High Churn Rates Hurt SVOD Sub Growth in Q3 2022

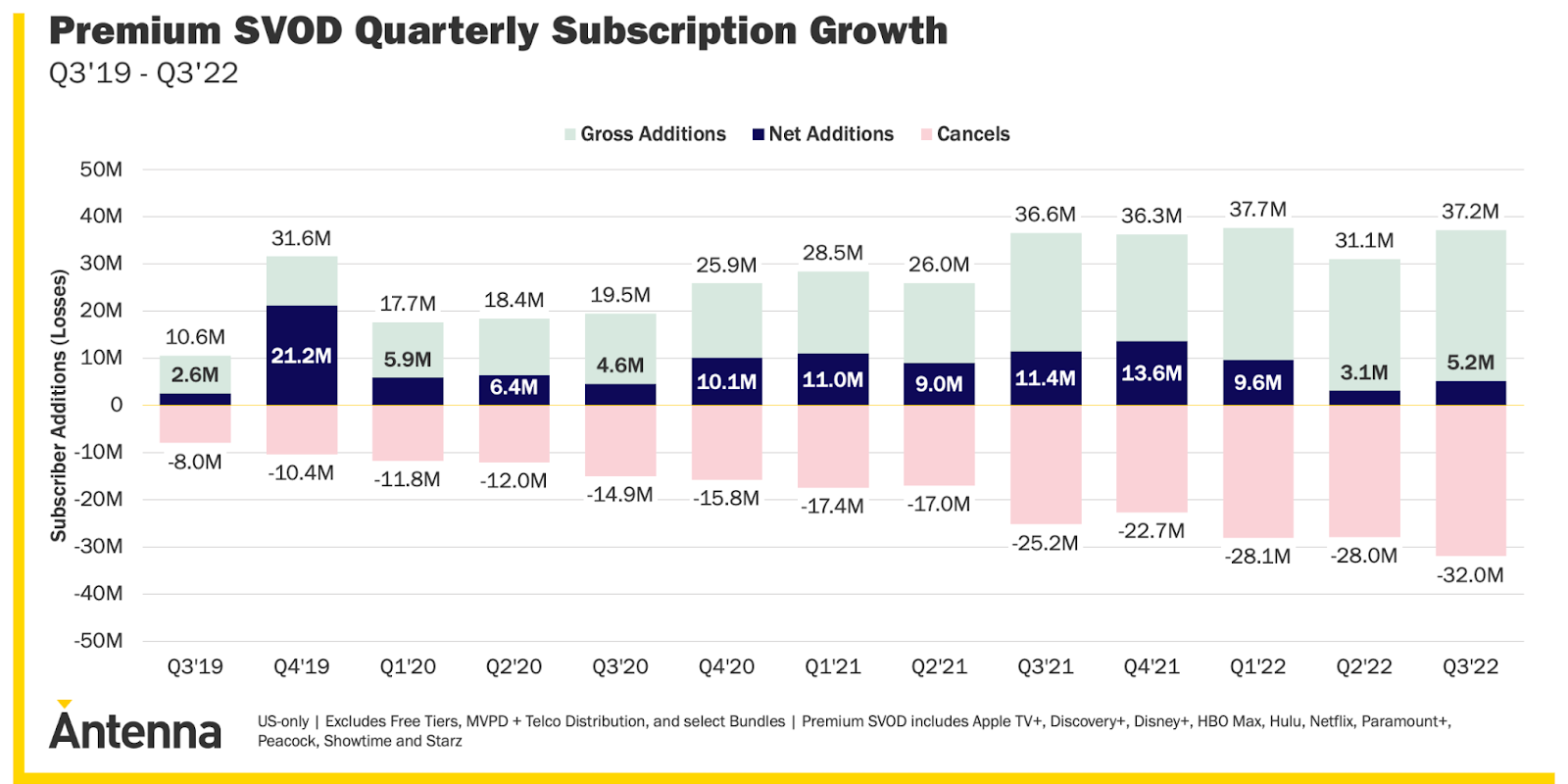

Churn expanded dramatically in Q3, with more than 32M cancellations of the 10 SVOD services tracked by Antenna

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Fickle subscribers dropping SVOD services continue to be a major problem for the streaming industry, with new research showing there were 32 million subscription cancellations of subscription video streaming services in Q3 2022 among the 10 major SVOD services tracked by Antenna.

That slowed overall SVOD subscription growth to 2.5% in Q3 versus Q2. The sluggish Q3 growth was however better than Q2, which was up only 1.5%, the smallest increase Antenna has seen since starting to track the market in 2019.

“Antenna has long highlighted Churn as a crucial dynamic in the SVOD industry,” explained Jonathan Carson, co-founder and chair in a blog post analyzing the data, who noted that the 32 million cancellations in Q3 was significantly up from the two previous quarters when they were running at about 28 million during each quarter.

