Tablet Sales Dropped 25% in Q4 2021

Supply constraints pushed tablet shipments down in Q4 but they declined only 3% for all of 2021 according to Strategy Analytics

BOSTON—While supply constraints cratered tablet sales in Q4 2021, pushing shipments down by 25%, new data from Strategy Analytics shows that some players did better than others.

Microsoft, for example, cashed in on the need for mobile productivity devices with a massive Surface portfolio refresh that improved sales and pushed it into the ranks of the top global tablet vendors for the first time ever.

The new report from Strategy Analytics also noted that the supply constraints that hurt the market so badly at the end of 2021 seem to be easing. It cautioned, however, that it wasn’t clear if demand for new tables will continue into 2022 or if frustrated consumers had moved onto other interests.

“Last year’s pre-vaccine holiday quarter was a tough one to compare against and when you add on the severe supply constraints impacting tablet vendors, it added up to a disappointing quarter,” explained Eric Smith, director – connected computing at Strategy Analytics. “The maddening thing is, demand far exceeded supply at the end of 2021, holding back higher revenues for everyone. There are signs that supply shortages are easing already in 2022, but we are not guiding this situation to end until after summer.”

“For the entire year, total tablet shipments fell just 3% to 183.1 million units,” Chirag Upadhyay, industry analyst at Strategy Analytics added. “Demand was steadily high through the year, but supply constraints caught up to all vendors by the end of the year. This is due to two factors. First, vendors prioritized notebook production to meet work-from-home and now hybrid work demand. Second, it was difficult to juggle sourcing components that tablets and smartphones share.”

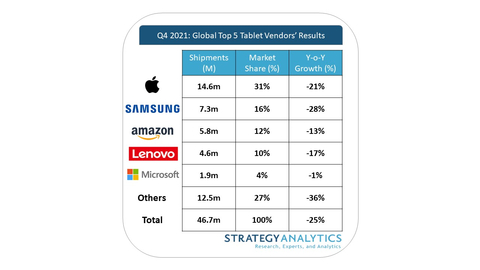

Apple shipments (sell-in) fell 22% year-on-year to 14.6 million units in Q4 2021, with worldwide market share climbing 1 percentage point to 31% as the vendor outpaced the market

While remaining the top Android vendor, Samsung tablet shipments declined 28% year-on-year in Q4 2021 to 7.3 million units; market share declined by 0.7 percentage points to 16% during the same period, the researchers noted.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Amazon performed the best among Android vendors with its deep holiday discounts; shipments declined 13% to 5.8 million units and market share grew 1.7 percentage points to 12%

Lenovo tablet shipments broke a nine-quarter streak of growth to fall 17% during Q4 2021 to reach 4.6 million units; market share climbed 1 percentage point year-on-year to 10%

For the first time ever, Microsoft cracked the top five global vendor list with tablet shipments totaling 1.9 million units and a marginal 1% year-on-year growth rate; market share increased by 1 percentage point to 4%

The full report from Strategy Analytics’ Connected Computing Devices (CCD) service, "Preliminary Global Tablet Shipments and Market Share: Q4 2021 Results" can be found here.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.