CHANTILLY, Va.—While even numbered years are usually a boon for broadcasters’ bottom line—with boosts in local ad spending spurred by the Olympics and political campaigns—slow economic growth is expected to dampen down expectations of a large boost in ad spending in 2024.

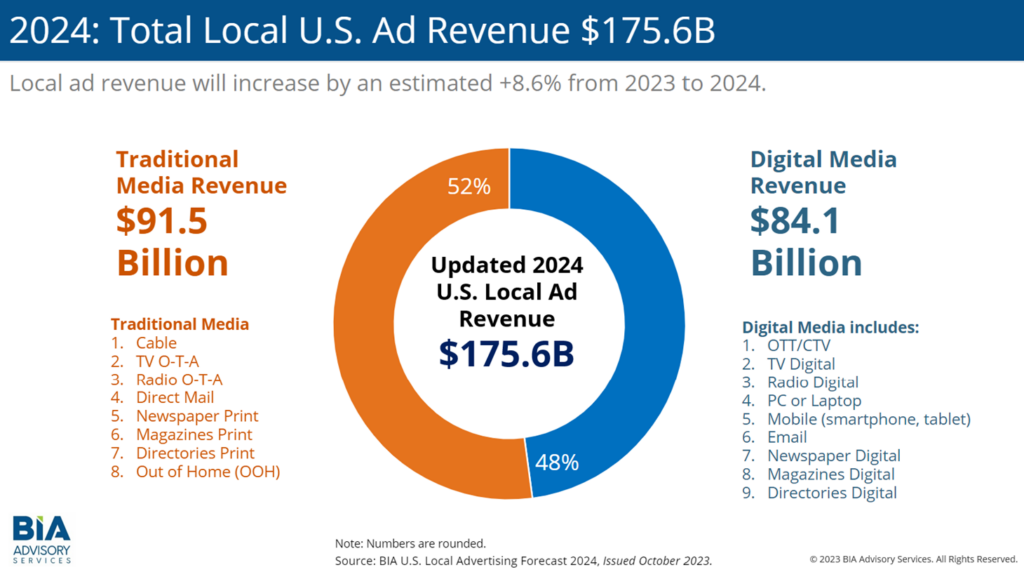

That’s the conclusion of BIA’s newly released 2024 U.S. Local Advertising Forecast, in which the research firm’s Advisory Services arm estimates local ad revenues across all media in the U.S. will increase 8.6%, totaling $175.6 billion, primarily due to the political season.

That increase over 2023 is slightly shadowed by concerns of an economic downturn and overall lower ad spending, BIA said. With the forecasted political revenues removed, BIA’s projection in 2024 is $164.6 billion in total local advertising, only a 2.2% increase in local advertising year-over-year.

“As expected, 2024 will be driven by political spending, and, even in markets that are not highly contested there will be a large amount of political advertising,” said Nicole Ovadia, VP Forecasting & Analysis, BIA Advisory Services. “Local political advertising will be fueled by the Presidential and Senate campaigns as well as issue-based advertising. When we look at the forecast without political, we expect only a slight increase in ad spending due to both global and local economic trends that may create more cautious spending.”

The split between traditional and digital advertising shows that digital has a slightly smaller share, 48%, of the overall advertising spend at $84.1 billion. Traditional media ad revenue is slated at 52% of the ad spend at $91.5 billion.

Commenting on the ad split, Ovadia said, “Digital isn’t growing as fast as it once was. Meta, Alphabet, and others lowered their advertising revenue expectations several times throughout 2023, which in turn has caused us to reflect these reductions in the digital ad spend we track across 96 business categories.”

Key takeaways from the 2024 U.S. Local Advertising forecast include:

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Top five growth channels for 2024:

- CTV/OTT (+39.5%)

- TV OTA (+30.0%)

- TV Digital (+24.3%)

- Cable TV (+19.7 %)

- Out-of-Home (+9.4 %)

Top three fastest-growing categories year-over-year:

- Political (+2028.3%)

- Special Restaurants, Food & Beverage Stores (+17.2%)

- Realtors (+16.7%)

Key local business verticals declining year-over-year:

- Veterinary Services (-15.8%)

- Online Gambling (-15.3%)

- Funeral Homes & Services (-14.4%)

“When you look at which media will grow from this year to 2024, local political advertising is the main driver, which is terrific for local sellers of these channels,” said Ovadia. “Beyond political, several other verticals will increase next year. One category to keep an eye on is Realtors looking to advertise to drum up demand. Declining verticals include those that experienced growth during the pandemic, like veterinary services, that have now waned. Also worth noting is that many states legalized online gambling this year so we expect this sector to reduce its local ad spending and move towards National/Network advertising going forward.”

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.