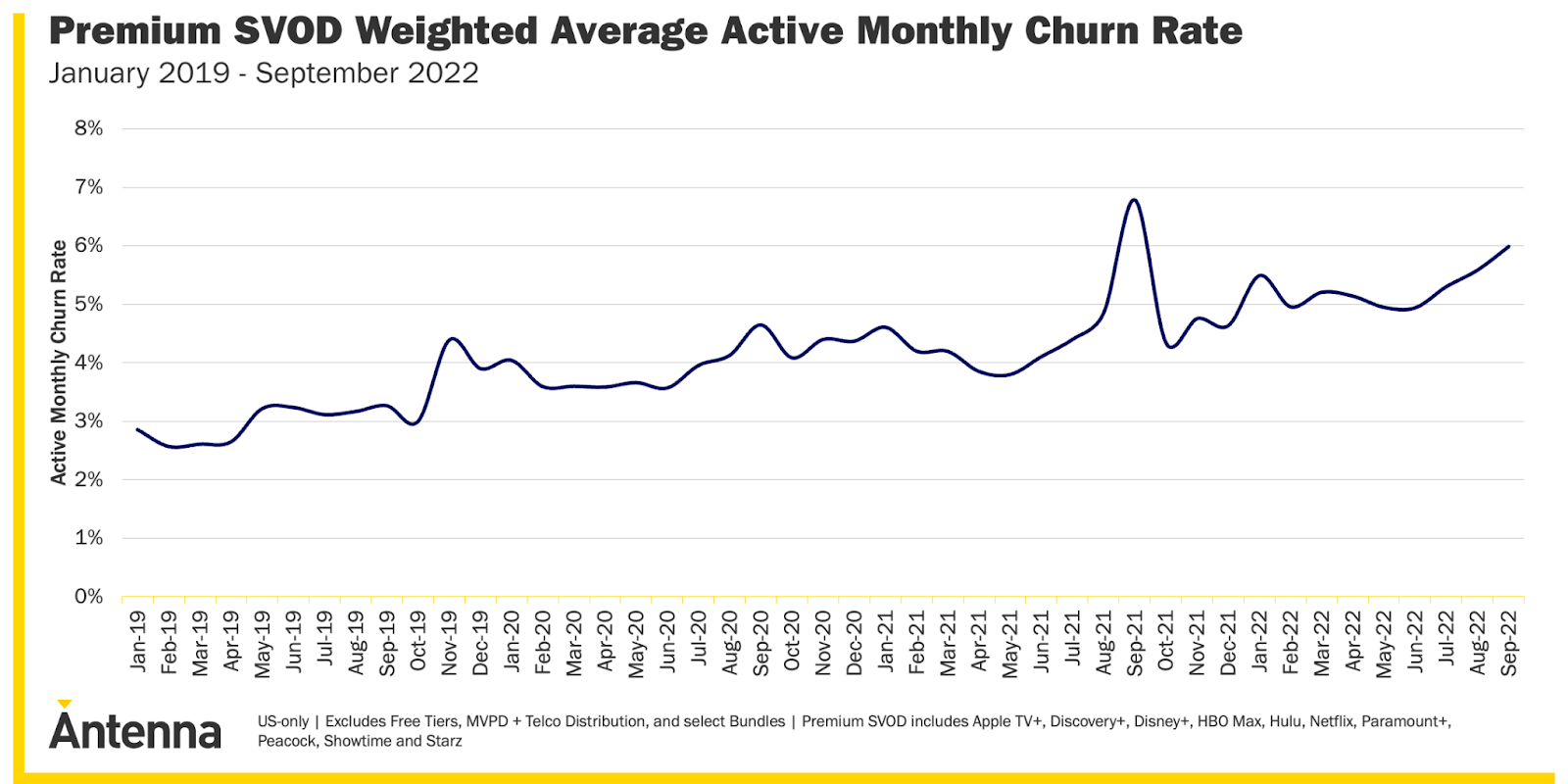

“The Average Monthly Churn rate for the Premium SVOD category reached 5.8% in September," he said. "To put this in perspective, category Churn in 2021 was 4.5%; in 2020 it was 4.0%; and in 2019 it was 3.2%.”

“Historical Churn data becomes even more insightful when analyzed at the Service level,” Carson added. “Antenna previously documented a meaningful uptick in Netflix Churn following its last price increase in January 2022. In fact, Netflix’s Average Monthly Churn was up again in Q3, to 3.5% from 3.4% in Q2, and 2.0% in 2021.”

