Magna Predicts 7.5% Drop in 2023 Long Form Video Advertising

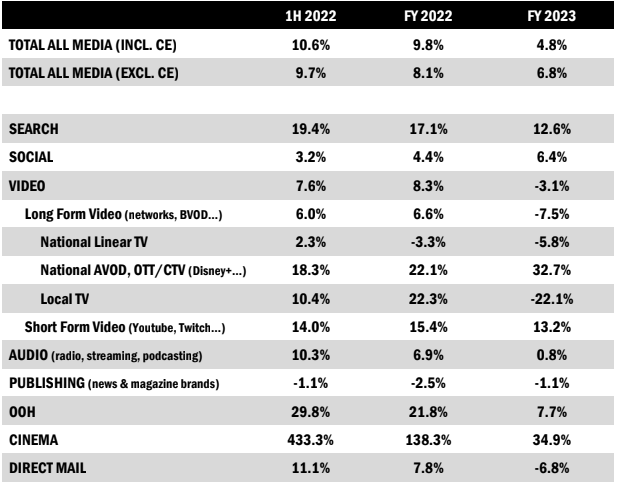

Gains in streaming and CTV advertising will not compensate for a 22.1% drop in local TV and a 5.8% decline in national linear TV

NEW YORK—The ongoing economic slowdown and the lack of major cyclical events like the midterm elections has prompted Magna to reduce its overall forecasts for U.S. advertising in 2023 and to predict a 7.5% drop in long-form video advertising.

For 2023, Magna is predicting a heft 32.7% increase in AVOD, OTT and CTV advertising in the U.S. But that won’t overcome an eye watering 22.1% slump in local TV advertising, which has been buoyed in 2022 by record levels of political advertising, and a 5.8% drop in national linear TV.

For all advertising, Magna has reduced its growth forecast to +4.8% for 2023 from +5.8% in the previous report.

“Following a strong first half, non-cyclical advertising spending is slowing down as several industries are facing an uncertain economic environment,” explained Vincent Létang, executive vice president of Global Market Intelligence at MAGNA and author of the report. “There are several growth factors that will help stabilize media owner ad revenues in coming months, however. In the short-term (2H22) cyclical factors: Billions of ad dollars will be spent by political campaigns in TV, direct mail, and digital media. In the mid-term (2023) there will be multiple organic growth factors, driven by marketing technology innovation: Retail media networks bringing below-the-line marketing budgets into digital media, programmatic spending in digital audio and digital OOH formats, and the expansion of AVOD and CTV advertising with new ad-supported tiers from Disney+ and Netflix.”

Magna reported that long-form video advertising increased by 6.0% in the first half of 2022 compared to very strong results in the first half of 2022 and that the sector should be up by 6% for all of 2022.

Local TV will be up 22% for the year while national linear TV advertising will be down 3.2% for all of 2022 compared to 2021.

National AVOD, OTT and CTV advertising will be up by 22% for 2022 compared to 2020.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Based on record fund-raising year-to-date, Magna is predicting that political advertising spending will grow by +63% over the previous mid-term cycle (2018) and generate $7.3 billion in incremental advertising revenue for media owners, with 70% of it concentrated in the second half.

Local television will attract almost two-thirds of that total, as political ad sales will account for 25% of total local TV ad revenue this year (and more for stations in “battleground” markets), the researchers said.

Digital media formats will receive $1.3 billion from political campaigns, with sales up between +150% and +200% for search, digital video, and social formats.

With a strong first half and political advertising mitigating the slowdown in the second half, Magna also expects full-year, all-media advertising revenues to surpass the $300 billion mark for the first time and reach $323 billion this year. That represents an increase of $29 billion over 2021 (+9.8%), with non-cyclical underlying growth at +8.1%.

Other key findings in the new Magna ad data and a forecast include:

- In the wake of a historically strong 2021, U.S. media owner’s advertising revenues grew by +11% to $151 billion in the first half of 2022, based on financial reports.

- Media channel performance varied greatly in the first half with strong revenue growth in out-of-home (+30%), and robust growth in keyword formats (search, retail media) (+19%), contrasted against stagnation in social media (+3%).

- The weaker economic environment will cause several industry verticals to reduce ad spend in the second half, but stronger-than-expected political spending will mitigate the impact on revenues of media owners.

- Full-year media owner revenues will thus cross the $300bn market for the first time, to reach $323bn. That’s +9.8% above 2021 levels (+8.1% if we only consider non-cyclical ad spend and exclude political dollars).

- For 2023, the continued economic slowdown and the lack of major cyclical events led Magna to reduce its growth forecast to +4.8% from +5.8% in the previous report.

- Magna expects Entertainment (Movies, Streaming), Travel and Betting to grow advertising spending next year, possibly joined by Automotive as the car market finally stabilizes.

- Keyword search formats (+13%) and OOH (+8%) will continue to outperform, while long-form AVOD spending will be driven by the addition of ad-supported tiers from Disney+ and Netflix (+33%).

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.