The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

CHANTILLY, Va—While traditional OTA broadcasting still garners the majority of TV marketing bucks, the OTT TV market is the fastest growing segment when it comes to attracting advertisers, who prefer the programmatic nature of targeted advanced advertising.

This is the conclusion of a new report from BIA Advisory Services The Local Programmatic Marketplace – OTT and Digital Reach Extension Channels, which explores local OTT advertising trends and programmatic buying that provides access to a network of OTT ad inventory from a variety of publishers. The paper includes findings from executive interviews performed for the preparation of the paper. Participants included local TV group executives, agencies, and technology solution providers, along with OTT platforms and aggregators. The report, sponsored by Madhive, is free to download.

In BIA’s current edition of its U.S. Local Advertising Forecast issued in June 2022, the fastest-growing media segment is OTT with an annual growth rate of 57.4% in 2022. OTT spending will exceed $2.0 billion this year, drawing strength from multiple business verticals and political, BIA said.

From 2022 to 2026, OTT will grow at 14.3 percent CAGR and hold the second spot behind TV Digital (owned and operated streaming and website advertisements sold by local broadcast stations), showing its impact on OTT video in various local markets, according to the report.

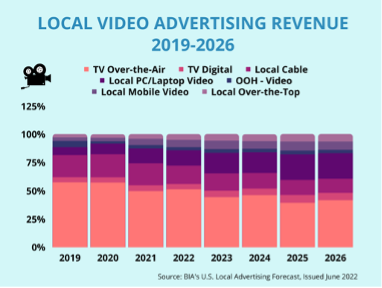

In the chart below, the tipping point seems to be nigh, with just over 50% of ad dollars currently going to traditional OTA TV and the other half coming from new OTT and digital platforms, with digital increasing its share of the pie over the next few years.

BIA is forecasting that spending on digital will grow to $116.6 billion by 2026 while spending on traditional OTA TV will only rise to $93.6 billion, having digital sales expand by 8.0 percent from 2022 to 2026. During that same period, BIA says that local TV spending will decrease from 51.2% to 41.7% of local video ad spending and local cable will decline from 16.2% to 12.5%.

Conversely, the market for all digital video ad platforms is growing with video display ad spend on laptops/PC nearly double in this period between 2022 and 2026 from 13.7% to 22.6% of local video spending. Spending on digital media spending will grow to 55% of total local ad spending by 2026.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

The BIA report illustrated how the pandemic impacted the market, showing that from 2019 to 2022, locally targeted digital sales rose from $55.9 billion to $79.5 billion, while traditional sales declined from $92.5 billion to $87.9 billion. When the lockdown occurred in 2020, more consumers turned to online platforms, driving a shift of 9.8% traditional sales towards digital across all TV markets.

The first half of 2022 saw the rate of cordcutting accelerate as more than two million TV households cancelled their pay TV services during the period. This is prompting media providers to focus on aggregating audiences across local TV and OTT distribution platforms, BIA said, which urged broadcasters to combine OTA/linear and digital premium video ad inventory to bring both linear and digital premium video ad inventory to cross-platform buyers through programmatic trading.

As explained by Ducey, “Programmatic trading is fast becoming the new norm because it empowers data-driven automated platforms to manage real-time and forward reserve bidding that matches publisher inventory with ad buyer targeted consumer segments at sufficient scale and at mutually agreeable price points.”

Programmatic platforms allow advertisers to maximize their ad inventory by providing the granular data that help marketers identify and activate targeted groups at scale across many publishers, protect against fraud, and deliver campaign optimization, analytics, and key performance metrics. The report offers a full explanation of both direct and programmatic trading and the impact on buyers and sellers.

Auto manufacturers and local auto dealers are the top 1 and 2 segments of the programmatic TV advertising market, according to the BIA report, with healthcare and legal three and four on the list.

The report notes that while local TV and OTT have traditionally operated separate and apart, things are changing as more advertisers demand more targeted advertising through programmatic. BIA cited TEGNA’s deployment of OTT streaming apps for its 64 local stations in 51 markets—which will bring its linear and digital premium ad inventory to cross-platform buyers—as one of the examples of this change.

“OTT is the fastest growing channel for local media in 2022 and looking ahead to next year,” said Rick Ducey, Managing Director at BIA Advisory Services and the report’s author. “It is progressively serving as a digital reach extension to linear TV. Until recently, however, local TV and OTT have operated in silos, each with its own culture, workflow, and different levels of automation. Our research shows this is changing as marketplace trading moves to a much faster pace of innovation than in the past.”

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.