How Wheatstone Is Coping With Tariff Uncertainties

The North Carolina-based broadcast equipment manufacturer produces most everything in-house

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

This article originally appeared on TV Tech sister brand Radio World.

With the U.S. economy in a state of flux as the Trump Administration tightens — and subsequently laxes — the flow of imports into the country, tariffs have been top of mind for many manufacturers, including those in the broadcast industry.

At the 2025 NAB Show this past April, as the Radio World team wandered from booth to booth, we asked exhibitors how they might be impacted by these ever-changing tariffs.

Their answer was simple: “We’re not sure, yet.”

For some broadcast manufacturers that import many of their materials from other countries like China, the situation looked rather bleak as the U.S. levied a 145% tax on Chinese goods.

For other U.S. companies that manufacture most of their materials in-house, the outlook is much sunnier. Broadcast equipment manufacturer Wheatstone is one of those companies, building all of its products at its factory in New Bern, N.C.

Wheatstone says 99% of all its metal extrusions were made in the U.S. Additionally, the company does all its own painting and uses powder coat paint that it buys from other U.S. companies. Finally, all the machinery Wheatstone has for fabricating, metal and surface mounting components are supported by U.S.-friendly companies, according to Wheatstone CEO and Founder Gary Snow.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

“It took years and years for us to build all that here in the USA,” said Snow, “and I’ll admit there were times when I wondered if it was such a smart thing to do, but I don’t question it now.”

While Snow told Radio World that Wheatstone largely remains unaffected, that doesn’t mean his company isn’t aware of how these “reciprocal tariffs” have been affecting the industry as a whole. Snow specifically references the strain put on container shipping and the freight industry.

“Companies that build offshore could be paying two and a half times more for containers of finished goods. That’s hundreds of thousands, possibly a million dollars more than what they had set aside — just to open the container,” said Snow. “This could very well threaten the stability of those companies if all their cash reserves are going to containers instead of to business as usual.

“At the very least, it will cost broadcasters more without any real benefit added to the products they buy, or worse, make it harder to get parts and support when they need it,” he said.

It’s important to note that, as previously mentioned, the state of global tariffs remains in great flux, with manufacturers scrambling to keep updated about ongoing changes. To that point, these quotes from Wheatstone executives were obtained by Radio World on May 9, just prior to an unexpected announcement made a few days later.

On Monday, May 12, the United States and China announced that they would suspend their respective tariffs for 90 days. Under the agreement, the U.S. would reduce the tariff on Chinese imports to 30% from its current 145%, while China would lower its import duty on American goods to 10% from 125%.

When asked which of Wheatstone’s necessary components could be subjected to these tariffs, Snow only listed one product: semiconductors.

“Semiconductors are excluded from excessive tariffs at this time, but even a 145% tariff on a 10-cent transistor is not much in the scheme of things,” said Snow. “As a manufacturer that makes just about everything except the semiconductors that go into our products, we are far more concerned with price fluctuations and the availability of components than the tariffs on those components, which is why we doubled down on parts inventory.”

Wheatstone Purchasing Manager Pattye Bagshaw said, even before the tariffs kicked in, she began padding inventory so Wheatstone would have more than enough parts to last through next year.

Snow told Radio World that this practice of keeping a spare supply of stock in-house is a holdover from the pandemic, and the desire to not be caught shorthanded.

“We are a well-oiled machine when it comes to ordering and stocking parts,” said Snow. “We buy from parts distributors in the U.S. that we’ve known for years and have direct relationships with all our major semiconductor manufacturers. In fact, Xilinx (which makes a critical FPGA used in Wheatstone products) put us on their priority list during Covid when it was hard to get parts because a lot of people were buying them up and scalping them.”

Even with extensive preparations, Wheatstone hasn’t been totally exempt from hiked prices. Bagshaw said they recently received a shipment from China and were hit with a 170% tariff.

(Read: Optimism Clashes With Tariff Anxieties at 2025 NAB Show)

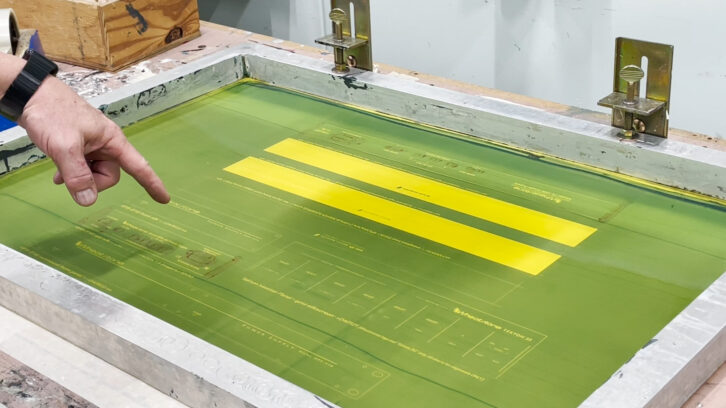

“This was for printed circuit boards,” said Bagshaw. “Wheatstone outsources the printing of circuit boards but designs and surface-mounts components in-house. We have since been able to move that business to vendors that we know of elsewhere and have worked with in the past.”

As for changes to product pricing, Wheatstone Senior Sales Manager Jay Tyler said, well, there is none.

“We have finished products on the shelf and are ready to ship at the same price now as before tariffs began,” said Tyler. “Although, tariffs here can have a snowball effect on our international customers especially because they’re already paying import tariffs on top of the price of products coming into their country.”

At the most recent NAB Show, Tyler said he heard about several manufacturers handing out new price lists with price increases spurred by the tariffs.

“I also heard that people who are rolling out new automation systems or other PC-centric systems were gobbling up computers while they could to avoid tariffs, and that could affect the supply chain,” he said.

Stressors on the supply chain, and potential increased costs on consumers continue to be a concern for manufacturers and buyers alike.

Per the Yale Budget Lab’s latest report on May 12, consumers face an overall average effective tariff rate of 17.8% — the highest since 1934 — which is estimated to dent households’ annual purchasing power by $2,800.

For Tyler’s customers, however, he isn’t worried.

“My customers want the same things they’ve always wanted. They want to be able to afford to move their studios if the rent goes up in their old building. They want to be able to pay for a new console to replace that older board that’s long overdue for retirement,” he said.

“From our perspective, tariffs should have very little effect on whether they can still do those things.”

Elle Kehres is a content producer for Radio World with a background spanning radio, television and print. She graduated from UNC-Chapel Hill with a degree in broadcast journalism. Before coming to Radio World, she was the assistant news director at a hyperlocal, award-winning radio station in North Carolina.