Worldwide Telecom Equipment Market Slumped in 2023

Data from Dell’Oro Group shows that revenue declined by 5% YoY, worse than expected

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

After five consecutive years of growth and stable trends in first half of 2023, the pendulum swung rapidly towards the negative in the second half of the year, with worldwide telecom equipment revenues dropping by 5% for 2023, according to a new blog post by Stefan Pongratz at the Dell’Oro Group.

Pongratz noted that preliminary findings also suggest that worldwide telecom equipment revenues across the six telecom programs tracked at the Dell’Oro Group—Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch—also performed worse than expected.

North American revenue declined faster than expected, he wrote, with initial readings show that the aggregate telecom equipment market dropped by roughly a fifth in the North America region, underpinned by weak activity in both RAN and Broadband Access. On the bright side, regional dynamics were more favorable outside of the US. Our assessment is that worldwide revenues excluding North America advanced in 2023, as positive developments in the Asia Pacific region were mostly sufficient to offset weaker growth across Europe.

Pongratz explained in his blog that there are multiple forces at play. “First and foremost, challenging comparisons in some of the advanced 5G markets with higher 5G population coverage taken together with the slow transition towards 5G SA helped to partially explain steep declines in wireless-based investments,” he wrote. “This capex deceleration was not confined to the RAN and MCN segments. Following a couple of years of robust PON investments, operators were able to curtail their home broadband capex as well. This reduction was more than enough to offset positive developments with optical transport and SP routers.”

Also contributing to the regional and technology trends is the disruption caused by Covid hoarding and the supply chain crisis, he said. Although this inventory correction was not felt everywhere and varied across the telecom segments, it was more notable in the RAN this past year.

Renewed concerns about macroeconomic conditions, Forex, and higher borrowing costs are also weighing down prospects for growth, he concluded.

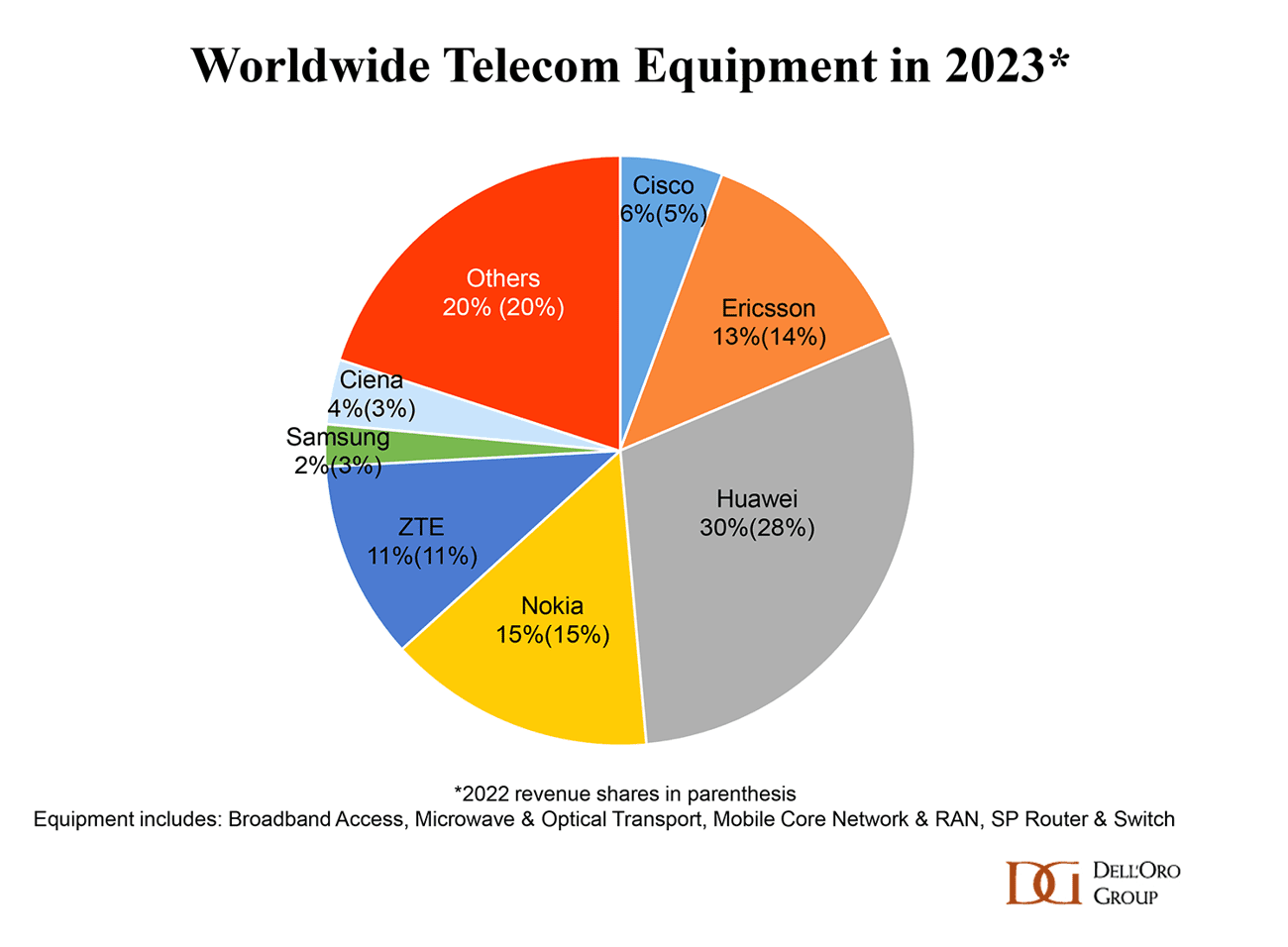

Despite the declines, supplier rankings were mostly unchanged and the top 7 suppliers accounted for around 80% of the overall market.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Looking forward Pongratz wrote that “market conditions are expected to remain challenging in 2024, though the decline is projected to be less severe than in 2023. The analyst team is collectively forecasting global telecom equipment revenues to contract 0 to -5% in 2024.”

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.