Cord Cutting, Rising Costs Hit Profits at Sports Nets

A new Kagan report finds rising programming expenses and dip in subscribers reduced profit margins

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

NEW YORK—While sports programming remains extremely popular, the cost of sports rights and a dip in subscribers hurt profit margins at sports networks in 2021, according to a new report from Kagan, a media research group within S&P Global Market Intelligence.

The declining profit margins came despite the fact that live sports account for the most popular telecasts across broadcast and cable television. Ratings increased at most sports networks in 2021 following a disrupted 2020 sports schedule due to shutdowns related to the COVID-19 pandemic.

The report also found that the combined net advertising revenue of the top 20 sports-related basic cable networks increased by 13.2% in 2021, following a 23.2% decline in 2020.

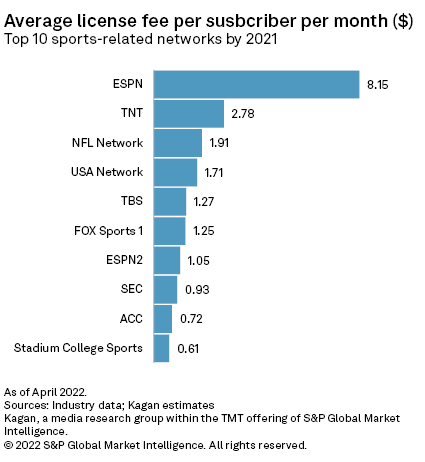

Sports networks charge operators some of the highest license fees in the industry, led by ESPN at $8.15 per subscriber per month, Kagan reported. This rate has consistently grown over the last 10 years at an average annual rate of 5.6%.

The rebound in advertising and high sub fees were, however, unable to overcome the rising cost of sports rights and ongoing cord cutting, which hurt subscriber numbers.

Kagan reported that the U.S. basic cable network industry average cash flow margin was estimated at 39.7% in 2020, which it projected will decline every year to an estimated 31.2% in 2025.

Total subscribers to packages of live linear networks across traditional and virtual multichannel services declined nearly 4.6 million (5.1%) in 2021, according to Kagan estimates for total U.S. residential and commercial video subscriptions.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Sports rights fees are also rising far faster than inflation, with the major leagues bringing in about $15.5 billion per year under current contracts. Rising sports rights costs have been passed from networks to operators and eventually to subscribers in the form of additional fees, which could be up to an additional $15 per month.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.