The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

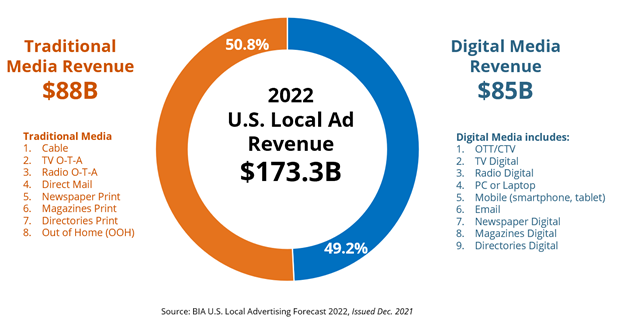

CHANTILLY, VA—BIA Advisory Services has increased its 2022 U.S. Local Advertising Forecast estimate to $173.3 billion, from its earlier estimate of $161.5 billion issued late summer.

The research firm says its 2022 forecast indicates an 11.4% increase over 2021 due to “faster than anticipated growth” in digital advertising and a strong political year. Traditional media ad revenue still maintains a slight advantage over digital at 50.8% of the ad spend ($88B), while digital media will get 49.2% of the ad spend at $85B.

“2021 has been a year of fluctuations,” said Mark Fratrik, senior vice president and chief economist, BIA Advisory Services. “The first two quarters of the year saw strong growth, with some stalling in Q3 once the Delta variant appeared late summer. We’ve taken pandemic concerns plus inflation and supply chain issues into account to prepare our local media estimates and, overall, we are bullish on ad revenue for 2022.”

BIA predicts that OTT ad revenues will grow 57.4%, surpassing the growth of mobile as consumers increase the consumption of the growing number of streaming services available. The top three paid media channels in 2022 will be mobile ($35.7B), direct mail ($33.4B) and PC/laptop ($32.1B).

Local TV is expected to garner a large portion of the revenues from political ads targeting the 2022 mid-term elections with BIA predicting a growth of 28.4% for local TV. Total local political advertising will approach $8.4B in 2022 with Fairbanks, Alaska, Augusta, Ga, and Tucson, Ariz. the top three strongest political ad markets for television, BIA predicts.

The finance/insurance sector is expected to be the biggest advertiser in 2022, a change from retail, which has traditionally been at the top of the list. Less money will be spent advertising cars (perhaps reflecting continuing issues in the supply chain), but more will be dedicated to technology and leisure/recreation.

BIA’s CEO and Founder, Tom Buono, offered his assessment of the forecast saying, “Political spending is anticipated to be very large next year and other bright spots are surfacing that will affect ad revenue across the country for all media channels. As we continuously track economic conditions, we realize it’s an ever-changing situation for local businesses, which affects their ad spend decisions. Except for restaurants and various retail categories, we anticipate most business verticals to exceed 2019 levels in 2022.”

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Buono discusses more details about the economic underpinnings of the forecast in the latest company podcast, BIA’s Expectations for Local Advertising 2022: December Update, which is available for download now.

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.