Pay TV Set-Top Box Market Down

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

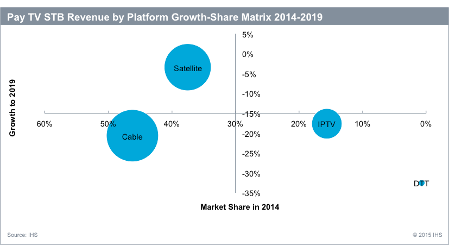

EL SEGUNDO, CALIF. – According to the Set-Top Box Market Monitor report from IHS, Pay TV operators purchased $15.3 billion worth of set-top boxes in 2014, down from 2013’s total of $15.9 billion. Despite a higher number of shipments in 2014, the effects of price erosion was big enough to cause the first dip in revenue from year to year since 2002.

“The industry is now at an inflection point,” said Daniel Simmons, head of connected home research at IHS Technology. “Mature pay TV markets are saturated with high-value advanced boxes, so shipments are set to decline there; and operators in emerging markets aren’t transitioning to advanced boxes fast enough to increase overall industry value.”

IHS also forecasts that the market will continue to decline for the next several years; falling to about $13.2 billion in 2018 before leveling out in 2019. An indication of this is the recent acquisitions and departures from the market, like South Korea’s Woojeon & Handan, and Swiss vendor Advanced Digital Broadcast. ARRIS also recently acquired Pace, the second largest vendor by revenue according to IHS.

There are still some bright spot areas in the market. Satellite pay STBs will still offer value to vendors as satellite vendors must invest in STB hardware to provide DVR and other traditional STB functions into the cloud so they can compete with IPTV operators who are able to access that through the Internet. There is also expected to be continued growth in Africa, the Middle East, South America and Central America in the pay TV market over the forecasted period.

The arrival of 4K and ultra-high definition for pay TV could also be beneficial to STB growth. South Korea, Japan and India have already launched new boxes that are capable of decode UHD video, with a number of U.S. pay TV operators expected to launch UHD STBs sometime this year. By 2019, UHD STBs look to be worth 40 percent of the market, totaling about $5.4 billion.

For more information regarding IHS’s report, click here.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.