

- While insurance companies were the top advertisers during the 2021 NFL season, there was a 3% YoY decrease in ad spend - still nearly $497 million was invested from 10 companies.

- Companies such as Intuit, and Lowe’s were advertising their apps while crypto (Crypto.com and FTX) and gambling companies (888.com) joined the ranks to showcase apps.

- Investment during the NFL season for quick service restaurants topped $282 million despite a 19% YoY decrease.

- Ad spend from cell providers exceeded $271 million during the 2021 season - a nearly 40% decrease. All major advertisers decreased: AT&T was down 70% YoY, T-Mobile reduced investment 55% YoY, and Verizon decreased 4% YoY.

- 81% of the nearly $225 million invested in 2021 advertising import automotive brands came from three top NFL season spenders: Honda, Hyundai and Toyota all invested over $50 million each.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.