The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

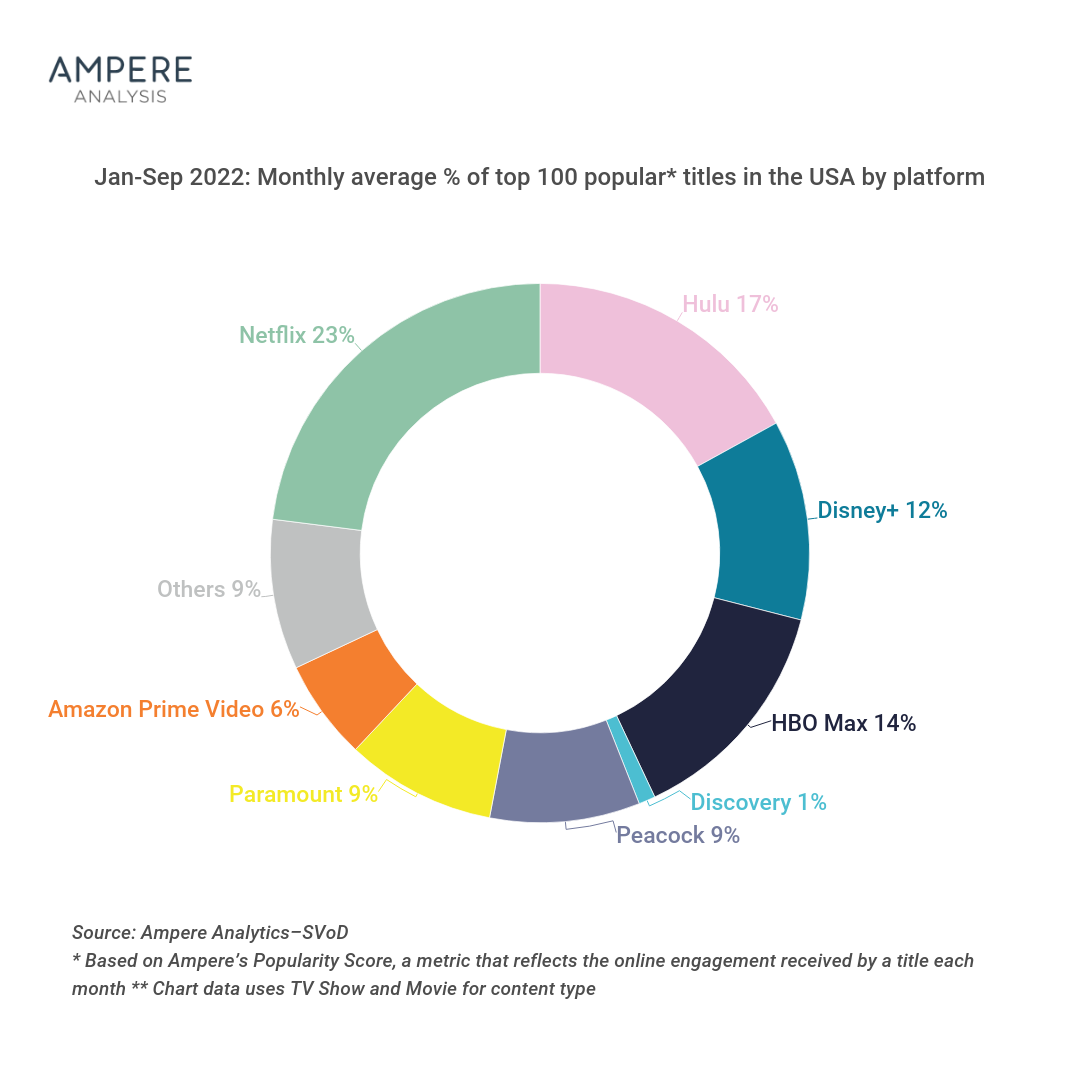

LOS ANGELES—A combined offering of Disney+ and Hulu would account for the largest share of the 100 most popular titles of any U.S. subscription video on demand service, accounting for approximately 30%, a comprehensive lead over second place Netflix’s 23% according to a recent study by Ampere Analysis.

Hulu is currently owned by Disney (67%) and Comcast (33%), who are due to reach a sale agreement in January 2024. However, recent reports suggest that Disney intends to close a deal earlier to take a 100% stake and integrate the streamer into Disney+ as a combined offering, giving subscribers access to popular titles from Disney’s Marvel Studios or Lucasfilm and Hulu originals like Only Murders in the Building and The Handmaid’s Tale.

Currently, subscribers to Hulu Plus Live TV already get a free subscription to premium or ad-supported versions of Disney+ at either $70 or $76 per month

Amper says a merger “seems logical,” as Disney’s share of Hulu content has grown significantly, suggesting that the company has continued to invest considerably in the platform. Since September 2016, the proportion of Hulu’s catalogue to which Disney owns the distribution rights has tripled, from 6% of all movies and TV shows to 19% by September 2022.

Meanwhile, the major studios without streaming platforms have reduced their contribution to Hulu’s content slate (down from 81% in 2016 to 71% in 2022), and those with their own streaming services have generally maintained or reduced their input. Specifically, the combined content from NBCUniversal, Paramount Global, and Warner Bros. Discovery now makes up less than 10% of all TV shows and movies on Hulu.

Ampere says the removal of content from Hulu to support newer services like Peacock, Paramount+ and HBO Max poses a threat to Hulu’s competitiveness. The streamer has already lost highly popular titles like America’s Got Talent (to Peacock), movies and TV shows set within the Star Trek universe (to Paramount+) or Family Matters (to HBO Max).

If major studios reclaim their proprietary content, Hulu could lose 10% of its overall catalogue. This figure rises to 37% of Hulu’s 100 most popular titles, using Ampere’s Popularity Score metric, which tracks overall online engagement with a title, the research firm said.

The professional video industry's #1 source for news, trends and product and tech information. Sign up below.

“The threat of further popular or critically acclaimed titles leaving Hulu for rival platforms is a concern as engaging content is critical for subscriber retention, especially as the US SVoD market nears saturation,” says Christen Tamisin, Analyst at Ampere Analysis. “This risk makes the argument for Disney to merge Hulu and Disney+ into a single platform stronger.”

“On the other hand, Disney+ and Hulu’s complementary catalogues mean a combined platform would have a more diverse content offering—akin to other major market players—than the two standalone platforms have currently. While the Disney brand has long been associated with family-friendly content, Hulu has a broader, general-audience appeal, offering a wide range of genres and more adult-targeted titles.”

The report was issued a day after Disney announced the return of former CEO Bob Iger, replacing Bob Chapek, who is stepping down.

Tom has covered the broadcast technology market for the past 25 years, including three years handling member communications for the National Association of Broadcasters followed by a year as editor of Video Technology News and DTV Business executive newsletters for Phillips Publishing. In 1999 he launched digitalbroadcasting.com for internet B2B portal Verticalnet. He is also a charter member of the CTA's Academy of Digital TV Pioneers. Since 2001, he has been editor-in-chief of TV Tech (www.tvtech.com), the leading source of news and information on broadcast and related media technology and is a frequent contributor and moderator to the brand’s Tech Leadership events.