On the eve of the 2022 FIFA World Cup taking place in Qatar, the worldwide TV business is poised to be among the biggest beneficiaries of the estimated $6.5 billion generated during the month-long event that starts Nov. 20.

That’s the consensus of S&P Global Market Intelligence, which issued a report in advance of the quadrennial sporting event, which is expected to draw an estimated 5 billion global audience across all platforms, with coverage of the 32 teams competition broadcast to 219 markets worldwide.

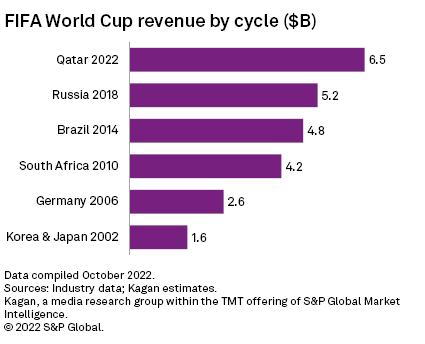

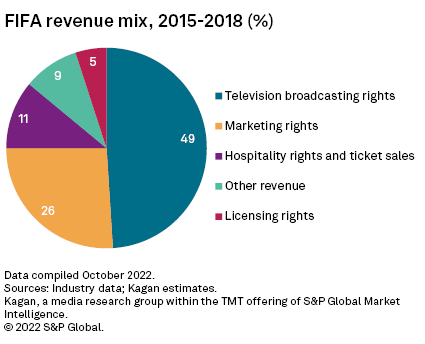

The $6.5 billion revenue estimate is a record, surpassing all previous tournaments and at four times the figure seen in Korea and Japan in 2002, S&P said. In its analysis of the last complete four-year World Cup cycle that led up to Russia 2018, just under half of FIFA revenue came from broadcasting rights fees and an additional 26% came from marketing rights with sponsors signing contracts to associate with the event, according to S&P.

One of the advantages of holding the World Cup at the end of the year (Qatar’s brutal summers didn’t allow for the event to be held in its usual summer time slot) is that the fourth quarter is a particularly lucrative time for advertising.

“The fourth quarter traditionally outperforms all other quarters across most markets as major campaigns target the holiday period when high levels of consumer goods transactions occur,” S&P said.

Although the event has been sold to pay-TV and free-to-air channels worldwide, some markets, particularly those in Europe, have passed legislation to ensure that the games in a home nation are available free to air, a consideration when estimating TV ad revenues. Time zones are another consideration: with Qatar 8 hours ahead of the U.S. east coast, this means live coverage of the U.S.-England match on Nov. 25 will take place in the morning, whereas in the U.K., it will be in primetime (7 p.m.)

“This scheduling influences viewing levels and consumption at a platform level as many will opt to watch on a mobile device with the game taking place during work hours,” S&P said.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

S&P concluded: “Overall, television is the largest beneficiary during the World Cup, but interactive experiences and mobile viewing mean that ad budgets will trickle down to online video and social media as well. According to Magna Global's June 2022 Global Ad Forecasts, cyclical events, which include the U.S. midterm elections and the World Cup, have boosted projected year-over-year global advertising growth for TV alone to 3.9%, from 2% in their absence.

“However, their absence in 2023 means linear TV advertising will decline year over year by 3.7% globally. Global advertising expenditure will naturally slow down in 2023 following a year of cyclical events, economic turmoil and declining GDP performance.”

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.