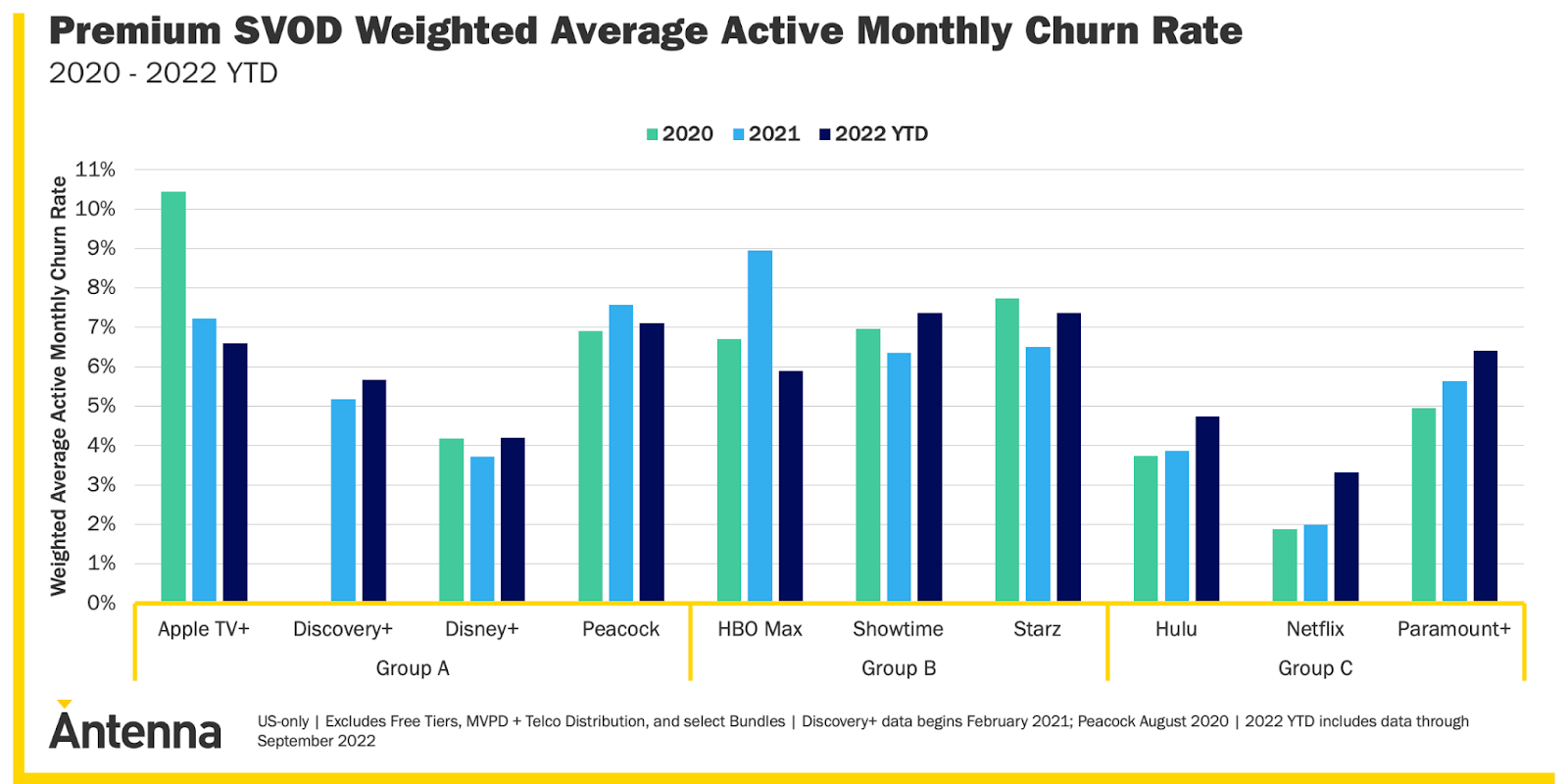

Carson stressed however that the problem of churn varied significantly between different players.

Services that have launched in the past three years since the so-called “streaming wars” began like Apple TV+, Discovery+, Disney+, and Peacock all have had fairly stable churn levels since their launch periods.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

Another group which is made up of legacy linear brands like HBO, Showtime and Starz have also seen relatively stable churn rates in part due to their long experience of intense competition with each other.

SVOD originals like Hulu, Netflix and Paramount Plus were initially “so differentiated in that less competitive market that they had significantly lower Churn than they face today,” Carson argued. “As the market became more competitive, however, the differentiation was more difficult for consumers to identify and the average monthly Churn rates rose accordingly: from 3.7% in 2020 to 4.7% thus far in 2022 for Hulu; from 4.9% to 6.4% for Paramount+; and from 1.9% to 3.3% for Netflix.”

“All in all, competition in SVOD will only intensify in the future, so having a robust understanding of what impacts Churn and the strategies available to minimize it will continue to be critical for all market players,” he concluded.

Details on Antenna’s methodology and metric definitions are available here.

George Winslow is the senior content producer for TV Tech. He has written about the television, media and technology industries for nearly 30 years for such publications as Broadcasting & Cable, Multichannel News and TV Tech. Over the years, he has edited a number of magazines, including Multichannel News International and World Screen, and moderated panels at such major industry events as NAB and MIP TV. He has published two books and dozens of encyclopedia articles on such subjects as the media, New York City history and economics.