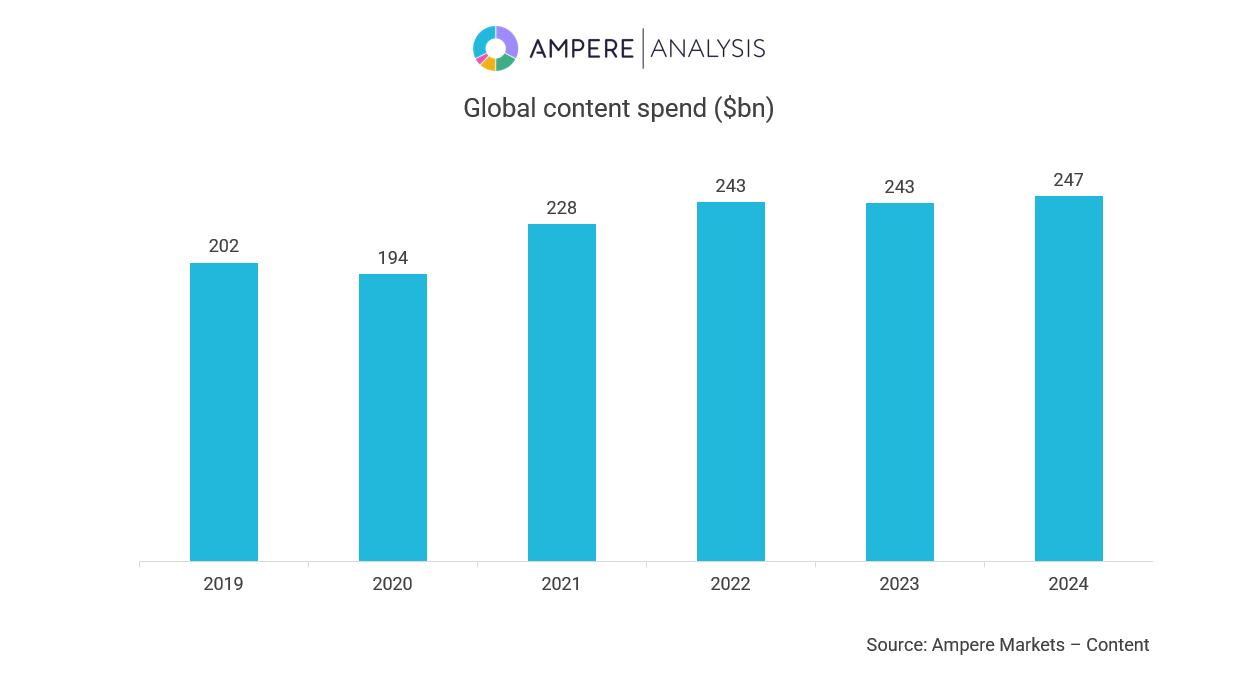

LONDON—Spending on content worldwide will climb 2% in 2024, reaching $247 billion. That marks a return to growth following the WGA and SAG-AFTRA strike, says Ampere Analysis.

The media analysis firm attributes the growth to the revival of postponed productions by broadcasters and streaming services.

“2023 was a worse than expected year for content spend due almost entirely to the Hollywood strikes. The good news is we can look forward to a small recovery of 2% as production resumes and the U.S. election approaches,” said Hannah Walsh, principal analyst at Ampere Analysis. “Global streaming services are forecast to increase total content investment by 7% in 2024 and thus remain key for content spend growth. However, it’s not all rosy as many studios look to cut back on theatrical releases, and broadcasters cut spending due to ongoing declines in TV advertising.”

Helping to buoy production during the strike, which brought production in the United States to a near-complete halt, were global streaming services that continued steady delivery of new original content last year with the help of non-U.S. productions, Ampere Analysis said.

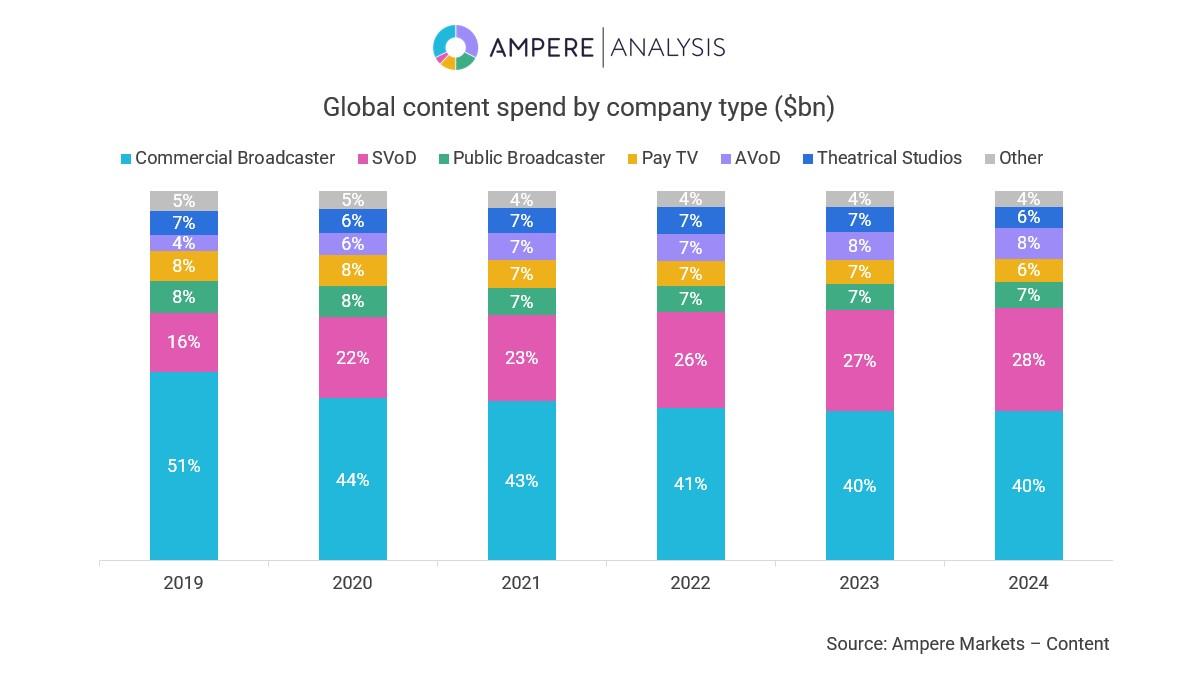

Greater spending on original shows and movies from markets like Germany, India and South Korea pushed up spending of global streaming services to more that $27 billion, an increase of 13% year-on-year. This year global streaming services are expected to increase their total content spend by 7% to $46 billion, it said.

While broadcasters were hardest hit by last year’s strike, the 2024 presidential election is expected to bolster ad revenue and content spending, preventing a further decline this year, it said.

Theatrical studios in the United States will see a 14% year-on-year decline in content investment in 2024 due to the lingering effects of the strike and a focus on cost efficiencies in the cinema market, which remains depressed following COVID, it said.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

However, Amazon and Apple are expected to buck this trend. Apple plans to leverage content to raise brand awareness of Apple TV+, and Amazon plans to take advantage of its 2022 MBM acquisition, it said.

More information is available on the company’s website.

Phil Kurz is a contributing editor to TV Tech. He has written about TV and video technology for more than 30 years and served as editor of three leading industry magazines. He earned a Bachelor of Journalism and a Master’s Degree in Journalism from the University of Missouri-Columbia School of Journalism.