A new survey from cordcutting.com concludes that the majority of cable and satellite TV customers think they’re wasting their money on their subscriptions, based on the paltry number of channels they view.

The survey, the website’s first since 2019, showed that these pay-TV subscribers have access to 190 channels but regularly only watch 15 of them. As expected broadcast networks and ESPN came out on top of the popularity poll. It also showed that the average cable TV monthly bill is grown from $96 to $147 since 2019, an increase of 52%.

That rise has likely been driven by the continued increase in cordcutting, prompting pay-TV operators to increase prices in response; as well as increases in broadcast and sports rights costs.

The survey also showed that the share of Americans watching cable or satellite TV has plunged by more than 20 percentage points from 2015 to 2021, with another 4.7 million households cutting the cord in 2021 alone. Meanwhile, streaming has become more popular—despite Netflix’s recent woes, the industry is up as a whole with spending on streaming growing 20 percent in 2021.

But when it comes to pay-TV subscriptions, the survey showed that nearly two out of every three subscribers think they’re not getting a good deal and 45% of cable TV subscribers saying that they would cancel their television packages if they weren't tied to their internet service provider.

In terms of the number of channels watched, the survey showed that out of the average lineup of 190 channels overall, subscribers watch only 15. By paying $147 per month to watch only 15 channels, the survey concluded that that averages out to $9.57 per channel watched, which rivals the average fee for an OTT streaming service. This results in an annual average of more than $1,600 “wasted” on subscription fees, up from $1,088 in 2019 according to cordcutting.com.

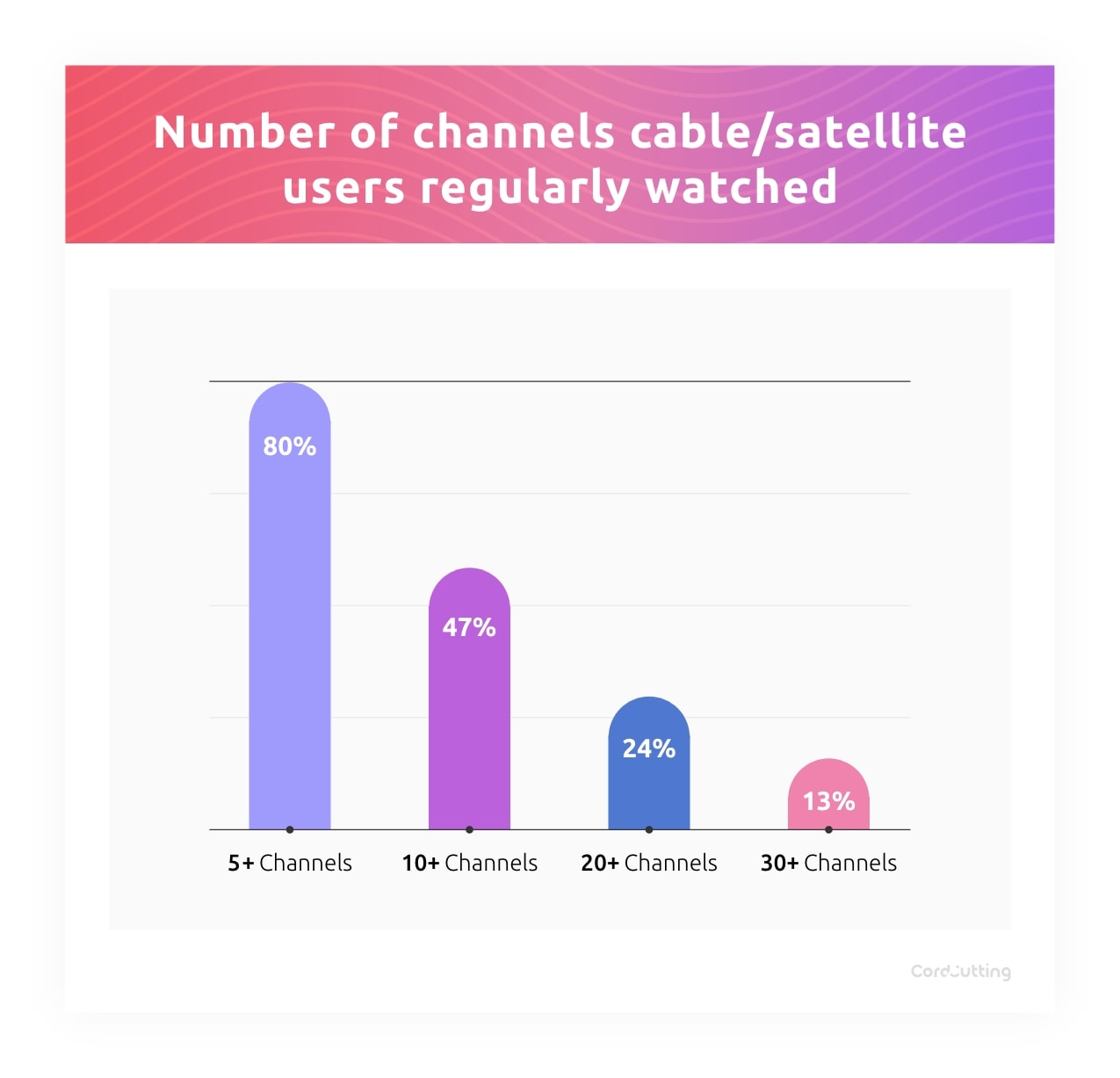

The cost is even higher for the many viewers who watch fewer stations—less than 50%percent of pay-TV subscribers regularly watch more than 10 channels, and less than a quarter regularly watched 20 or more channels in their subscription.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Cordcutting.com said that many pay-TV subscribers continue their subscriptions out of habit and the lack of knowledge over their viewing options.

“For less than half of the price of the average cable or satellite subscription, customers could obtain basic subscriptions to most major streaming services (and for a few dollars more, they can access ad-free versions),” said Stephen Lovely, cordcutting.com managing editor in a blog post. “Some viewers resist completely cutting the cord out of unfounded fear that they'll lose live television access. In reality, the major broadcast channels are free with a digital antenna, Paramount+ (CBS) and Peacock (NBC) carry live network streams, and other platforms (Apple TV+, Prime Video) are already adding live sports to compete with ESPN.

"With streaming options providing nearly all the services as cable TV at more affordable prices, it’s hard to understand why anyone stays with cable or satellite packages," Lovely added. "Perhaps that’s why industry experts expect the number of cable TV subscribers to soon drop to 50 million unless rising streaming prices drive a resurgence.

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.